FS Bancorp Inc (FSBW) Reports Solid Earnings Growth and Dividend Increase for 2023

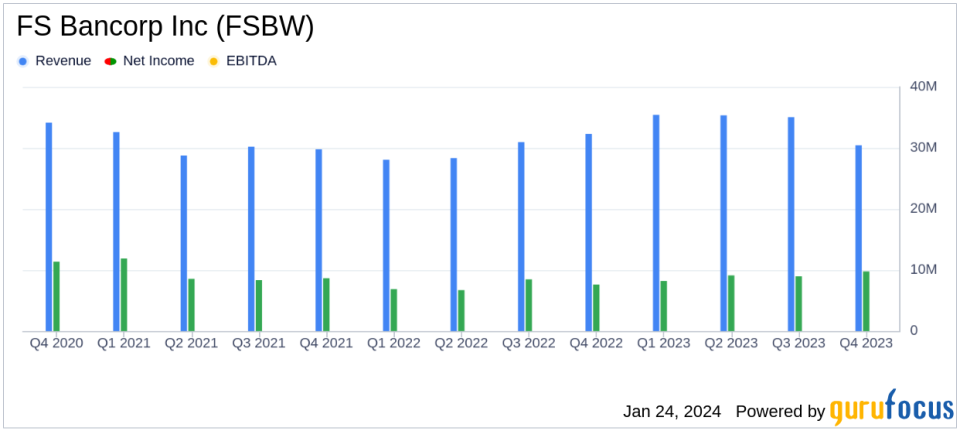

Net Income: FS Bancorp Inc (NASDAQ:FSBW) reported a net income of $36.1 million for 2023, a significant increase from the $29.6 million in 2022.

Earnings Per Share (EPS): Diluted EPS for 2023 stood at $4.56, up from $3.70 in the previous year.

Quarterly Dividend: The company announced a 4% increase in its quarterly dividend to $0.26 per share.

Asset Growth: Total assets grew by 12.9% year-over-year, reaching $2.97 billion at the end of 2023.

Loan Portfolio: Loans receivable, net increased by $210.6 million compared to the previous year, indicating robust loan growth.

Capital Ratios: FS Bancorp maintained strong capital ratios, with a total risk-based capital ratio of 13.7% and a CET1 ratio of 10.5% at the end of 2023.

Credit Quality: The allowance for credit losses on loans (ACLL) increased to $31.5 million, or 1.30% of gross loans receivable.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 24, 2024, FS Bancorp Inc (NASDAQ:FSBW) released its 8-K filing, detailing a robust financial performance for the year 2023. The company, which is the holding entity for 1st Security Bank, reported a substantial increase in net income and a hike in its quarterly dividend, reflecting its strong financial health and commitment to shareholder returns.

FS Bancorp Inc (NASDAQ:FSBW) operates through two segments: Commercial and Consumer Banking, offering a diverse range of financial products and services, and Home Lending, focusing on residential mortgage loans. The company's strategic growth initiatives, including the integration of seven retail branches acquired from Columbia State Bank, have contributed to its financial success in 2023.

Financial Performance and Challenges

The company's net income for 2023 was $36.1 million, or $4.56 per diluted share, compared to $29.6 million, or $3.70 per diluted share in 2022. The fourth quarter alone saw a net income of $9.8 million, or $1.23 per diluted share, an increase from $7.6 million, or $0.97 per diluted share, in the same quarter of the previous year. This performance underscores the company's ability to navigate varying rate and economic environments effectively.

CEO Joe Adams highlighted the company's diversified balance sheet as a key factor in achieving strong financial results. The company's Board of Directors also approved a 4% increase in the quarterly cash dividend, marking the forty-fourth consecutive quarterly dividend, which will be paid on February 22, 2024, to shareholders of record as of February 8, 2024.

Segment Reporting and Financial Achievements

The Commercial and Consumer Banking segment reported a net income of $10.03 million for the fourth quarter of 2023, while the Home Lending segment experienced a slight loss. For the year, the Commercial and Consumer Banking segment contributed $35.71 million to the net income, with Home Lending adding $341,000. These figures reflect the company's ability to generate income across its diversified lending portfolios.

FS Bancorp's total assets grew by 1.8% in the fourth quarter of 2023 compared to the previous quarter and by 12.9% compared to the end of 2022. The growth in assets was primarily driven by increases in loans receivable, net, and securities available-for-sale. The company's loan portfolio saw a net increase of $25.9 million in the fourth quarter, with significant growth in one-to-four-family loans and construction and development loans.

Analysis of Financial Statements

The company's balance sheet strength is evident in the increase in total assets, which reached $2.97 billion at the end of 2023. The loan portfolio expanded, with real estate loans comprising the largest portion at 63% of total loans receivable. The growth in loans receivable, net, was primarily funded through deposits received from the retail branch acquisition.

FS Bancorp's capital ratios remained robust, with a total risk-based capital ratio of 13.7% and a CET1 ratio of 10.5% at the end of 2023. The company's credit quality also remained solid, with an allowance for credit losses on loans of $31.5 million, or 1.30% of gross loans receivable.

Net interest income for the year increased by $19.0 million to $123.3 million, reflecting the company's ability to originate new loans at higher rates and reprice variable rate loans in response to market interest rate increases. However, the net interest margin (NIM) decreased slightly for the three months ended December 31, 2023, due to rising deposit and borrowing costs.

In conclusion, FS Bancorp Inc (NASDAQ:FSBW) has demonstrated strong financial performance for 2023, with significant growth in net income and assets, as well as a commitment to returning value to shareholders through increased dividends. The company's diversified lending strategies and prudent management of its balance sheet position it well for continued success in the banking industry.

Explore the complete 8-K earnings release (here) from FS Bancorp Inc for further details.

This article first appeared on GuruFocus.