FTAI Aviation Ltd. Soars with Strong Q4 and Full Year 2023 Earnings, Declares Dividend

Net Income: FTAI Aviation Ltd. (NASDAQ:FTAI) reported a substantial increase in net income attributable to shareholders, reaching $110.03 million in Q4 2023.

Earnings Per Share: Basic and Diluted Earnings per Ordinary Share from Continuing Operations stood at $1.10 and $1.09, respectively.

Adjusted EBITDA: The company achieved a robust Adjusted EBITDA of $162.33 million, reflecting strong operational performance.

Dividends: FTAI declared a dividend of $0.30 per ordinary share for Q4 2023, alongside dividends on its preferred shares.

Revenue Growth: Total revenues for the year ended December 31, 2023, were $1.17 billion, a significant increase from $708.41 million in the previous year.

Balance Sheet Strength: FTAI's balance sheet shows a healthy cash position with $90.76 million in cash and cash equivalents as of December 31, 2023.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

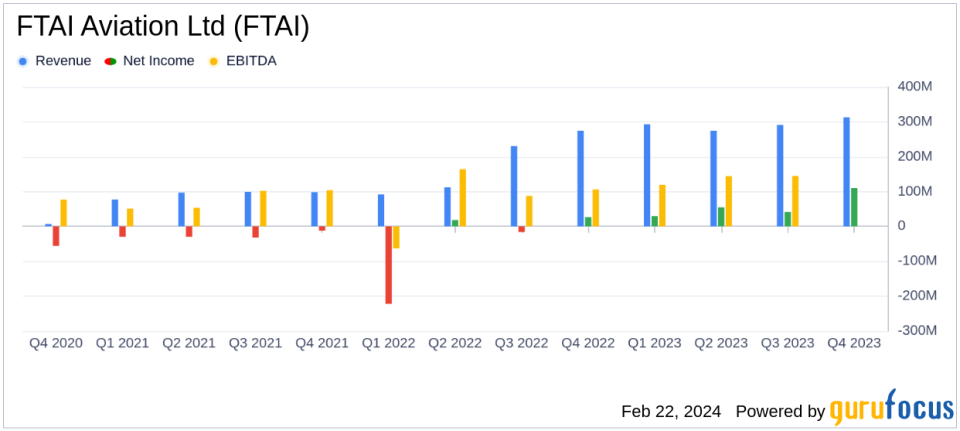

On February 22, 2024, FTAI Aviation Ltd. (NASDAQ:FTAI) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The aerospace company, known for owning and maintaining commercial jet engines, particularly CFM56 engines, and leasing jet aircraft, reported a significant increase in net income attributable to shareholders, which amounted to $110.03 million for the fourth quarter. This performance underscores the company's ability to generate strong and stable cash flows, with potential for earnings growth and asset appreciation.

Financial Performance Highlights

FTAI's financial achievements for the year 2023 are notable, with total revenues reaching $1.17 billion, up from $708.41 million in the previous year. This increase reflects the company's successful investment in aviation assets and aerospace products. The basic and diluted earnings per share from continuing operations were $1.10 and $1.09, respectively, indicating a strong profitability per share. Adjusted EBITDA, a key performance measure for the company, stood at $162.33 million for Q4 2023, which provides insight into the company's operational efficiency and ability to generate earnings before interest, taxes, depreciation, and amortization.

Dividend Declaration and Shareholder Returns

FTAI's Board of Directors declared a cash dividend of $0.30 per ordinary share for Q4 2023, payable on March 20, 2024, to shareholders of record as of March 8, 2024. This dividend declaration is a testament to the company's commitment to delivering shareholder value. Additionally, dividends on various series of preferred shares were also declared, further enhancing shareholder returns.

Balance Sheet and Cash Flow Analysis

The balance sheet of FTAI as of December 31, 2023, shows a solid liquidity position, with cash and cash equivalents totaling $90.76 million. The company's total assets were valued at $2.96 billion, with liabilities amounting to $2.78 billion. The net cash provided by operating activities for the year 2023 was $128.98 million, indicating healthy cash flow generation from the company's core operations.

Operational Challenges and Industry Outlook

While FTAI has reported strong financial results, the aerospace industry faces ongoing challenges such as fluctuating demand for air travel, regulatory changes, and technological advancements. FTAI's focus on CFM56 and V2500 engines positions it well within the market, but the company must continue to adapt to industry trends and customer needs to maintain its growth trajectory.

For additional information and a detailed financial analysis, investors are encouraged to review the full earnings report and listen to the conference call hosted by management. FTAI's commitment to investing in aviation assets that generate stable cash flows and the potential for asset appreciation remains central to its strategy, as reflected in its impressive full-year financial performance.

For further details on FTAI's financial performance and strategic initiatives, investors and interested parties are advised to visit the company's website and consult the Annual Report on Form 10-K when available.

FTAI Aviation Ltd. continues to navigate the complexities of the aerospace industry with a clear focus on value creation and operational excellence, as evidenced by its latest earnings report.

Explore the complete 8-K earnings release (here) from FTAI Aviation Ltd for further details.

This article first appeared on GuruFocus.