FTAI Infrastructure Inc Reports Q4 and Full Year 2023 Results Amidst Challenges

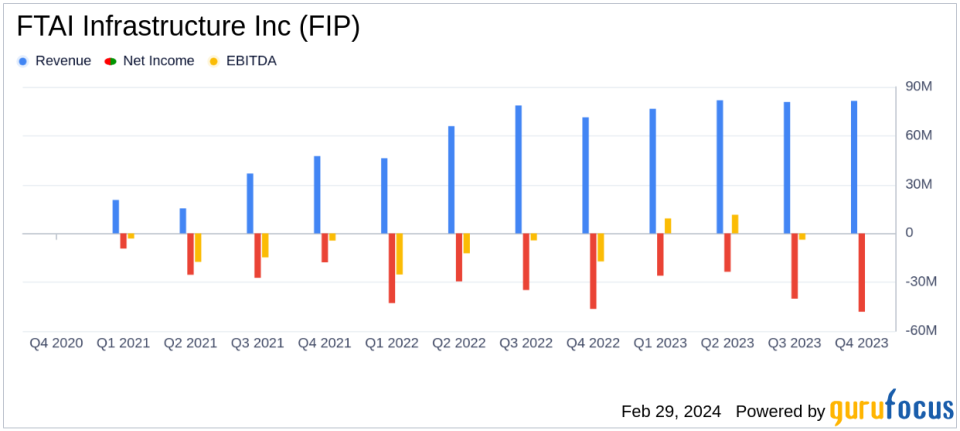

Net Loss: FIP reported a net loss of $48.2 million for Q4 and $183.7 million for the full year 2023.

Adjusted EBITDA: Q4 Adjusted EBITDA reached $33.3 million, and $107.5 million for the full year, marking a significant metric for operational performance.

Dividend: Despite the net loss, FIP declared a Q4 dividend of $0.03 per share, showcasing confidence in its cash flow generation.

Revenue Growth: Total revenues increased to $81.4 million in Q4, up from $71.4 million in the same period last year.

Operational Highlights: Transtar and Jefferson Terminal segments set records in Q4 for Adjusted EBITDA and throughput, respectively.

Balance Sheet: FIP ended the year with $29.4 million in cash and cash equivalents, down from $36.5 million at the end of 2022.

On February 29, 2024, FTAI Infrastructure Inc (NASDAQ:FIP) released its 8-K filing, disclosing its financial results for the fourth quarter and full year of 2023. Despite facing a net loss attributable to stockholders of $48.2 million in Q4 and $183.7 million for the full year, the company declared a dividend of $0.03 per share for Q4, payable in April 2024. This move indicates a strategic approach to maintain investor confidence and a commitment to shareholder returns.

Company Overview

FTAI Infrastructure Inc operates across various segments, including Railroad, Jefferson Terminal, Repauno, Power and Gas, and Sustainability and Energy Transition. The company's diversified portfolio includes freight railroads, a multi-modal crude oil and refined products terminal, a deep-water port with multiple industrial opportunities, and investments in energy transition and sustainability projects.

Financial Performance and Challenges

The company's performance in Q4 saw a record Adjusted EBITDA of $42.4 million for its core segments and $33.3 million on a consolidated basis. Transtar, one of FIP's segments, achieved a record Adjusted EBITDA of $23.6 million, with increases in carload volume and average rate per carload. Jefferson Terminal also reported a record throughput, averaging 185,000 barrels per day. These achievements are critical as they demonstrate the company's ability to generate operational efficiencies and optimize asset utilization, which is vital for conglomerates like FIP that manage a range of infrastructure assets.

However, the reported net losses highlight the challenges FIP faces, including the impact of operating expenses, general and administrative costs, and interest expenses. The company's net loss widened from the previous year, which may raise concerns about its long-term profitability and ability to sustain dividend payments. The importance of monitoring these challenges is paramount as they can affect the company's financial stability and growth prospects.

Financial Statements Summary

FTAI Infrastructure Inc's balance sheet reflects a decrease in cash and cash equivalents from the previous year, ending with $29.4 million. Total revenues for the year increased to $320.5 million from $262 million in the previous year, indicating growth in the company's operations. However, the increase in total expenses, particularly operating expenses and interest expense, contributed to the net loss for the year.

The company's cash flow statement shows a net cash provided by operating activities of $5.5 million for the year, which is a positive sign of the company's ability to generate cash from its core business operations. Nonetheless, the cash used in investing and financing activities indicates significant capital expenditures and debt financing, which are common in the infrastructure industry but require careful management to ensure financial sustainability.

Analysis of Performance

FTAI Infrastructure Inc's performance in 2023 reflects a company navigating through a complex financial landscape. The declaration of a dividend amidst net losses suggests a strategic approach to balance shareholder returns with financial prudence. The growth in revenue and record Adjusted EBITDA in certain segments are positive indicators of the company's operational strengths. However, the net losses and increased expenses underscore the need for continued focus on cost management and operational efficiency.

For investors, the mixed financial results present a nuanced picture. The company's ability to generate cash flow and pay dividends is encouraging, yet the net losses and challenges in profitability warrant a cautious approach. Value investors, in particular, may find FIP's infrastructure assets and potential for earnings growth appealing, but will need to weigh these against the risks highlighted in the financial statements.

FTAI Infrastructure Inc's management will host a conference call to discuss the earnings report in detail, providing an opportunity for investors to gain further insights into the company's strategy and outlook.

For a more comprehensive understanding of FTAI Infrastructure Inc's financial performance and future prospects, investors are encouraged to review the full 8-K filing and attend the upcoming earnings call.

Explore the complete 8-K earnings release (here) from FTAI Infrastructure Inc for further details.

This article first appeared on GuruFocus.