FTI Consulting: Experts With Impact

FTI Consulting Inc. (NYSE:FCN), along with its consolidated entities, operates as a global business advisory company. Its primary mission revolves around assisting organizations in navigating change, minimizing risks and resolving a variety of disputes, encompassing financial, legal, operational, political, regulatory, reputational and transactional challenges.

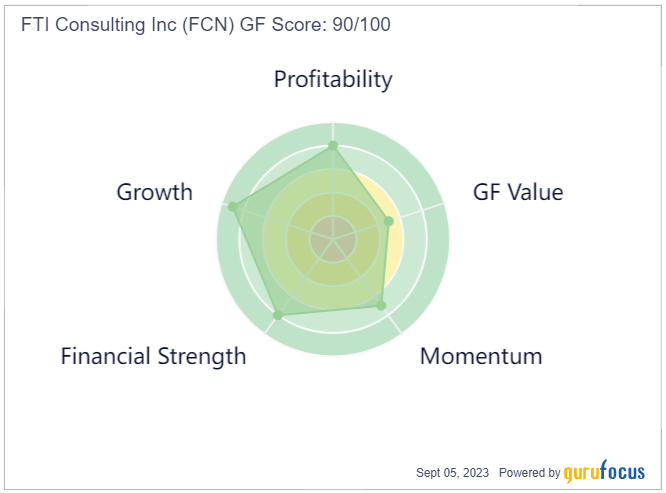

The company has a GF Score of 90, meaning that it has good outperformance potential.

Market position and expertise

The market for business advisory services is growing rapidly due to the increasing complexity of business operations and the need for companies to comply with regulations. FTI Consulting is well-positioned to capitalize on this growth, as it has a broad range of services and a strong reputation.

Each of the company's individual segments and practices is staffed by experts renowned for their extensive knowledge and a proven track record of effecting change. As a cohesive entity, FTI Consulting offers a comprehensive suite of services tailored to support clients across the entire business spectrum, from proactive risk management to swift responses to unforeseen developments and ever-evolving business environments.

An investment presentation the company gave in August noted the company was an adviser to 99 of the worlds top 100 law firms and an adviser to 50 of the worlds top 50 bank holding companies.

Business segments and growth gpportunities

The company's operations are organized into five distinct reportable segments. These include Corporate Finance, Forensic & Litigation Consulting, Economic Consulting, Technology, and Strategic Communications. Each segment focuses on a specific area of business advisory, offering a diverse array of services to a wide range of clients.

The Corporate Finance segment focuses on addressing the strategic, operational, financial, transactional and capital-related needs of its global clientele. This client base includes companies, boards of directors, investors, private equity sponsors, lenders, creditor groups and other relevant stakeholders. The segment provides a diverse array of services centered around three core offerings: Business Transformation & Strategy, Transactions and Turnaround & Restructuring.

Management stated it is aiming to enhance this divisions business transformation and transactions capabilities, grow restructuring globally and gain deeper penetration in key areas such as health care, telecom, media and technology, industrials, automotive and energy.

The Forensic & Litigation Consulting segment serves law firms, companies, boards of directors, government entities, private equity firms and other parties with a broad range of multidisciplinary and independent services. These services span the fields of risk assessment, investigations and dispute resolution, including cybersecurity concerns. The segment places a particular emphasis on highly regulated industries, offering specialized services like construction and evironmental solutions and health solutions. Data and analytics technology-enabled solutions support these services, enabling clients to analyze extensive, disparate datasets related to their operations during regulatory inquiries and commercial disputes.

Management is aiming to enhance construction and environmental solutions, cybersecurity and data and analytics capabilities, grow the United Kingdom and Hong Kong businesses and increase utilization in disputes, investigations and health solutions practices.

The Economic Consulting segment, which includes subsidiary Compass Lexecon LLC, offers analyses of complex economic issues to law firms, companies, government entities and other interested parties. These analyses find application in international arbitration, legal and regulatory proceedings, strategic decision-making and public policy debates worldwide.

In the recent investment presentation, management stated its medium-term growth opportunities in this segment will come from maintaining its leading position for Compass Lexecon in the U.S., growing European and Asian businesses and by developing adjacent businesses in the U.S. for international arbitration, energy, health care, TMT and financial services.

The Technology segment delivers a comprehensive suite of global digital insights and risk management consulting services. Its professionals assist organizations in addressing risk by managing the increasing volume and variety of enterprise data in the context of legal, regulatory and compliance requirements. The segment offers expert solutions driven by investigations, litigation, mergers and acquisitions, antitrust and competition considerations, as well as compliance and risk management.

As well as growing their overseas businesses, management is aiming to expand its addressable market through new distribution channels for consulting and services and invest in new and adjacent services across information governance, privacy and security services and contract intelligence.

Finally, the Strategic Communications segment specializes in the development and execution of communications strategies. These strategies aid management teams, boards of directors, law firms, governments and regulators in managing change and mitigating risk associated with transformational and disruptive events, including transactions, investigations, disputes, crises, regulation and legislation. The segment provides services in three principal areas: Corporate Reputation, Financial Communications and Public Affairs.

Management has identified the following areas for growth: to further develop large, complex client relationships, enhance market share in highly regulated industries and to more widely leverage FTI Consultings wider platform.

Financial performance and valuation

For the financial year 2022, 64% of revenue came from the U.S. and 14% from the United Kingdom. Corporate Finance was the largest segment at 36% of operating revenue. So, like the investment banks, who are its clients, deal volume is a key driver for the company. The stock has a decent Piotroski F-Score of 7 out of 9 and a very safe Altman Z-Score of 5.0.

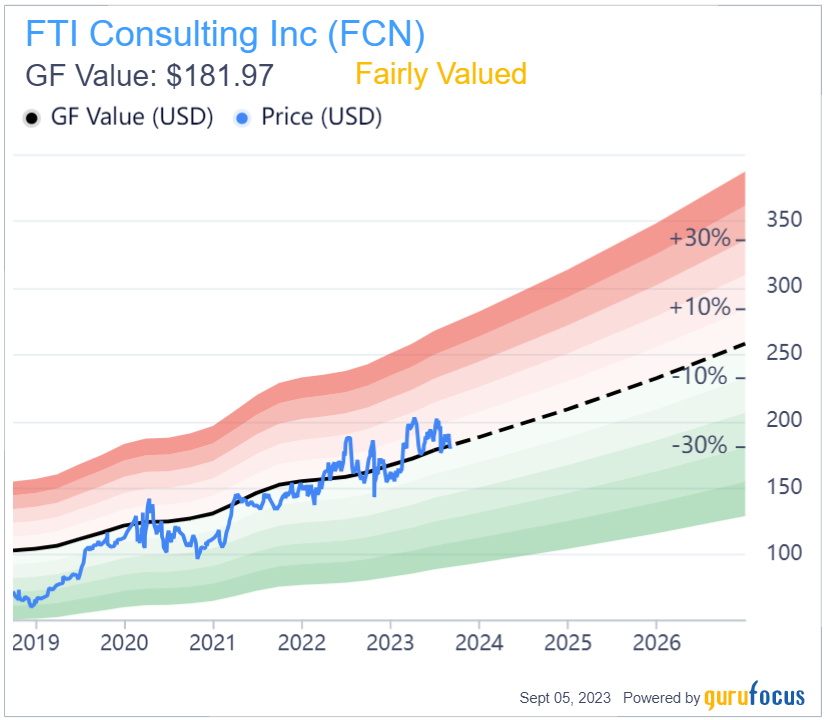

While the stock is Fairly Valued by GF Value, its worth noting that guru Jeremy Grantham (Trades, Portfolio) bought into the stock earlier this year. The company has managed to grow Free Cash Flow per share by nearly 10% annually over the last 10 years.

Conclusion

In sum, the company's investment thesis hinges on an organic growth strategy that prioritizes profitable revenue expansion while maintaining a steadfast commitment to cultivating a sustainable, resilient business model that endures through varying economic conditions. Demonstrating a willingness to allocate Ebitda into strategic growth areas where they hold a competitive edge, FTI Consulting boasts a healthy balance sheet and robust cash flows, further fortified by a pledge to return capital to shareholders. This strategic vision paves the way for sustained double-digit year-over-year growth in Adjusted EPS, affirming its enduring commitment to both clients and investors alike. Definitely one for your US watchlist.

This article first appeared on GuruFocus.