FTI Consulting (FCN) Stock Gains 28% in a Year: Here's Why

FTI Consulting, Inc. FCN has had an impressive run in the past year. The stock has gained 27.6%, outperforming 14.3% and 13.4% growth of the industry and S&P 500 composite, respectively.

Reasons Behind the Rally

FTI Consulting has a unique potential to bring together diverse issues like damage assessment, accounting, economics, finance and the industry on a single platform. This makes it an excellent partner for global clients, thereby generating continued revenue growth from the existing international operations. Global operations help the company to expand its geographic footprint. FCN’s revenues rose 15% on a year-over-year basis in the third quarter of 2023.

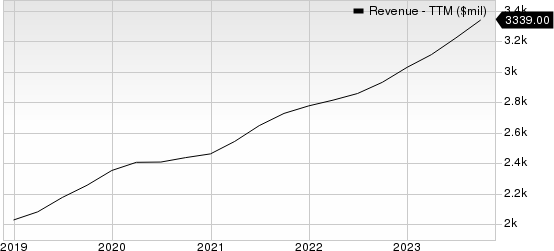

FTI Consulting, Inc. Revenue (TTM)

FTI Consulting, Inc. revenue-ttm | FTI Consulting, Inc. Quote

Increased regulatory scrutiny and a proliferation of corporate litigation are likely to increase the demandfor FCN’s products.Additionally, structural change has become necessary in the rapidly evolving global markets as management teams look to fend off rivals, protect intellectual property rights and transform businesses via M&A, divestiture and other restructuring activities. These developments call for its specialized skill sets and will likely boost its revenues.

FTI Consulting has a consistent track record of share buybacks. In 2022, 2021 and 2020, the company had repurchased shares of worth $85.4 million, $46.1 million, and $353.6 million. Apart from instilling investors’ confidence these initiatives positively impact earnings per share.

Zacks Rank and Other Key Picks

FTI Consulting currently carries a Zacks Rank #2 (Buy).

Investors can also consider the following other top-ranked stocks:

Rollins ROL currently carries a Zacks Rank #2. For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at 20 cents, indicating year-over-year growth of 17.7%.You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

ROL has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 7.2%.

Fiserv FI also carries a Zacks Rank #2. For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at $2.15, indicating year-over-year growth of 12.6%.

FI has a decent earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 0.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report