FTI Consulting Inc (FCN) Reports Record Financial Results for Q4 and Full Year 2023

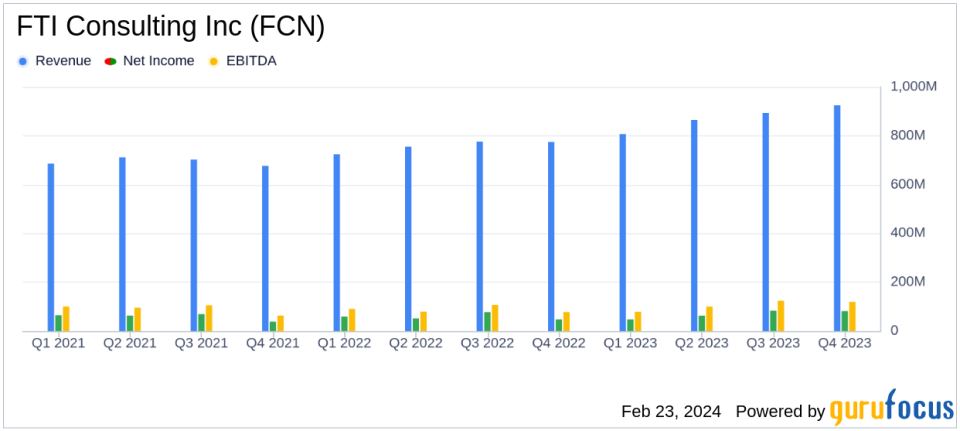

Revenue Growth: Full year 2023 revenues rose by 15.2% to $3.489 billion.

Net Income Increase: Net income for the year improved to $274.9 million from $235.5 million in the prior year.

Earnings Per Share: EPS for 2023 was $7.71, up from $6.58 in the prior year.

Adjusted EBITDA: Full year 2023 Adjusted EBITDA reached $424.8 million, or 12.2% of revenues.

Cash Position: Cash and cash equivalents and short-term investments totaled $328.7 million at year-end.

Capital Allocation: The company repurchased 112,139 shares at an average price of $158.70 per share in 2023.

2024 Guidance: FTI Consulting projects 2024 revenues to range between $3.650 billion and $3.790 billion, with EPS between $7.75 and $8.50.

On February 22, 2024, FTI Consulting Inc (NYSE:FCN) released its 8-K filing, announcing record financial results for the fourth quarter and full year ended December 31, 2023. The company, a global business advisory firm, operates through five segments, offering a range of services to clients across various industries, predominantly in the United States.

Financial Highlights and Segment Performance

FTI Consulting's full year 2023 revenue increased significantly by 15.2% to $3.489 billion, driven by higher demand across all business segments. The company's net income also saw a notable rise to $274.9 million, up from $235.5 million in the prior year. This increase in net income was primarily due to the higher revenues, despite being partially offset by increased compensation, a 17.2% rise in SG&A expenses, and higher income taxes.

The company's earnings per diluted share (EPS) for the full year stood at $7.71, compared to $6.58 in the prior year. The adjusted EPS, which excludes certain non-recurring items, matched the reported EPS at $7.71, indicating a strong operational performance without significant exceptional items.

FTI Consulting's cash position remained robust, with net cash provided by operating activities reaching $224.5 million for the year, an increase from the $188.8 million reported in the previous year. The company's cash and cash equivalents, along with short-term investments, totaled $328.7 million at the end of 2023.

Challenges and Outlook

Despite the strong financial performance, FTI Consulting faced challenges such as increased compensation expenses related to headcount growth, higher operating expenses, and a higher use of working capital required for growth. These factors, along with the increase in SG&A expenses, could pose challenges to the company's future profitability if not managed effectively.

Looking ahead, FTI Consulting provided guidance for 2024, estimating revenues to range between $3.650 billion and $3.790 billion, with EPS expected to be between $7.75 and $8.50. The company's confidence in its future performance is underpinned by its sustained growth trajectory and its ability to meet client needs effectively.

Investor and Analyst Perspectives

Steven H. Gunby, President and Chief Executive Officer of FTI Consulting, expressed confidence in the company's future, citing its ability to deliver value to clients and attract top talent as key drivers of its success. He stated:

In 2023, we continued our sustained, multi-year growth trajectory and once again delivered record revenues and earnings. These results reflect our continued ability to win in the two markets that matter most: the market for making a difference for clients and the market for great talent. That progress leaves me ever more confident about the future of our firm.

FTI Consulting's strong performance in 2023, along with its positive outlook for 2024, suggests a company well-positioned to navigate the complexities of the global business environment. Investors and analysts will likely keep a close eye on the company's ability to maintain its growth momentum and manage operating expenses in the coming year.

For a detailed analysis of FTI Consulting's financial results, including segment performance and reconciliations of non-GAAP financial measures, interested parties can access the full earnings release and financial tables on the company's investor relations website.

FTI Consulting will host a conference call to discuss the fourth quarter and full year 2023 financial results, providing an opportunity for analysts and investors to gain further insights into the company's performance and strategic direction.

Explore the complete 8-K earnings release (here) from FTI Consulting Inc for further details.

This article first appeared on GuruFocus.