Fulton Financial Corp (FULT) Reports Mixed Q4 and Full-Year 2023 Results Amid Rising Interest ...

Net Income: Q4 net income available to common shareholders was $61.7 million, down 11.3% from Q3, while full-year net income was $274.0 million, a 1.0% decrease from 2022.

Earnings Per Share (EPS): Q4 EPS stood at $0.37, with full-year EPS at $1.64, reflecting a slight year-over-year decline.

Net Interest Income: Q4 net interest income decreased by $1.8 million from Q3 to $212.0 million, and down 6.2% from Q4 2022.

Asset Quality: Non-performing assets were 0.56% of total assets, up from 0.52% in Q3 but down from 0.66% in Q4 2022.

Non-Interest Income: Increased by 7.4% to $60.1 million in Q4 compared to Q3, with wealth management revenues contributing significantly.

Non-Interest Expense: Rose to $180.6 million in Q4, a 5.6% increase from Q3, influenced by the "FultonFirst" initiative and a special FDIC assessment.

Balance Sheet: Total assets reached $27.56 billion, with net loans at $21.35 billion and deposits at $21.54 billion by the end of 2023.

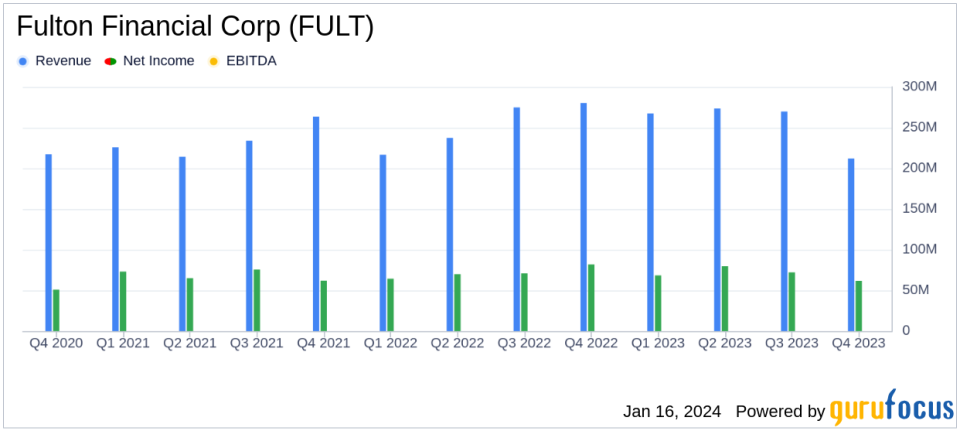

Fulton Financial Corp (NASDAQ:FULT) released its 8-K filing on January 16, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The U.S.-based financial services holding company, operating across five states and offering a range of banking products and services, faced a challenging environment with rising interest rates and operational changes.

Financial Performance Overview

Fulton Financial reported a decrease in net income for both the fourth quarter and the full year of 2023. The fourth quarter saw a decline of 11.3% from the previous quarter, with net income available to common shareholders at $61.7 million, or $0.37 per diluted share. The full-year net income also saw a slight decrease of 1.0% compared to 2022, totaling $274.0 million, or $1.64 per diluted share.

The net interest income for the fourth quarter was $212.0 million, a decrease from both the previous quarter and the same quarter in the previous year. This decline was primarily due to an increase in the rate on average interest-bearing deposits and a shift in the funding mix, partially offset by higher loan yields and an increase in the average balance of net loans.

Challenges and Initiatives

Fulton Financial launched the "FultonFirst" initiative in the fourth quarter, aimed at improving operational efficiency. This initiative led to $3.2 million in related expenses for the quarter. Additionally, the bank recognized a $6.5 million FDIC special assessment charge. Despite these challenges, Chairman and CEO Curtis J. Myers expressed satisfaction with the year's results and optimism for 2024.

"2023 was an extraordinary year and we were pleased with our results," said Myers. "Our team advanced our strategic objectives. We grew loans and deposits in a challenging environment, delivered enhancements to the customer experience, continued to operate with excellence and served our stakeholders well. Looking forward, 2024 is full of opportunity."

Asset Quality and Non-Interest Income

Asset quality remained stable, with non-performing assets constituting 0.56% of total assets at the end of 2023, a slight increase from the previous quarter but an improvement from the end of 2022. Non-interest income before investment securities gains (losses) increased by 7.4% to $60.1 million in the fourth quarter compared to the third quarter, driven by market movements in the commercial customer interest rate swap program and increases in wealth management revenues.

Non-Interest Expense and Tax Rate

Non-interest expenses rose to $180.6 million in the fourth quarter, up 5.6% from the third quarter, primarily due to the FDIC insurance expense and costs related to the FultonFirst initiative. The effective tax rate for 2023 was 18.5%, compared to 17.3% for 2022.

Conclusion

Overall, Fulton Financial Corp navigated a year marked by economic challenges and strategic initiatives, resulting in a modest decline in net income. The company's focus on operational efficiency and customer experience enhancements, coupled with a solid foundation in asset quality and non-interest income growth, positions it to capitalize on opportunities in 2024.

For more detailed information, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Fulton Financial Corp for further details.

This article first appeared on GuruFocus.