Fund 1 Investments, LLC Acquires Stake in Tile Shop Holdings Inc

On October 30, 2023, Fund 1 Investments, LLC (Trades, Portfolio) made a significant addition to its portfolio by acquiring 4,455,547 shares in Tile Shop Holdings Inc (NASDAQ:TTSH). This article provides an in-depth analysis of the transaction, the profiles of the involved parties, and the potential implications for value investors.

Details of the Transaction

The transaction saw Fund 1 Investments, LLC (Trades, Portfolio) add 1,000 shares to its holdings in Tile Shop Holdings Inc at a trade price of $5.15 per share. This acquisition increased the firm's total holdings in TTSH to 4,455,547 shares, representing 9.45% of its portfolio and 10.00% of TTSH's traded stock. Despite the transaction's relatively small impact on the firm's portfolio, it signifies a growing interest in the retail - cyclical industry.

Profile of Fund 1 Investments, LLC (Trades, Portfolio)

Fund 1 Investments, LLC (Trades, Portfolio), a firm based in Rincon, Puerto Rico, manages a diverse portfolio of 66 stocks, with a total equity of $243 million. The firm's top holdings include Amazon.com Inc (NASDAQ:AMZN), Children's Place Inc (NASDAQ:PLCE), Tile Shop Holdings Inc (NASDAQ:TTSH), Tilly's Inc (NYSE:TLYS), and J.Jill Inc (NYSE:JILL). The firm's investment philosophy is primarily focused on the Consumer Cyclical and Consumer Defensive sectors.

Overview of Tile Shop Holdings Inc

Tile Shop Holdings Inc, a specialty retailer based in the USA, offers a wide range of natural stone and man-made tiles, setting and maintenance materials, and related accessories. The company, which went public on November 19, 2010, also provides delivery services. As of October 31, 2023, TTSH has a market capitalization of $233.949 million and a stock price of $5.25. The company's PE percentage stands at 18.10, indicating a profitable operation.

Analysis of Tile Shop Holdings Inc's Stock

According to GuruFocus, TTSH's stock is modestly undervalued, with a GF Value of $6.08. The stock's price to GF Value ratio is 0.87, suggesting a potential upside for investors. Since the transaction, the stock has gained 1.94%, although it has declined by 45.03% since its IPO. However, the stock has shown a positive trend this year, with a YTD percent of 21.81.

Evaluation of Tile Shop Holdings Inc's Performance

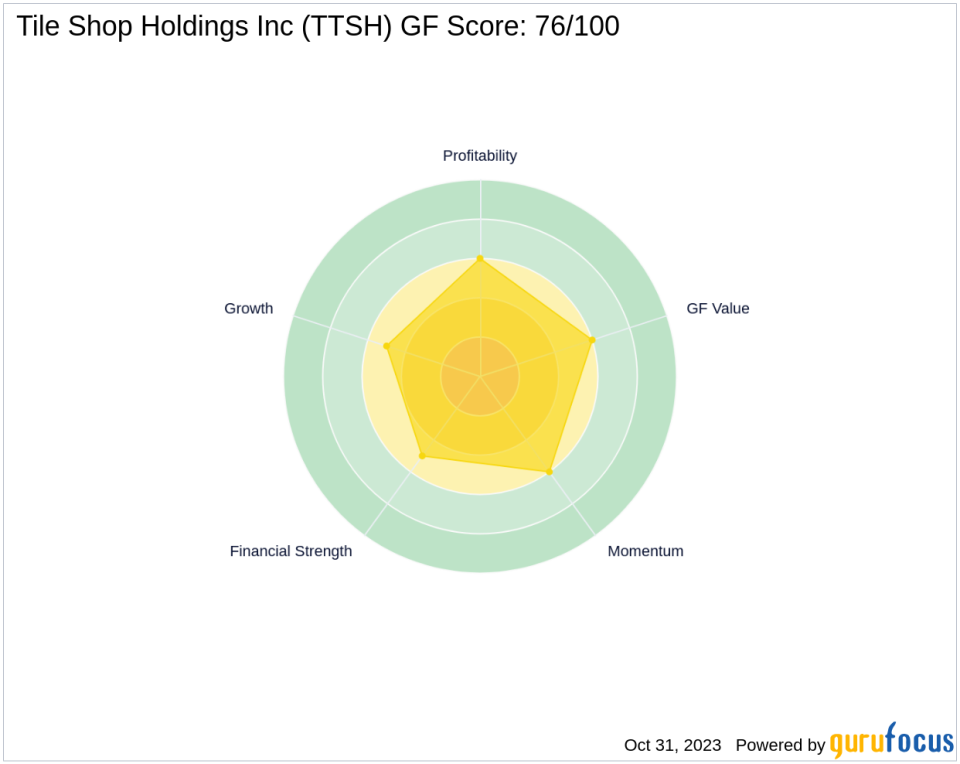

Tile Shop Holdings Inc has a GF Score of 76/100, indicating a likely average performance. The company's Financial Strength is ranked 5/10, while its Profitability Rank and Growth Rank are both 6/10. The company's Piotroski F-Score is 6, and its Altman Z score is 2.15, indicating a low risk of bankruptcy. However, its cash to debt ratio of 0.10 suggests a high level of debt.

Comparison with the Largest Guru

The largest guru holding TTSH's stock is First Eagle Investment (Trades, Portfolio) Management, LLC. Although the exact share percentage is not available, it's clear that Fund 1 Investments, LLC (Trades, Portfolio)'s recent acquisition has made it a significant player in TTSH's stock.

Conclusion

In conclusion, Fund 1 Investments, LLC (Trades, Portfolio)'s recent acquisition of TTSH's shares signifies a strategic move towards the retail - cyclical industry. With TTSH's stock being modestly undervalued and showing a positive trend this year, this transaction could potentially yield significant returns for the firm. However, investors should also consider TTSH's high debt level and average performance indicators. As always, it's crucial to conduct thorough research and analysis before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.