Fund 1 Investments, LLC Boosts Stake in Citi Trends Inc

On October 16, 2023, Fund 1 Investments, LLC (Trades, Portfolio), a Rincon, PR-based firm, increased its holdings in Citi Trends Inc (NASDAQ:CTRN) by adding 12,903 shares at a trade price of $23.06. This transaction has brought the firm's total shares in Citi Trends Inc to 939,368, representing 8.91% of its portfolio and 10.97% of Citi Trends Inc's total shares.

About Fund 1 Investments, LLC (Trades, Portfolio)

Fund 1 Investments, LLC (Trades, Portfolio) is a firm that manages an equity of $243 million. The firm's investment philosophy is centered around the Consumer Cyclical and Consumer Defensive sectors. Its top holdings include Amazon.com Inc (NASDAQ:AMZN), Children's Place Inc (NASDAQ:PLCE), Tile Shop Holdings Inc (NASDAQ:TTSH), Tilly's Inc (NYSE:TLYS), and J.Jill Inc (NYSE:JILL).

Overview of Citi Trends Inc

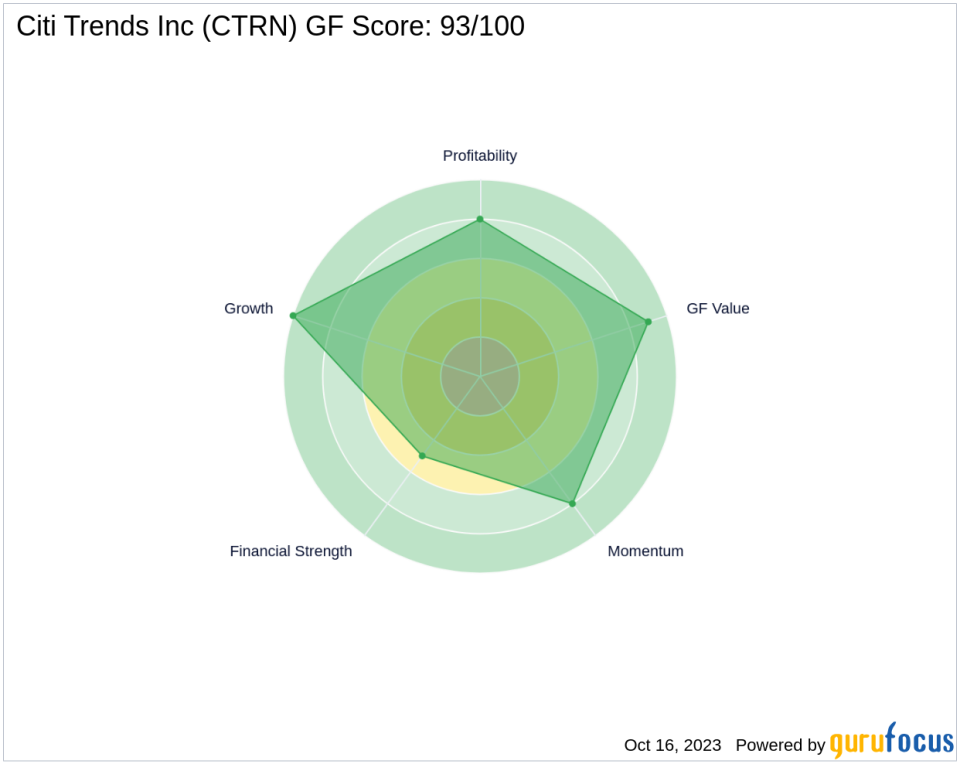

Citi Trends Inc is a US-based retailer of urban fashion apparel and accessories. The company operates in various segments, including Accessories & Beauty, Footwear, Home & Lifestyle, Kids, Ladies, and Mens. As of October 17, 2023, the company has a market capitalization of $202.797 million and its current stock price is $23.68. The company's GF Score is 93/100, indicating its high outperformance potential.

Financial Performance of Citi Trends Inc

Citi Trends Inc has a PE Percentage of 9.81, suggesting its profitability. The company's GF Valuation indicates that the stock is modestly undervalued, with a GF Value of $32.25 and a Price to GF Value of 0.73. The company's stock has gained 2.69% since the transaction and has seen a price change of 39.71% since its Initial Public Offering (IPO).

Balance Sheet and Profitability of Citi Trends Inc

Citi Trends Inc has a Balance Sheet Rank of 5/10 and a Profitability Rank of 8/10. The company's Growth Rank is 10/10, indicating its strong growth potential. The company's Piotroski F-Score is 4 and its Altman Z Score is 2.87, suggesting its financial stability.

Industry Position of Citi Trends Inc

Citi Trends Inc operates in the Retail - Cyclical industry. The company's ROE is 12.63 and its ROA is 3.69, indicating its efficiency in generating profits. The company's Gross Margin Growth is 1.10 and its Operating Margin Growth is -2.40, suggesting its profitability trends.

Growth of Citi Trends Inc Over the Years

Citi Trends Inc has seen a Revenue Growth 3 Year of 13.10 and an EBITDA Growth 3 Year of 52.80. The company's Earning Growth 3 Year is 72.00, indicating its strong earnings growth.

Conclusion

In conclusion, Fund 1 Investments, LLC (Trades, Portfolio)'s recent acquisition of additional shares in Citi Trends Inc is a strategic move that aligns with the firm's investment philosophy. Citi Trends Inc's strong financial performance, growth potential, and industry position make it a valuable addition to the firm's portfolio. This transaction is expected to have a positive impact on both the stock and the guru's portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.