Fund 1 Investments, LLC Boosts Stake in Citi Trends Inc

On October 11, 2023, Fund 1 Investments, LLC (Trades, Portfolio), a renowned investment firm, increased its stake in Citi Trends Inc (NASDAQ:CTRN), a leading retailer of urban fashion apparel and accessories in the United States. The firm added 17,673 shares to its portfolio, representing a 1.94% change in shares and a 0.17% impact on the portfolio. The shares were traded at a price of $22.88 each, bringing the total shares held by the firm to 926,465. This transaction has increased the firm's position in Citi Trends Inc to 8.72% of its portfolio and 10.82% of the company's holdings.

About Fund 1 Investments, LLC (Trades, Portfolio)

Fund 1 Investments, LLC (Trades, Portfolio), located at 100 CARR 115 RINCON, PR 00677, is a value-oriented investment firm with a focus on long-term capital appreciation. The firm currently holds 66 stocks in its portfolio, with a total equity of $243 million. Its top holdings include Amazon.com Inc (NASDAQ:AMZN), Children's Place Inc (NASDAQ:PLCE), Tile Shop Holdings Inc (NASDAQ:TTSH), Tilly's Inc (NYSE:TLYS), and J.Jill Inc (NYSE:JILL). The firm's investments are primarily concentrated in the Consumer Cyclical and Consumer Defensive sectors.

Overview of Citi Trends Inc

Citi Trends Inc, with a market capitalization of $204.614 million, is a prominent player in the Retail - Cyclical industry. The company offers a wide range of products, including fashion sportswear for men, women, and children, accessories, home products, beauty products, books, and toys. The company's segments include Accessories & Beauty, Footwear, Home & Lifestyle, Kids, Ladies, and Mens. As of October 12, 2023, the company's stock price stands at $23.67, with a PE percentage of 9.82. According to GuruFocus valuation, the stock is modestly undervalued with a GF Value of $32.20.

Analysis of the Transaction

The recent transaction by Fund 1 Investments, LLC (Trades, Portfolio) has significantly increased its stake in Citi Trends Inc. The firm now holds 926,465 shares of the company, representing 8.72% of its portfolio and 10.82% of the company's holdings. The shares were traded at a price of $22.88 each, indicating the firm's confidence in the company's growth potential.

Evaluation of Citi Trends Inc's Financial Performance

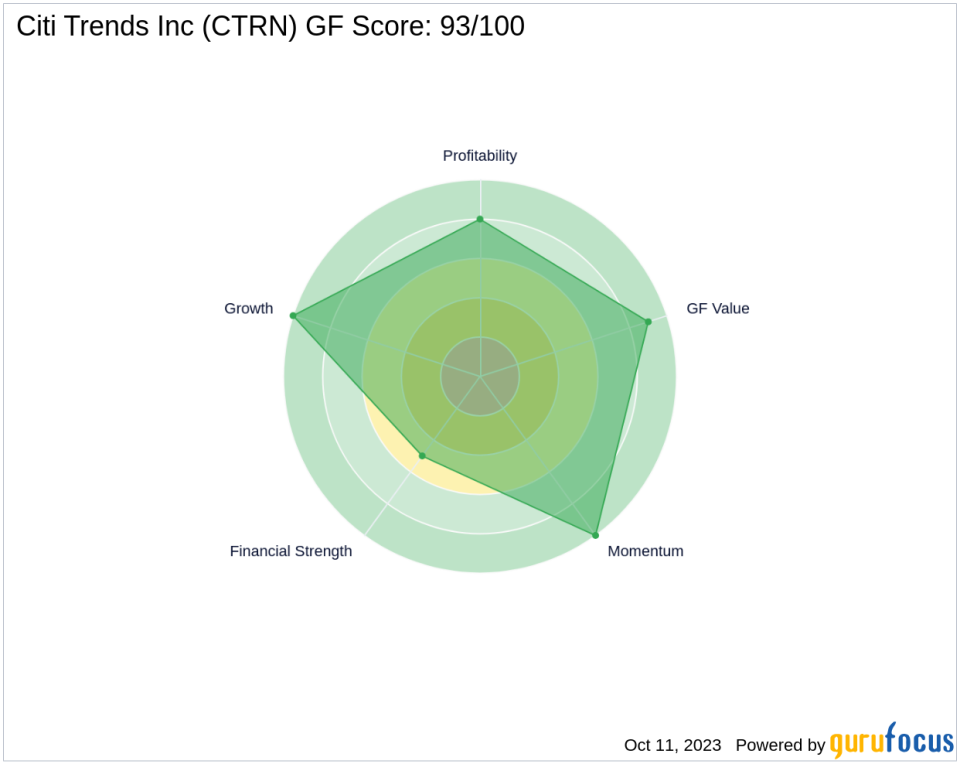

Citi Trends Inc has demonstrated strong financial performance, with a GF Score of 93/100, indicating high outperformance potential. The company's financial strength is rated 5/10, with a cash to debt ratio of 0.27. Its profitability rank is 8/10, with a return on equity (ROE) of 12.63% and a return on assets (ROA) of 3.69%. The company's growth rank is 10/10, indicating strong growth potential.

Examination of Citi Trends Inc's Stock Performance

Since its IPO on May 18, 2005, Citi Trends Inc's stock has gained 39.65%. However, the stock has declined by 11.78% year-to-date. The company's stock is currently trading at a price to GF Value ratio of 0.74, indicating that it is modestly undervalued. The company's momentum index for the past 6 - 1 month is 19.04, and its 14-day RSI is 52.02, suggesting moderate momentum.

Conclusion

In conclusion, Fund 1 Investments, LLC (Trades, Portfolio)'s recent acquisition of additional shares in Citi Trends Inc reflects the firm's confidence in the company's growth potential. With strong financial performance and an undervalued stock, Citi Trends Inc presents an attractive investment opportunity. However, investors should conduct their own due diligence before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.