Fund 1 Investments, LLC Reduces Stake in J.Jill Inc

On October 18, 2023, Fund 1 Investments, LLC (Trades, Portfolio) made a significant move in the stock market by reducing its stake in J.Jill Inc. This article provides an in-depth analysis of the transaction, the profiles of both Fund 1 Investments, LLC (Trades, Portfolio) and J.Jill Inc, and the potential implications of this move on the market.

Details of the Transaction

Fund 1 Investments, LLC (Trades, Portfolio) reduced its holdings in J.Jill Inc by 55,574 shares, representing a 5.02% decrease from its previous position. The shares were traded at a price of $29.56 each. Following this transaction, the firm now holds 1,052,526 shares in J.Jill Inc, which constitutes 12.9% of its portfolio. The firm's stake in J.Jill Inc now stands at 9.93%.

Profile of Fund 1 Investments, LLC (Trades, Portfolio)

Fund 1 Investments, LLC (Trades, Portfolio) is a renowned investment firm based in Rincon, Puerto Rico. The firm manages a portfolio of 66 stocks, with a total equity of $243 million. Its top holdings include Amazon.com Inc, Children's Place Inc, Tile Shop Holdings Inc, Tilly's Inc, and J.Jill Inc. The firm primarily invests in the Consumer Cyclical and Consumer Defensive sectors.

Overview of J.Jill Inc

J.Jill Inc, a national lifestyle brand based in the USA, offers apparel, footwear, and accessories under the J.Jill brand name. The company operates through its e-commerce platform, catalog, and retail stores. As of October 20, 2023, the company has a market capitalization of $308.115 million. The stock is currently trading at $29.06, which is significantly overvalued according to the GF Value Rank, with a GF Value of $15.44.

Analysis of J.Jill Inc's Financial Health

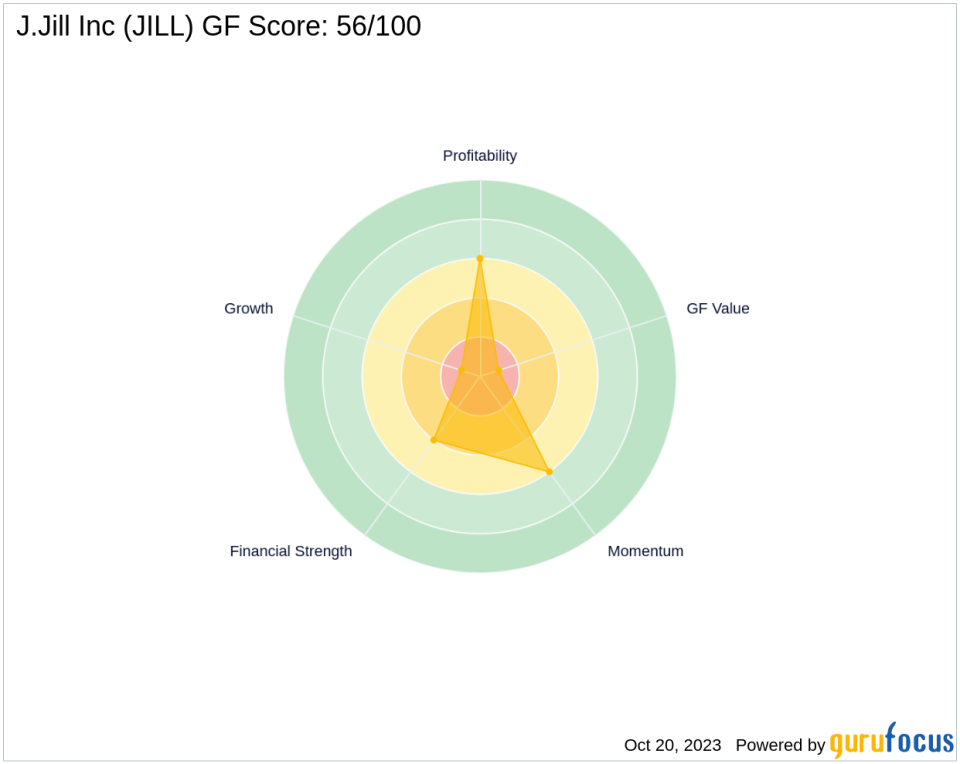

J.Jill Inc's financial health is evaluated based on various metrics. The company has a Financial Strength rank of 4/10, a Profitability Rank of 6/10, and a Growth Rank of 1/10. Its cash to debt ratio stands at 0.16, and it has an interest coverage of 3.48. The company's ROE and ROA ranks are 17 and 273, respectively.

Evaluation of J.Jill Inc's Stock Performance

Since its IPO on March 9, 2017, J.Jill Inc's stock has decreased by 54.42%. However, the stock has gained 14.82% year-to-date. The stock has a GF Score of 56/100, indicating poor future performance potential. It also has a Piotroski F-Score of 6 and an Altman Z score of 1.80.

Assessment of J.Jill Inc's Market Momentum

J.Jill Inc's market momentum is evaluated based on its RSI and momentum index. The stock has an RSI 5 Day of 54.82, an RSI 9 Day of 57.50, and an RSI 14 Day of 59.10. Its momentum index 6 - 1 month is -2.00, and its momentum index 12 - 1 month is 32.83.

Conclusion

The recent transaction by Fund 1 Investments, LLC (Trades, Portfolio) has slightly reduced its exposure to J.Jill Inc. However, the firm still holds a significant stake in the company. Given J.Jill Inc's current financial health and market performance, it will be interesting to see how this move impacts both the firm's portfolio and the stock's performance in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.