These Fundamentals Make Hubbell Incorporated (NYSE:HUBB) Truly Worth Looking At

Attractive stocks have exceptional fundamentals. In the case of Hubbell Incorporated (NYSE:HUBB), there’s is a well-regarded dividend payer with a a great history of delivering benchmark-beating performance. Below, I’ve touched on some key aspects you should know on a high level. If you’re interested in understanding beyond my broad commentary, take a look at the report on Hubbell here.

Established dividend payer with proven track record

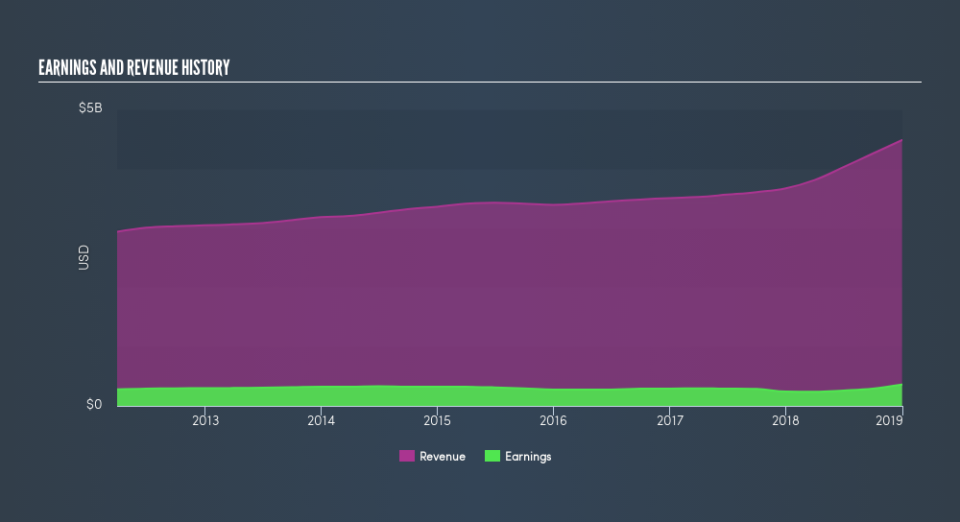

Over the past year, HUBB has grown its earnings by 48%, with its most recent figure exceeding its annual average over the past five years. This illustrates a strong track record, leading to a satisfying return on equity of 20%. which paints a buoyant picture for the company.

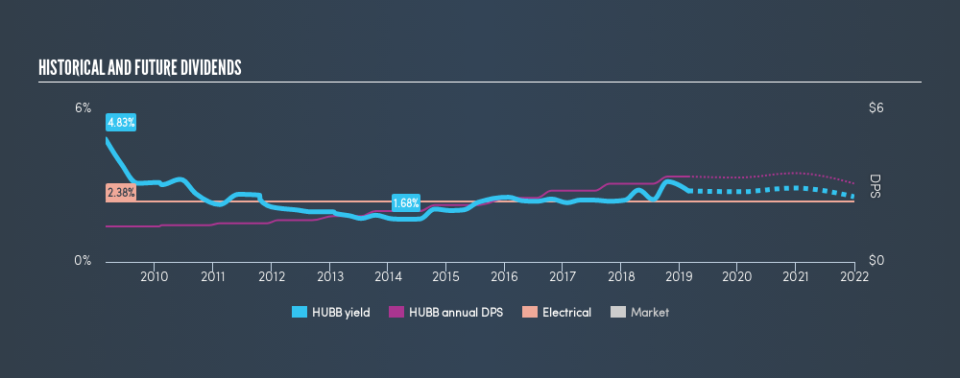

HUBB is also a dividend company, with ample net income to cover its dividend payout, which has been consistently growing over the past decade, keeping income investors happy.

Next Steps:

For Hubbell, there are three relevant aspects you should further examine:

Future Outlook: What are well-informed industry analysts predicting for HUBB’s future growth? Take a look at our free research report of analyst consensus for HUBB’s outlook.

Financial Health: Are HUBB’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of HUBB? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.