Funko's (NASDAQ:FNKO) Q4 Sales Beat Estimates, Stock Jumps 15.3%

Pop culture collectibles manufacturer Funko (NASDAQ:FNKO) reported Q4 FY2023 results exceeding Wall Street analysts' expectations , with revenue down 12.6% year on year to $291.2 million. On the other hand, next quarter's revenue guidance of $220.5 million was less impressive, coming in 8% below analysts' estimates. It made a non-GAAP profit of $0.01 per share, improving from its loss of $0.35 per share in the same quarter last year.

Is now the time to buy Funko? Find out by accessing our full research report, it's free.

Funko (FNKO) Q4 FY2023 Highlights:

Revenue: $291.2 million vs analyst estimates of $282 million (3.3% beat)

EPS (non-GAAP): $0.01 vs analyst estimates of -$0.02 ($0.03 beat)

Management's adj EBITDA guidance for the upcoming financial year 2024 is $75.0 million at the midpoint, above analyst estimates of $70.5 million (6.4% beat)

Free Cash Flow of $29.53 million, up from $810,000 in the previous quarter

Gross Margin (GAAP): 37.6%, up from 28.3% in the same quarter last year

Market Capitalization: $323.1 million

“In 2023, we implemented a comprehensive plan to significantly reduce costs, improve operational efficiencies and focus on our core product offerings,” said Michael Lunsford, Funko’s Interim Chief Executive Officer.

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

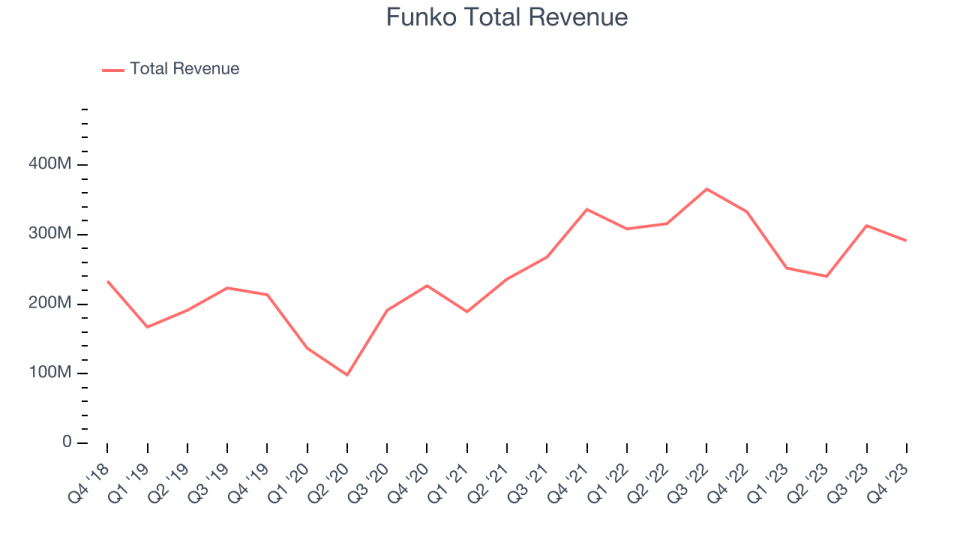

Sales Growth

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Funko's annualized revenue growth rate of 9.8% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Funko's recent history shows the business has slowed as its annualized revenue growth of 3.2% over the last two years is below its five-year trend.

This quarter, Funko's revenue fell 12.6% year on year to $291.2 million but beat Wall Street's estimates by 3.3%. The company is guiding for a 12.5% year-on-year revenue decline next quarter to $220.5 million, an improvement from the 18.3% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 1.2% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

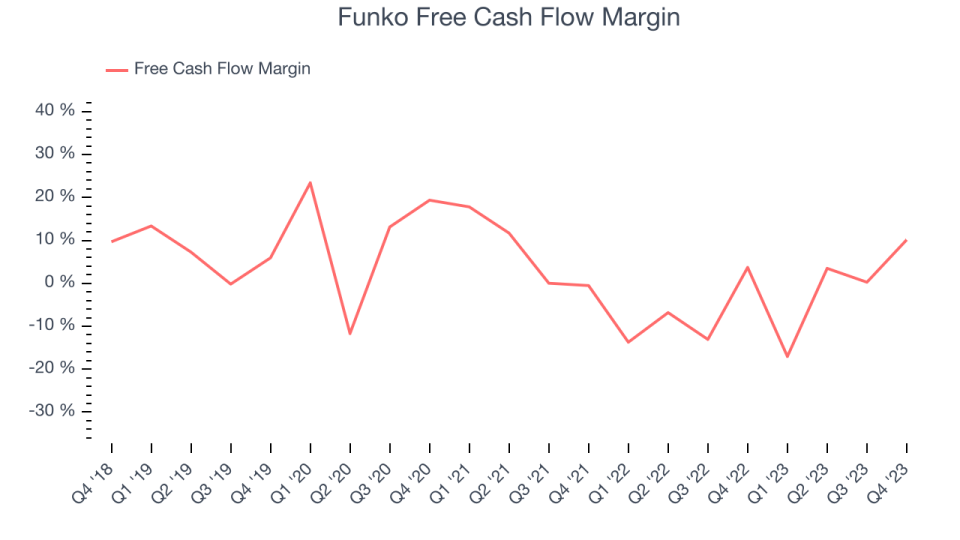

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

While Funko posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Funko's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 4.3%.

Funko's free cash flow came in at $29.53 million in Q4, equivalent to a 10.1% margin and up 140% year on year.

Key Takeaways from Funko's Q4 Results

We were impressed by how significantly Funko blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. Lastly, while revenue guidance for next quarter fell short of Wall Street's estimates, full year adjusted EBITDA guidance was nicely ahead. Overall, this was a solid quarter for Funko. The stock is up 15.3% after reporting and currently trades at $7.45 per share.

So should you invest in Funko right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.