Further Upside For Blue Bird Corporation (NASDAQ:BLBD) Shares Could Introduce Price Risks After 32% Bounce

Blue Bird Corporation (NASDAQ:BLBD) shareholders have had their patience rewarded with a 32% share price jump in the last month. The last month tops off a massive increase of 133% in the last year.

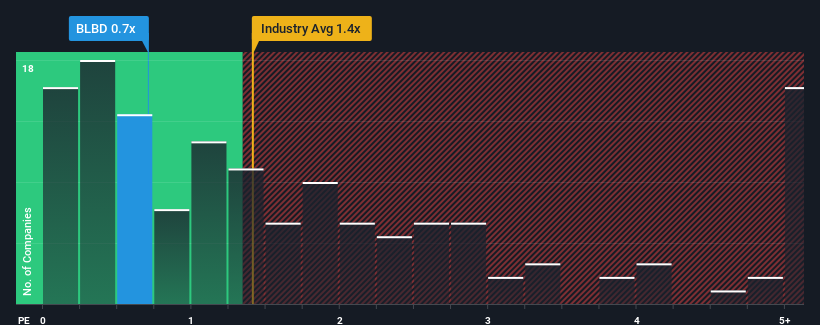

In spite of the firm bounce in price, when close to half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Blue Bird as an enticing stock to check out with its 0.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Blue Bird

What Does Blue Bird's P/S Mean For Shareholders?

Recent times have been advantageous for Blue Bird as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Blue Bird's future stacks up against the industry? In that case, our free report is a great place to start.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Blue Bird would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. The latest three year period has also seen a 29% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 8.3% over the next year. That's shaping up to be materially higher than the 2.3% growth forecast for the broader industry.

In light of this, it's peculiar that Blue Bird's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Despite Blue Bird's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Blue Bird's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Blue Bird that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.