Further Upside For Lazard Ltd (NYSE:LAZ) Shares Could Introduce Price Risks After 30% Bounce

Lazard Ltd (NYSE:LAZ) shares have had a really impressive month, gaining 30% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

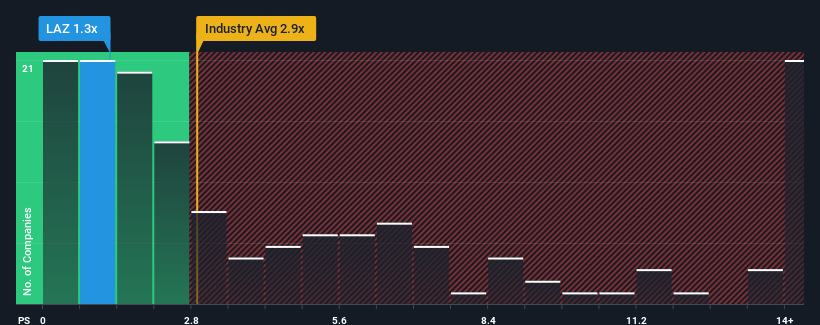

Although its price has surged higher, Lazard may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 2.9x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Lazard

How Has Lazard Performed Recently?

Lazard could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lazard.

Is There Any Revenue Growth Forecasted For Lazard?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Lazard's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 8.0% as estimated by the six analysts watching the company. With the industry predicted to deliver 8.8% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Lazard's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Lazard's P/S Mean For Investors?

Lazard's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Lazard's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Lazard, and understanding them should be part of your investment process.

If you're unsure about the strength of Lazard's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.