Further weakness as 111 (NASDAQ:YI) drops 11% this week, taking three-year losses to 51%

If you love investing in stocks you're bound to buy some losers. Long term 111, Inc. (NASDAQ:YI) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 51% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 29% lower in that time. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for 111

111 wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

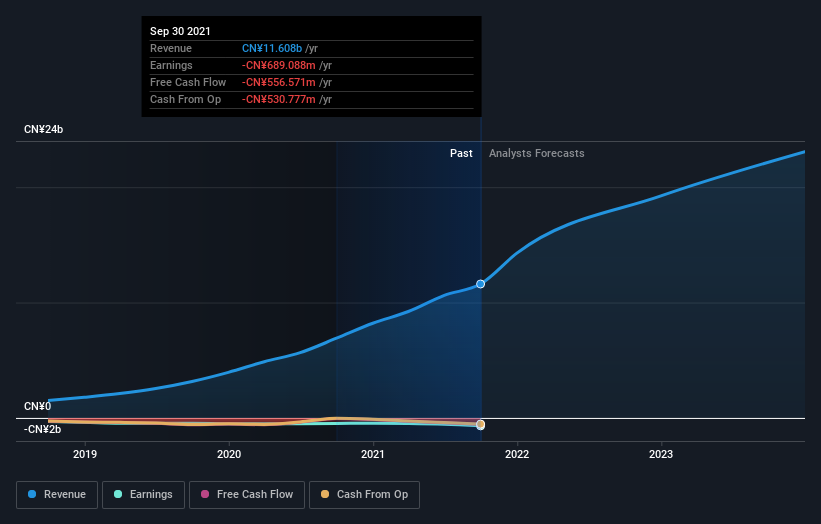

Over three years, 111 grew revenue at 63% per year. That's well above most other pre-profit companies. In contrast, the share price is down 15% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for 111 shares, which cost holders 29%, while the market was up about 30%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 15% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - 111 has 3 warning signs (and 2 which are significant) we think you should know about.

Of course 111 may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.