Further weakness as ams-OSRAM (VTX:AMS) drops 15% this week, taking five-year losses to 88%

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held ams-OSRAM AG (VTX:AMS) for five whole years - as the share price tanked 92%. We also note that the stock has performed poorly over the last year, with the share price down 29%. More recently, the share price has dropped a further 21% in a month. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for ams-OSRAM

ams-OSRAM isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, ams-OSRAM grew its revenue at 30% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 14% throughout that time. It could be that the stock was over-hyped before. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

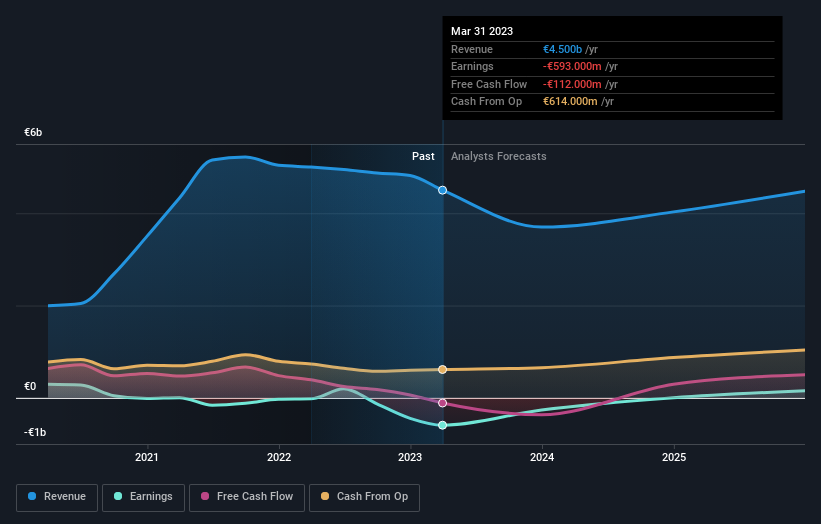

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

ams-OSRAM is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between ams-OSRAM's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. ams-OSRAM's TSR of was a loss of 88% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in ams-OSRAM had a tough year, with a total loss of 29%, against a market gain of about 3.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 14% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand ams-OSRAM better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for ams-OSRAM you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here