Further weakness as Denali Therapeutics (NASDAQ:DNLI) drops 7.4% this week, taking three-year losses to 67%

Denali Therapeutics Inc. (NASDAQ:DNLI) shareholders should be happy to see the share price up 18% in the last month. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 67% in that time. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

If the past week is anything to go by, investor sentiment for Denali Therapeutics isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Denali Therapeutics

Denali Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Denali Therapeutics saw its revenue shrink by 6.7% per year. That's not what investors generally want to see. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 19% per year. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

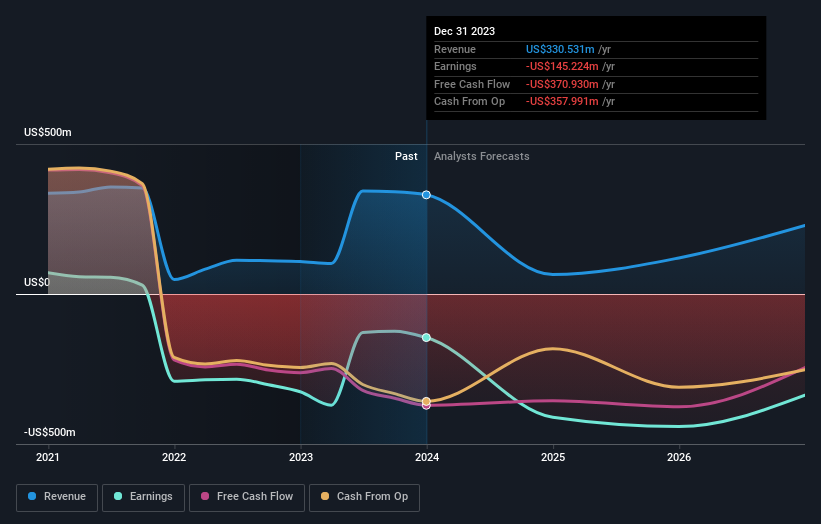

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Denali Therapeutics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Denali Therapeutics in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 31% in the last year, Denali Therapeutics shareholders lost 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Denali Therapeutics you should be aware of.

But note: Denali Therapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.