The ‘Future Is Bright’ for These 2 Banking Stock Giants, Says Morgan Stanley

The banking crisis and recession of 2008 predictably led to tighter restrictions and regulations on the international banking industry – but a new note from Morgan Stanley’s sector expert Betsy Graseck suggests that the most recent set of regulations, the Basel III endgame, may be eased in the near future.

The new rules derive from a set of regulations proposed last summer, imposing high levels of capital requirements on banks with $100 billion or more in total assets. Graseck, however, has been talking to management teams from the banking giants, and believes that the rules will not be as restrictive as had been previously assumed.

“We’re anticipating that a final rule set will better align with global standards, driving a lower risk-weighted assets uplift than banks originally disclosed,” Graseck said, and she went on to point out that larger banks will see larger benefits, as they have more excess capital to set to work, once the lighter rules are in place. She expects to see a significant increase in buybacks as the banks start using that excess capital.

Zooming in, Graseck takes the time to give several major bank stocks a closer look in light of this development. She sees reason to upgrade several, believing the ‘future is bright’ for particular names in the space. So, let’s take a closer look at two of her recent upgrades and with help from the TipRanks database, we can also gauge general Street sentiment toward these stocks.

Bank of America (BAC)

We’ll start with Bank of America, one of the world’s largest banking firms. BofA boasts a market cap of $265 billion, and has approximately $3.18 trillion in total assets on the books. The bank is one of the top four in the US (alongside JPM, Wells Fargo, and Citigroup) and is ranked second by total domestic bank deposits. Bank of America has more than 3,900 retail banking locations, and some 16,000 ATMs.

The company released its 4Q23 and full-year 2023 results on January 12. The top line revenue figure for the quarter came to $22 billion, for a 10.5% year-over-year slip and missing expectations by $1.77 billion. For the year, revenue came to $98.6 billion, compared to $95 billion in 2022. At the bottom line, BoA reported an adjusted quarterly EPS of 70 cents per share, beating the forecast by 6 cents.

Of particular interest, in light of analyst Graseck’s comments above on the banking sector generally, BofA has a long-held commitment to capital return. During the fourth quarter, the bank paid out $1.9 billion in dividends, and spent $800 million on share repurchases. The last dividend payment was declared on January 31, at 24 cents per share. The annualized payment of 96 cents gives a yield of 2.87%.

For Graseck, the important point on BAC is the relatively discounted price of the stock. She writes, “We are upgrading BAC primarily on valuation, as the stock is trading at only 9x our 2025 EPS, near the low end of its 8-15x average range over the last decade. We do not think a stock that can deliver 10% or more ROE should trade at an 11% cost of equity. Bank of America also benefits from a strong consumer deposit franchise, with 92% of consumer checking accounts being primary accounts and 67% of deposit balances being with customers that have been at BAC for more than 10 years.”

Looking ahead, the Morgan Stanley analyst sees plenty of potential for Bank of America to hold the line in its business, and notes the bank’s sound liquidity potential: “In our view, we see extraordinarily low risk BAC would have to tap unrealized losses in its HTM securities book given the strength, stickiness and diversity of its growing deposit franchise, ability to increase deposit rates to grow deposit balances if desired, extensive global liquidity sources of $897B, and daily LCR (liquidity coverage ratio) testing as a GSIB (global systemically important banks).”

All of that makes a sound foundation for this bank, and supports Graseck’s upgrade from Equal-weight (i.e., Neutral) to Overweight (Buy). Her price target on the shares, bumped up from $32 to $41, implies a one-year potential upside of 22.5%. (To watch Graseck’s track record, click here)

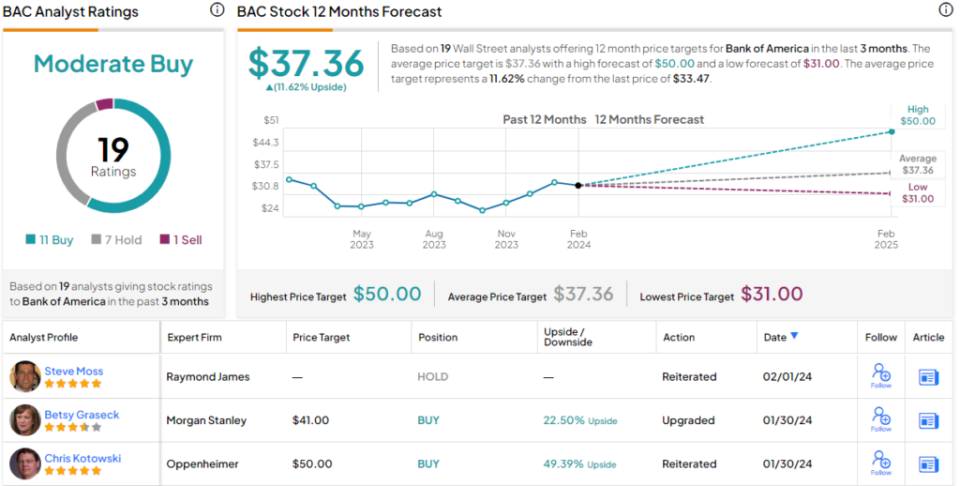

The 19 recent analyst reviews on BAC break down to 11 Buys, 7 Holds, and 1 Sell, for a Moderate Buy consensus rating on the shares. The stock is trading for $33.47 and its $37.36 average target price points toward a 12-month gain of 11.5%. (See BAC stock forecast)

Goldman Sachs (GS)

Next on our list is one of the best-known names in investment banking and financial services, Goldman Sachs. GS caters to a customer base made up of banks, corporations, financial institutions, governments and government agencies, and high-net-worth individuals, offering a full range of banking and credit services, including wealth and asset management and investment banking. Goldman is based in New York City, maintains offices in many of the world’s iconic financial centers, and has been in operation for over 150 years.

With its lower Manhattan address and its well-heeled clientele, Goldman definitely occupies a high-prestige niche in the banking world. The bank’s experts are well-known on Wall Street, and their views on the economy, the stock market, and the international financial scene are frequently in demand, making Goldman a leader in global investment research. GS has built up a market cap north of $126 billion, and as of December 31 last year had $1.642 trillion in total assets.

Goldman isn’t shy about returning capital to its investors. The bank reported its last set of financial results, for the fourth quarter and full year 2023, on January 16, and those results showed that, in 2023, the firm returned $9.39 billion worth of capital to common shareholders. This return included $5.8 billion in common stock repurchases, along with $3.59 billion in common share dividend payments. The most recent dividend, of $2.75, was declared for a March 28 payment. The dividend has an annualized rate of $11, and a forward yield of 2.84%.

That total capital return was based on the company’s strong performance. Quarterly revenue came to $11.32 billion, up almost 7% y/y and some $360 million over the forecast. The bottom-line earnings, reported as $5.48 per share, were $1.55 per share better than had been anticipated.

Analyst Graseck notes that Goldman’s current position makes it particularly suited to gain on a capital rebound, and writes at length to explain why, saying, “Goldman is the most exposed in our Large Cap Banks coverage to a capital markets rebound, with 64% of revenues coming from Global Banking & Markets in 2024 in our model. We model Goldman’s M&A advisory revenues increasing by 45% in 2024, ECM increasing 59% and DCM increasing 42%, a large percentage inflection off of a low base… We estimate $14B excess CET1 (1.9% of CET1 ratio) in scenario where Basel Endgame aligns with Europe, setting stage for a sharp uplift in net share buybacks from 1% of shares in 4Q23 ann. run rate to 7% of shares in ’26.”

Looking ahead, Graseck uses these comments to back up her Equal-weight (Neutral) to Overweight (Buy) upgrade on GS shares. Her price target is now set at $449 (up from $333), implying a 16% upside on the one-year horizon.

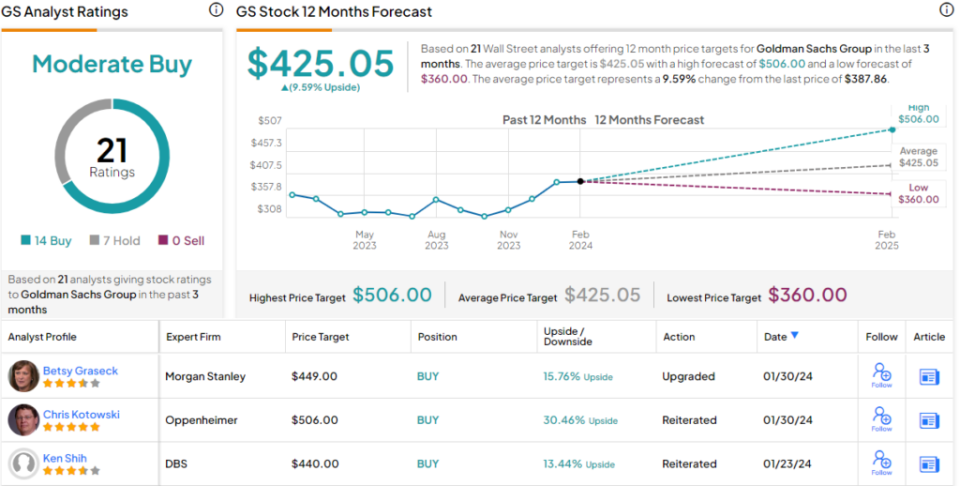

Overall, Goldman gets a Moderate Buy from the Street’s consensus, based on 21 recent reviews that include 14 Buys to 7 Holds. Shares are trading for $387.86 and their $425.05 average price target suggests an increase of 9.5% in the next 12 months. (See GS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.