What Is The Future Prospect For Healthcare And CEL-SCI Corporation (NYSEMKT:CVM)?

CEL-SCI Corporation (AMEX:CVM), a USD$22.01M small-cap, is a healthcare company operating in an industry, which faces key trends such as rising demand fuelled by an aging population and the growing prevalence of chronic diseases. Healthcare analysts are forecasting for the entire industry, a relatively muted growth of 9.04% in the upcoming year , and a whopping growth of 49.33% over the next couple of years. Not surprisingly, this rate is more than double the growth rate of the US stock market as a whole. Below, I will examine the sector growth prospects, as well as evaluate whether CEL-SCI is lagging or leading in the industry. Check out our latest analysis for CEL-SCI

What’s the catalyst for CEL-SCI’s sector growth?

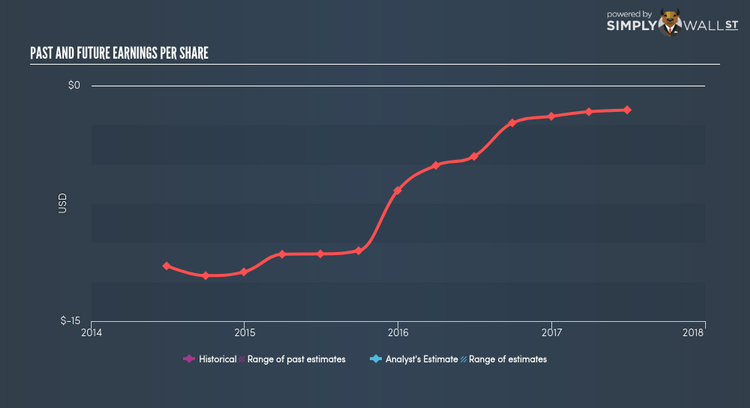

New R&D methods and big data analytics are creating opportunities for innovations, however, stakeholders have been challenged to keep abreast of this structural shift while under pressure to cut costs. In the past year, the industry delivered growth in the teens, beating the US market growth of 10.87%. CEL-SCI lags the pack with its sustained negative earnings over the past couple of years. The company’s outlook seems uncertain, with a lack of analyst coverage, which doesn’t boost our confidence in the stock. This lack of growth and transparency means CEL-SCI may be trading cheaper than its peers.

Is CEL-SCI and the sector relatively cheap?

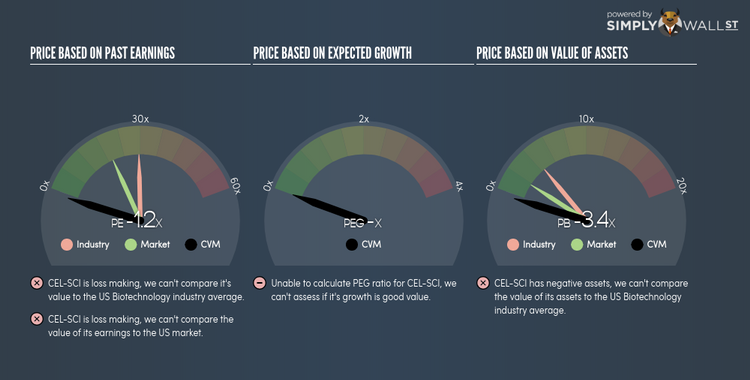

The biotech industry is trading at a PE ratio of 29x, above the broader US stock market PE of 20x. This means the industry, on average, is relatively overvalued compared to the wider market. However, the industry did return a higher 16.06% compared to the market’s 10.46%, which may be indicative of past tailwinds. Since CEL-SCI’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge CEL-SCI’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? CEL-SCI recently delivered an industry-beating growth rate in earnings, which is a positive for shareholders. If you’re bullish on the stock and well-diversified by industry, you may decide to hold onto CEL-SCI as part of your portfolio. However, if you’re relatively concentrated in biotech, you may want to value CEL-SCI based on its cash flows to determine if it is overpriced based on its current growth outlook.

Are you a potential investor? If CEL-SCI has been on your watchlist for a while, now may be the time to enter into the stock, if you like its ability to deliver growth and are not highly concentrated in the biotech industry. Before you make a decision on the stock, take a look at CEL-SCI’s cash flows and assess whether the stock is trading at a fair price.

For a deeper dive into CEL-SCI’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other healthcare stocks instead? Use our free playform to see my list of over 1000 other healthcare companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.