G-III Apparel (GIII) Q2 Earnings Beat, Sales Improve Y/Y

G-III Apparel Group, Ltd. GIII posted better-than-expected results in second-quarter fiscal 2024, wherein the top and bottom line beat the Zacks Consensus Estimate. Adjusted earnings of 40 cents per share outpaced the consensus estimate of earnings of 2 cents per share. Also, the bottom line increased 2.6% from the year-earlier quarter’s earnings of 39 cents per share.

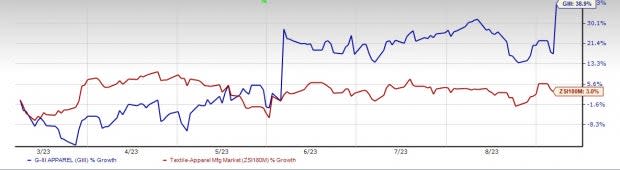

Shares of this Zacks Rank #3 (Hold) company have gained 38.9%, outperforming the industry’s 3% rise in the past six months.

Q2 in Detail

Net sales rose 9% year over year to $659.8 million and surpassed the Zacks Consensus Estimate of $595 million.

Moreover, gross profit jumped 20.9% year over year to $276.7 million. SG&A expenses increased 25.2% year over year to $239.2 million. Further, operating came in at $31.5 million in the fiscal second quarter compared with $31.3 million in the year-earlier quarter.

Image Source: Zacks Investment Research

Management has announced a new license agreement with HanesBrands to manufacture an outerwear collection for the Champion brand.

Other Financial Details

G-III Apparel ended second-quarter fiscal 2024 with cash and cash equivalents of $197.7 million and total debt of $466 million.

Total stockholders’ equity was $1,382.1 million.

Outlook

For fiscal 2024, management projects net sales to be about $3.30 billion and net income to be $145-$150 million, or between $3.05 per share and $3.15 per share. This compares favorably to net sales of $3.23 billion and a net loss of $(133.1) million, or $(2.79) per share, for fiscal 2023.

The company is expecting adjusted net income to be between $152 million and $157 million, or between $3.20 per share and $3.30 per share. This compares favorably to adjusted net income of $138.8 million, or $2.85 per share, for fiscal 2023.

The company is expecting adjusted EBITDA for fiscal 2024 to be between $284 million and $289 million versus adjusted EBITDA of $266.1 million in fiscal 2023.

For the third quarter, management expects net sales to be about $1.13 billion versus $1.08 billion in the same period last year. It estimates net income for the third quarter of fiscal 2024 to be between $94 million and $99 million or between $1.99 per share and $2.09 per share.

The company is anticipating adjusted net income for the third quarter of fiscal 2024 to be between $96 million and $101 million, or between $2.03 per share and $2.13 per share. This compares favorably to non-GAAP net income of $65.6 million or $1.35 per share in prior year’s third quarter.

Eye These Solid Picks

Some top-ranked companies are Royal Caribbean RCL, lululemon athletica LULU and Ralph Lauren RL.

Royal Caribbean sports a Zacks Rank of 1, at present. You can see the complete list of today’s Zacks #1 Rank stocks here

RCL has a trailing four-quarter earnings surprise of 28.5%, on average. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates increases of 54.5% and 180.3%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank #2 (Buy), at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 17.2% and 18.5%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

Ralph Lauren, a footwear and accessories dealer, has a Zacks Rank of 2 at present. RL has a trailing four-quarter earnings surprise of 17.3%, on average.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and EPS suggests growth of 2.5% and 13.7%, respectively, from the year-ago corresponding figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report