G-III Apparel Group (GIII): A Closer Look at Its Undervalued Status

G-III Apparel Group Ltd (NASDAQ:GIII) recently experienced a daily gain of 18.42%, and a 3-month gain of 11.66%. However, it reported a Loss Per Share of $3.47. This raises the question: is the stock modestly undervalued? This article aims to provide a comprehensive valuation analysis of G-III Apparel Group. Let's delve deeper.

Company Overview

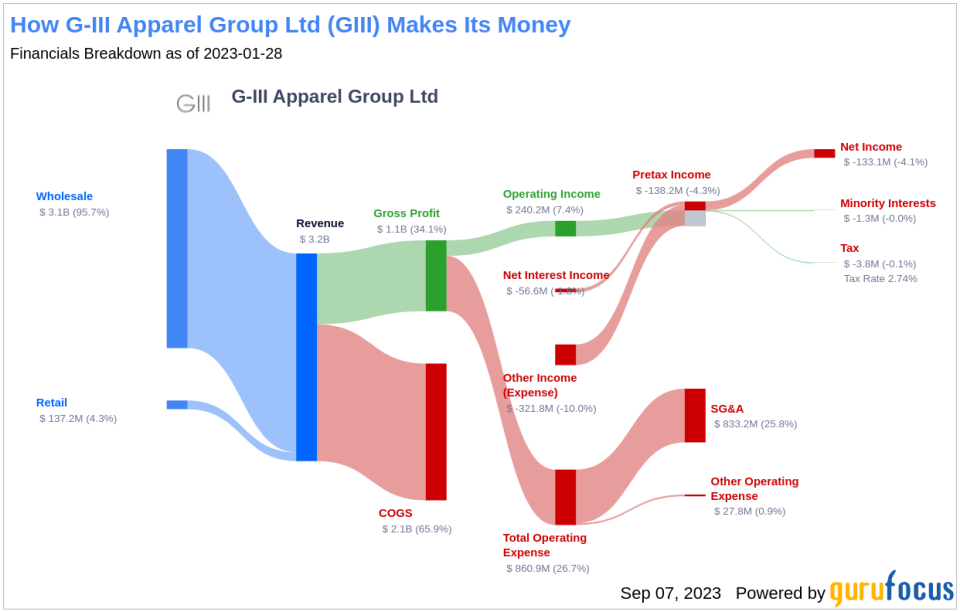

G-III Apparel Group Ltd is a renowned textile company with a diverse range of apparel, footwear, and accessories. The company operates under its own brands, licensed brands, and private-label brands. G-III boasts a substantial portfolio with five global power brands: DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger, and Karl Lagerfeld. The company has two reportable operations: Wholesale Operations and Retail Operations. The majority of its revenues are derived from Wholesale operations.

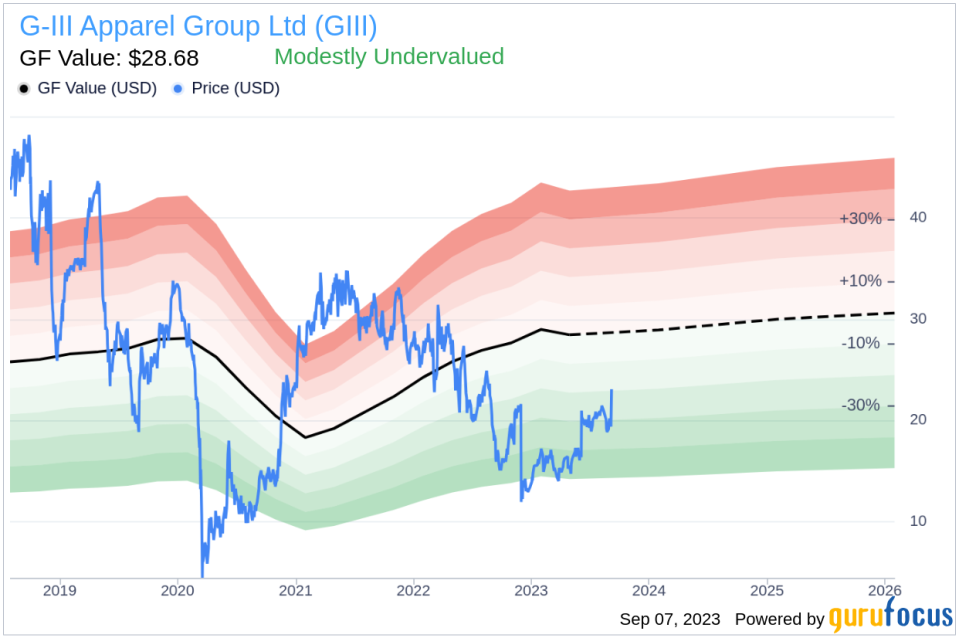

As of September 07, 2023, G-III Apparel Group's stock price was $22.86, with a market cap of $1 billion. The GF Value, an estimation of fair value, stands at $28.68, suggesting that the stock might be modestly undervalued.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return is likely to be higher.

For G-III Apparel Group (NASDAQ:GIII), the stock is estimated to be modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

For higher future returns at reduced risk, consider these companies.

Financial Strength

Investing in companies with poor financial strength can lead to a higher risk of permanent loss. G-III Apparel Group has a cash-to-debt ratio of 0.36, which is worse than 56.31% of 998 companies in the Manufacturing - Apparel & Accessories industry. The overall financial strength of G-III Apparel Group is 6 out of 10, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies, especially those demonstrating consistent profitability over the long term, poses less risk. G-III Apparel Group has been profitable 9 out of the past 10 years. Its operating margin is 6.39%, ranking better than 62.74% of 1036 companies in the Manufacturing - Apparel & Accessories industry. The company's profitability is ranked 7 out of 10, indicating fair profitability.

Growth is a crucial factor in company valuation. G-III Apparel Group's average annual revenue growth is 1.6%, ranking worse than 53.27% of 1008 companies in the Manufacturing - Apparel & Accessories industry. The 3-year average EBITDA growth is 1.2%, ranking worse than 60.05% of 861 companies in the same industry.

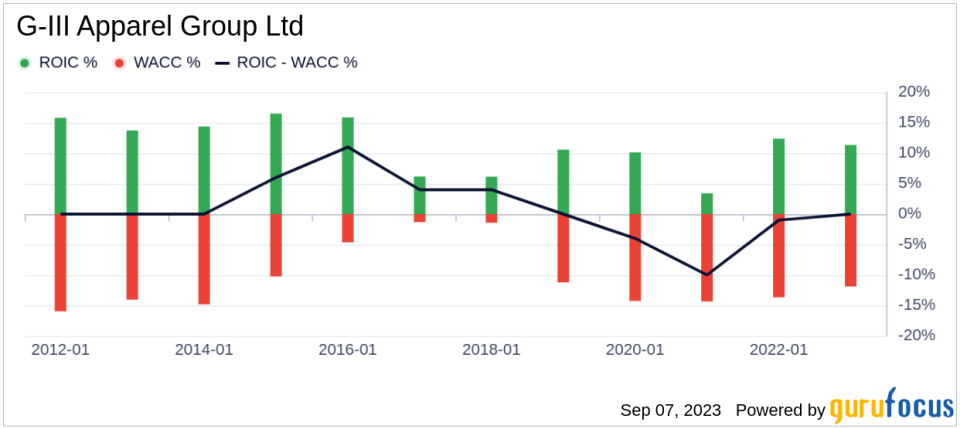

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. G-III Apparel Group's ROIC is 8.3 while its WACC is 11.6. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders.

Conclusion

In summary, G-III Apparel Group (NASDAQ:GIII) stock is estimated to be modestly undervalued. The company's financial condition and profitability are fair. However, its growth ranks worse than 60.05% of 861 companies in the Manufacturing - Apparel & Accessories industry. For more information about G-III Apparel Group stock, check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, consider the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.