G-III Apparel Group Reports Fiscal 2024 Earnings, Reveals Outlook for 2025

Net Sales: Decreased by 4.0% to $3.10 billion for fiscal 2024.

Net Income: Reported at $176.2 million, or $3.75 per diluted share for fiscal 2024, a significant recovery from the prior year's net loss.

Non-GAAP Adjustments: Non-GAAP net income per diluted share was $4.04 for fiscal 2024, compared to $2.85 in the prior year.

Adjusted EBITDA: Expected to be between $290.0 million and $295.0 million for fiscal 2025, compared to $324.1 million in fiscal 2024.

Fiscal 2025 Outlook: Anticipates net sales of approximately $3.20 billion and net income between $167.0 million and $172.0 million.

Liquidity Position: Ended the year in a net cash position with over a billion dollars in liquidity.

Strategic Brand Growth: Increased penetration of higher margin, owned brands to 47% of fiscal 2024 net sales.

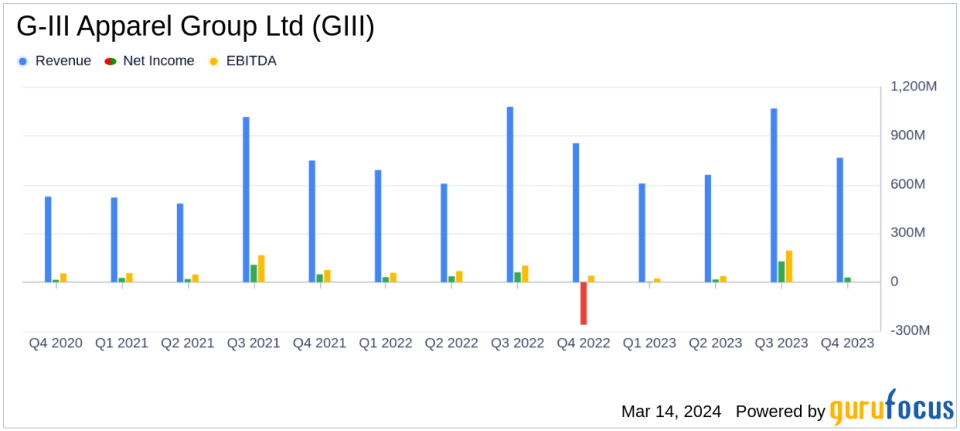

On March 14, 2024, G-III Apparel Group Ltd (NASDAQ:GIII) released its 8-K filing, detailing the financial results for the fourth quarter and the full fiscal year ended January 31, 2024. The company, known for its diverse portfolio of licensed and proprietary brands including DKNY, Donna Karan, Calvin Klein, Tommy Hilfiger, and Karl Lagerfeld, operates through two segments: Wholesale Operations and Retail Operations. Despite a challenging economic environment, G-III Apparel Group has managed to navigate through the fiscal year with a strategic focus on brand growth and operational efficiency.

Financial Performance and Challenges

G-III Apparel Group's net sales for the fourth quarter decreased by 10.5% to $764.8 million compared to the prior year's quarter. However, the company reported a net income of $28.9 million, or $0.61 per diluted share, a substantial improvement from the previous year's net loss of $(261.1) million. This recovery is primarily attributed to the absence of a significant non-cash goodwill impairment charge that impacted the prior year's results. The full fiscal year saw a decrease in net sales by 4.0% to $3.10 billion, with net income reported at $176.2 million, or $3.75 per diluted share, compared to a net loss in the prior year.

The company's performance is particularly important as it reflects the resilience of G-III Apparel Group's business model and its ability to adapt to market challenges, including supply chain disruptions and changes in consumer demand. The focus on growing high-margin owned brands and the strategic expansion of its portfolio with new additions such as Nautica, Halston, and Champion outerwear are pivotal in driving future growth.

Financial Achievements and Industry Significance

The company's financial achievements, including a strong liquidity position with over a billion dollars and the successful pivot towards higher margin owned brands, are crucial in the competitive Manufacturing - Apparel & Accessories industry. These achievements not only demonstrate G-III Apparel Group's financial health but also its strategic foresight in brand management and market positioning.

Key Financial Metrics

Important metrics from the financial statements include a net cash position, reflecting the company's strong credit profile, and an increase in the penetration of owned brands in net sales, which is significant for profitability. The company's non-GAAP net income per diluted share, which excludes certain one-time expenses and non-cash charges, stood at $4.04 for the fiscal year, up from $2.85 in the prior year, indicating an improved operational performance.

Morris Goldfarb, G-IIIs Chairman and Chief Executive Officer, stated, "This year was important for G-III as we began to execute on our path for the future, while delivering strong profitability. We delivered strong growth with DKNY, Karl Lagerfeld and Vilebrequin, increasing penetration of our higher margin, owned brands to 47% of fiscal 2024 net sales, up from 40% last year."

Goldfarb's commentary underscores the strategic direction of the company and its focus on brand growth and profitability. The optimism for fiscal 2025 is supported by the company's financial flexibility and the investments in marketing, talent, and technology to enhance operational capabilities.

Analysis of Company's Performance

G-III Apparel Group's performance in fiscal 2024, despite a decrease in net sales, shows a strong rebound in profitability and a solid strategic direction for the future. The company's ability to end the year in a net cash position and its increased focus on owned brands are indicative of a robust business model capable of weathering market fluctuations. The outlook for fiscal 2025, with expected net sales of approximately $3.20 billion and net income between $167.0 million and $172.0 million, reflects confidence in the company's growth initiatives and its ability to deliver long-term growth.

For value investors and potential GuruFocus.com members, G-III Apparel Group's latest earnings report and future outlook present a picture of a company that is not only recovering from past challenges but is also strategically positioning itself for sustainable growth. The emphasis on brand development, operational efficiency, and financial flexibility are key factors that could make G-III Apparel Group an attractive investment opportunity.

Explore the complete 8-K earnings release (here) from G-III Apparel Group Ltd for further details.

This article first appeared on GuruFocus.