G-III (NASDAQ:GIII) Reports Sales Below Analyst Estimates In Q4 Earnings

Fashion conglomerate G-III (NASDAQ:GIII) missed analysts' expectations in Q4 FY2023, with revenue down 10.5% year on year to $764.8 million. On the other hand, next quarter's outlook exceeded expectations with revenue guided to $615 million at the midpoint, or 1% above analysts' estimates. It made a GAAP profit of $0.61 per share, improving from its loss of $5.54 per share in the same quarter last year.

Is now the time to buy G-III? Find out by accessing our full research report, it's free.

G-III (GIII) Q4 FY2023 Highlights:

Revenue: $764.8 million vs analyst estimates of $817 million (6.4% miss)

EPS: $0.61 vs analyst expectations of $0.67 (9.3% miss)

Revenue Guidance for Q1 2024 is $615 million at the midpoint, above analyst estimates of $608.6 million

Management's revenue guidance for the upcoming financial year 2024 is $3.2 billion at the midpoint, missing analyst estimates by 0.6% and implying 3.3% growth (vs -3.6% in FY2023)

Gross Margin (GAAP): 36.9%, up from 33% in the same quarter last year

Market Capitalization: $1.39 billion

Morris Goldfarb, G-III’s Chairman and Chief Executive Officer, said, “This year was important for G-III as we began to execute on our path for the future, while delivering strong profitability. We delivered strong growth with DKNY, Karl Lagerfeld and Vilebrequin, increasing penetration of our higher margin, owned brands to 47% of fiscal 202[3] net sales, up from 40% last year. Our diverse business model and disciplined operating approach has allowed us to further strengthen our credit profile as we ended the year in a net cash position, with over a billion dollars in liquidity. We began to implement our new growth initiatives with the successful launch of our Donna Karan brand and the development of three new additions to our portfolio, Nautica, Halston and Champion outerwear, all of which we have recently brought to market with first deliveries in fiscal 202[4].”

Founded as a small leather goods business, G-III (NASDAQ:GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

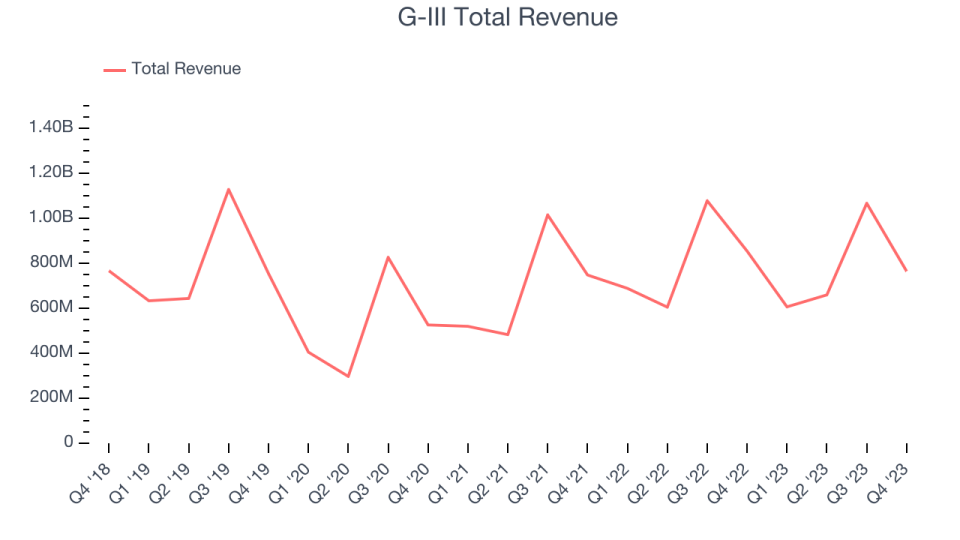

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. G-III's revenue was flat over the last five years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. G-III's annualized revenue growth of 5.8% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, G-III missed Wall Street's estimates and reported a rather uninspiring 10.5% year-on-year revenue decline, generating $764.8 million of revenue. The company is guiding for revenue to rise 1.4% year on year to $615 million next quarter, improving from the 11.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

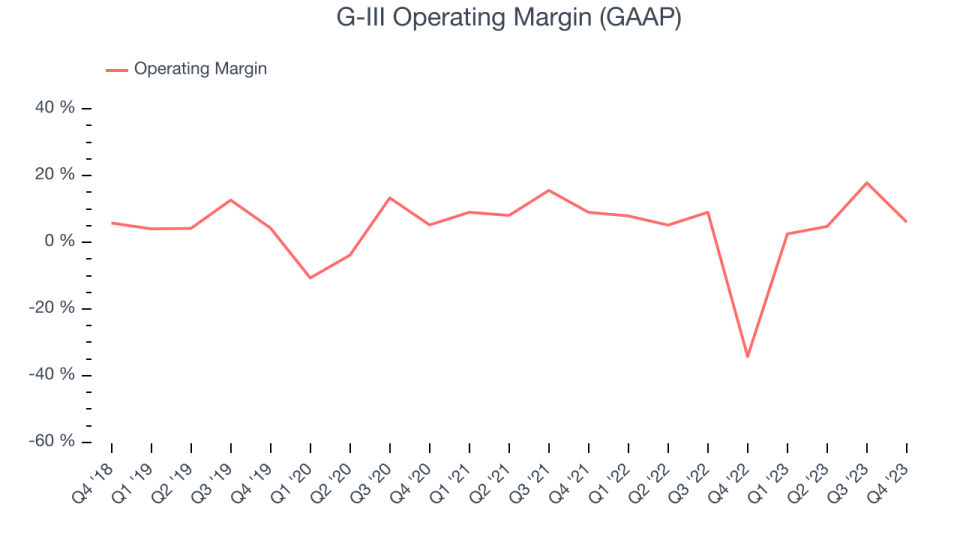

G-III was profitable over the last two years but held back by its large expense base. Its average operating margin of 2.7% has been paltry for a consumer discretionary business.

This quarter, G-III generated an operating profit margin of 6.1%, up 40.3 percentage points year on year.

Over the next 12 months, Wall Street expects G-III to maintain its LTM operating margin of 9.1%.

Key Takeaways from G-III's Q4 Results

We struggled to find many strong positives in this quarter's results. Its revenue guidance for next quarter beat analysts' expectations, but looking at the company's full-year 2024 outlook, its forecasted revenue was in line while its forecasted EPS fell short. Furthermore, this quarter's revenue and EPS missed Wall Street's estimates. Overall, the results could have been better. The company is down 2.2% on the results and currently trades at $29.69 per share.

G-III may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.