G1 Therapeutics Inc (GTHX) Reports Strong Revenue Growth in 2023

Net Revenue Growth: G1 Therapeutics Inc (NASDAQ:GTHX) achieved a 48% increase in net revenue from COSELA sales in 2023, amounting to $46.3 million.

Fourth Quarter Performance: The company reported a 29% growth in net COSELA revenue in Q4 2023, reaching $13.9 million.

Operational Efficiency: Operating expenses significantly reduced, contributing to a lower net loss compared to the previous year.

Research and Development: R&D expenses decreased as the company focused on ongoing clinical trials, including the pivotal PRESERVE 2 trial.

2024 Revenue Guidance: G1 Therapeutics provided a net revenue guidance of $60 to $70 million for COSELA in 2024.

Financial Position: The company ended 2023 with $82.2 million in cash, cash equivalents, and marketable securities, extending its cash runway into 2025.

G1 Therapeutics Inc (NASDAQ:GTHX), a commercial-stage biopharmaceutical company, released its 8-K filing on February 28, 2024, detailing its financial results for the fourth quarter and full year of 2023. The company, known for developing novel therapies for cancer treatment, reported a significant increase in net revenue driven by sales of its flagship product, COSELA (trilaciclib).

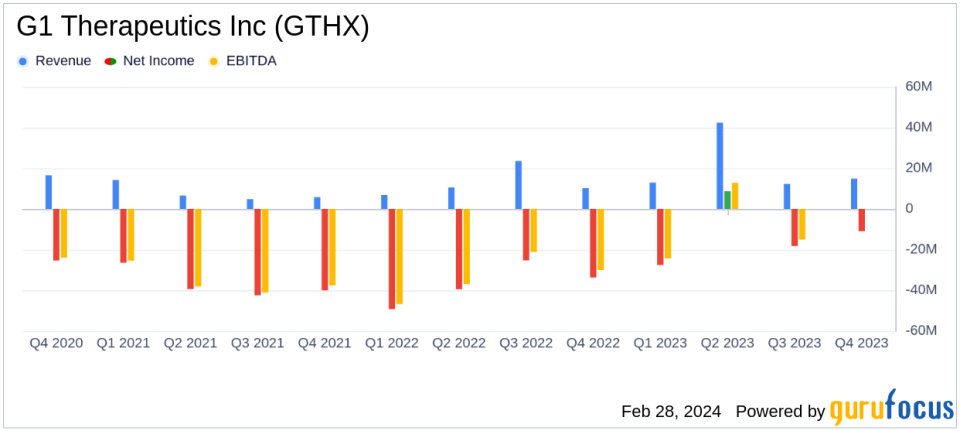

For the full year 2023, G1 Therapeutics saw net revenue from COSELA sales grow by 48% to $46.3 million, with a 29% increase in the fourth quarter alone, reaching $13.9 million. This growth comes despite a platinum-based chemotherapy shortage, underscoring the drug's importance in treating extensive-stage small cell lung cancer and the potential for further market penetration.

Financial Highlights and Operational Efficiency

The company's financial discipline is evident in its reduced operating expenses, which decreased from $41.1 million in Q4 2022 to $23.8 million in Q4 2023. Full-year operating expenses also saw a significant reduction from $187.5 million in 2022 to $122.0 million in 2023. This operational efficiency contributed to a lower net loss of $10.9 million in Q4 2023, compared to $33.6 million in the same quarter of the previous year. The full-year net loss also improved, shrinking from $147.6 million in 2022 to $48.0 million in 2023.

Research and development expenses were $7.4 million for Q4 2023, a decrease from $16.6 million in Q4 2022, reflecting a strategic focus on key clinical trials. Selling, general, and administrative expenses also decreased, from $23.6 million in Q4 2022 to $15.2 million in Q4 2023, due to reduced commercialization activities and personnel costs.

2024 Outlook and Clinical Developments

Looking ahead, G1 Therapeutics provided a revenue guidance of $60 to $70 million for COSELA in 2024, indicating confidence in the drug's continued sales acceleration in the U.S. market. The company's cash position, with $82.2 million on hand, is expected to fund operations into 2025.

In the clinical arena, G1 Therapeutics highlighted the ongoing Phase 3 PRESERVE 2 trial for metastatic triple negative breast cancer, with final analysis expected in Q3 2024. Preliminary results from a Phase 2 trial suggest improved overall survival when trilaciclib is used in combination with a TROP2 antibody-drug conjugate, with updated results anticipated in mid-2024.

COSELA has also been recommended as a myeloid supportive agent in the updated ASCO SCLC guidelines, further validating its clinical utility.

Conclusion

G1 Therapeutics Inc (NASDAQ:GTHX) has demonstrated a strong financial performance in 2023, with significant revenue growth and improved operational efficiency. The company's strategic focus on its clinical pipeline and the commercial success of COSELA position it well for continued growth in 2024. Investors and stakeholders can look forward to further developments, particularly in the company's clinical trials, which could potentially expand COSELA's label and market reach.

For a more detailed analysis of G1 Therapeutics' financial results and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from G1 Therapeutics Inc for further details.

This article first appeared on GuruFocus.