Galecto (GLTO) Down 71% as Lung Disease Candidate Fails

Galecto’s GLTO mid-stage study evaluating inhaled GB0139 for treatment of idiopathic pulmonary fibrosis (IPF) did not meet its primary endpoint of change from baseline in rate of decline in forced vital capacity (FVC). FVC is a widely used and validated standard measurement for IPF studies. Shares of the company plunged more than 71% on Tuesday, in response to the failure.

Following the disappointing results, Galecto intends to discontinue development of GB0139 and focus on the development of treatments for severe liver diseases.

The phase IIb GALACTIC-1 study evaluated the safety and efficacy of GB0139 in patients with IPF — a chronic lung disease characterized by progressive scarring of lung tissue. Currently there are only two approved treatments for IPF — Esbriet (pirfenidone) marketed by Roche RHHBY/Genentech and Ofev (nintedanib) marketed by Boehringer Ingelheim.

Roche’s Esbriet received regulatory approval in Europe and the United States in 2017. However, with its first generic version launched in the second quarter of 2022, Roche is facing generic competition for the drug in the United States. Roche reported U.S. sales of CHF 63 million for Esbriet in the first half of 2023.

Galecto had cash, cash equivalents and investments of $49.0 million as of Jul 31, 2023. The result of the GALACTIC-1 study has led the company to evaluate its resource allocation strategy to extend its financial runway until 2025.

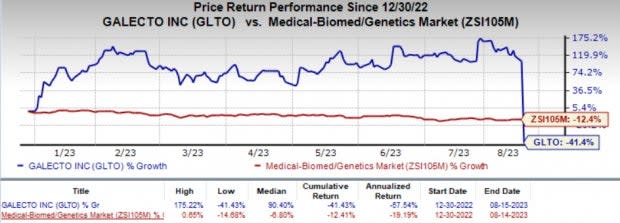

Galecto’s shares have plunged 41.4% year to date compared with the industry’s 12.4% decline.

Image Source: Zacks Investment Research

The company is developing two product candidates, GB1211 and GB2064, both of which are in phase II studies for severe liver diseases. GB1211 is a selective oral small molecule inhibitor of galectin-3 that showed antifibrotic and anticancer activity in the preclinical studies.

The company plans on initiating a long-term phase IIa study of GB1211 in patients with decompensated nonalcoholic steatohepatitis (NASH) cirrhosis by early 2024. NASH is the most severe form of fatty liver disease, wherein the liver builds up excessive fat deposits. The study, which will be referred to as GULLIVER-3, will evaluate the efficacy and tolerability of the candidate at multiple dose levels.

The other candidate, GB2064, is a selective oral small molecule inhibitor of LOXL2 being developed to treat myelofibrosis — a type of bone marrow cancer. The ongoing phase IIa MYLOX-1 is evaluating GB2064, wherein the primary endpoint is safety. The secondary endpoints include measurements of drug levels in the bone marrow and grade of fibrosis, improvement of anemia and/or thrombocytopenia and assessment of spleen and liver size. Data from the study is expected by 2023-end.

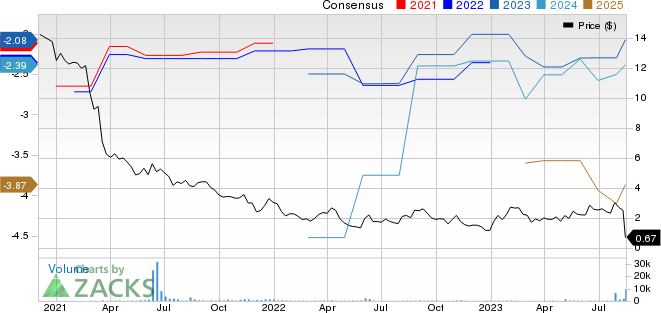

Galecto, Inc. Price and Consensus

Galecto, Inc. price-consensus-chart | Galecto, Inc. Quote

Zacks Rank & Stocks to Consider

Galecto currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the same industry are JAZZ Pharmaceuticals JAZZ and Corcept Therapeutics CORT, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for JAZZ Pharmaceuticals has gone up from earnings of $17.44 per share to $17.61 for 2023. The bottom-line estimate has also moved up from $19.45 to $19.54 for 2024 during the same time frame. Shares of the company have lost 12.1% year to date.

JAZZ’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 27.59%.

In the past 90 days, the Zacks Consensus Estimate for Corcept has gone up from earnings of 66 cents per share to 75 cents for 2023. The bottom-line estimate has also improved from 64 cents to 81 cents for 2024 during the same time frame. Shares of the company have rallied 52.4% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Galecto, Inc. (GLTO) : Free Stock Analysis Report