Galp Energia: A Strong Diversified Energy Franchise

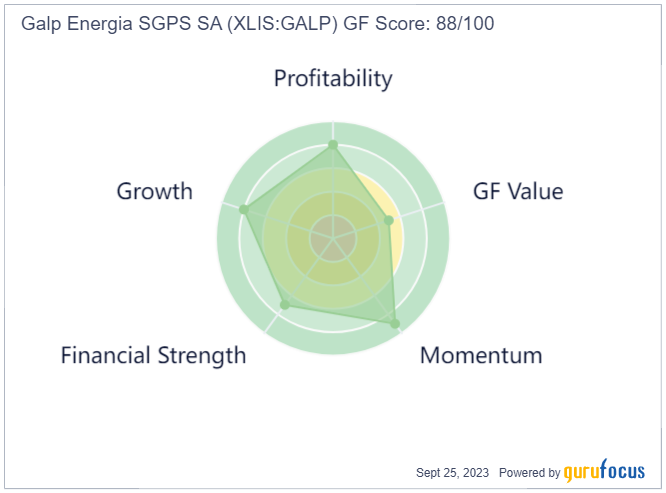

Galp Energia SGPS SA (XLIS:GALP) is an integrated oil and gas company headquartered in Portugal. It operates the following four segments: Upstream, Renewables & New Businesses, Industrial & Midstream and Commercial. The stock has a GF Score of 88 out of 100, meaning it has good outperformance potential.

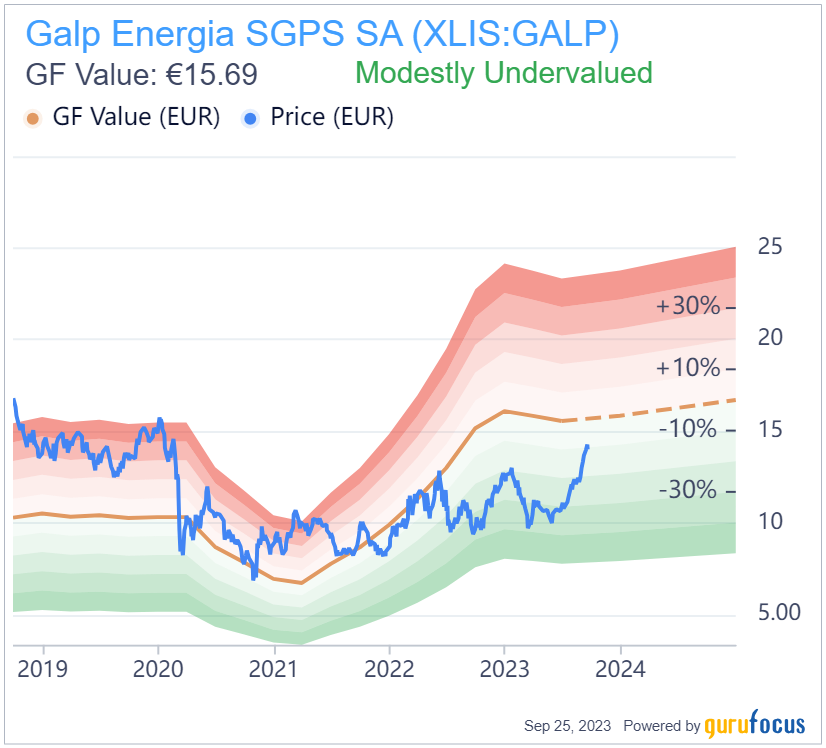

In addition, the stock is rated as modestly undervalued by the GF Value Line.

Operational highlights in 2022

In 2022, Galp processed a total of 88 million barrels of oil equivalent, representing a strong 15% year-over-year increase. This accomplishment played a pivotal role in ensuring a stable supply of oil products to the Iberian region, even in the face of significant disruptions experienced during the period. Galp's adaptable system demonstrated its versatility in optimizing the overall value of its operations, effectively managing challenges such as self-imposed reductions in oil product imports from Russia and adjustments to natural gas consumption.

In response to surging prices in the power and natural gas markets, Galp implemented initiatives to mitigate the impact on energy costs. These initiatives included substituting some gas consumption with naphtha, transitioning from natural gas to LPG to augment the fuel gas network and enhancing the efficiency of the cogeneration cycle.

Crude oil constituted the majority of the raw materials processed, accounting for 85% of the total, with 84% of this portion comprising medium and heavy crude grades. Notably, the processed crude was predominantly sweet grades.

Galp's refining margin exhibited a notable year-over-year increase, rising from $3.30 per boe to $11.60 per boe. This gain was driven by the escalation in international oil product prices, particularly middle distillates, despite elevated costs associated with energy and carbon dioxide emissions.

Among Galp's product portfolio, diesel and gasoline held significant importance, representing 36% and 19% of the production mix. Fuel oil also played a substantial role, constituting 19% of the production.

Sines, Portugal

Galp owns the sole operating refinery in Portugal, located in Sines. The Sines refinery ranks as one of the largest in Iberia, boasting a distillation capacity of approximately 226 kbpd.

Sines' refinery possesses the capability to process a diverse range of crude oil grades, offering operational flexibility in various modes. The process begins with the atmospheric distillation unit, yielding valuable products such as diesel. The residue from this process undergoes further treatment in vacuum distillation units, separating into additional valuable output streams. Depending on their specific characteristics, these streams are directed to fluid catalytic cracking, hydrocracking or visbreaker units, optimizing conversion rates and desired output yields.

The refinery's advantageous combination of complexity and capacity, coupled with its strategic coastal location and deep-water port infrastructure in Sines, facilitates the efficient supply of crude oil and enables seamless product exports. This positioning enhances the refinery's competitiveness and equips it to navigate sector challenges.

Galp's power generation activities are supported by a cogeneration unit with a total installed capacity of 91 megawatts within the refinery. This highly efficient unit simultaneously generates heat and electricity, serving as a significant steam supplier for the refinery's operations. In 2022, cogeneration activities contributed to a total production of 630 gigawatt-hours, marking a 6% year-over-year increase on a comparable basis.

Commercial

Oil product sales amounted to 7.4 million tons, representing a 14% increase, reflecting the post-pandemic demand recovery in Iberia. Natural gas sales reached 19 terawatt hours, driven by stronger consumption levels, while electricity sales remained consistent with 2021 at 4.1 TWh.

In the electric mobility sector, Galp maintained its leadership position, more than doubling the number of electric vehicle charging points in operation and surpassing 2,000 points by year-end. Galp Solar expanded to over 7,700 installations in Portugal and Spain, solidifying its status as the fastest-growing distributed energy player in Iberia.

Sales of oil products to direct customers rose by 14% year over year to a total of 7.4 million tons, driven by increased demand during the period, as Iberia experienced a recovery following the pandemic years. Sales of natural gas to direct customers reached 18.5 TWh, marking a 4% increase. Electricity sales amounted to 4.1 TWh, representing a 1% decline.

Throughout 2022, Galp continued transforming its retail network to better align with future consumption patterns. Over 150 convenience stores underwent refurbishment, and a new hub concept was deployed in 12 selected premium locations, bolstering contribution. Simultaneously, the company doubled its electric vehicle charging network to 2,382 charging points and significantly expanded its distributed solar footprint by installing over 7,700 new rooftop solar panels in Portugal and Spain.

Internationally, Galp maintained a network comprising 202 service stations and 137 convenience stores across five African countries.

Renewables

The startup of 400 megawatts of renewable generation capacity during the year increased gross operating capacity to 1.4 gigawatts by year-end, contributing to nearly double the generation achieved in 2021, totaling 1.90 TWh (on a 100% basis).

Galp's inaugural renewable generation project in Portugal, a 144 MW solar plant in Algarve, commenced operations.

The renewable portfolio expanded to 9 gigawatts on a 100% basis, encompassing projects under operation, construction and development.

Galp extended its presence in Brazil, gaining access to a 5 GW pipeline of photovoltaic projects in the solar belt and wind projects.

To bolster its renewable position in Iberia, Galp secured full ownership of Titan, pursuing new value enhancement opportunities. Efforts are underway to develop hybridization and storage projects in Iberian parks, ensuring continued renewable growth and efficiency.

Additionally, Galp approved its first direct investment in Corporate Venture Capital, aiming to invest in 6K, a company developing disruptive cathode materials manufacturing technology.

Galp now ranks as one of the largest solar photovoltaic energy producers in Iberia. By the close of 2022, its gross renewable energy generation pipeline had expanded from 4.70 GW to 9 GW, comprising projects under operation, construction and various developmental stages in Portugal, Spain and Brazil.

The company's renewable strategy balances its presence in mature and emerging markets to secure a long-term sustainable portfolio, tailored to the risks and opportunities of each market. It actively pursues energy management, capital structure optimization and asset rotation to enhance the value creation of its renewables projects and deliver quality growth. Expanding the renewable energy generation portfolio remains a key enabler of Galp's decarbonization journey. As such, Galp has bolstered its workforce to enhance its growth capabilities, developing core competencies recognized as accelerators of its learning curve, allowing for the rapid development of its portfolio and diversification both geographically and technologically.

Conclusion

The stock has a safe Altman Z-Score of 3.4 and a decent Piotroski F-Score of 6 out of 9. Galp has performed well in the bounce back from the pandemic and is well placed in traditional and renewable energies. Being diversified across segments and regions with 82% of operating revenue from Europe and 18% from the rest of the world gives the company a level of resilience most energy players do not have. The company committed in 2021 to allocate about half its net investment in low- or zero-carbon opportunities by 2025, so it is well placed to face the energy transition too. For investors looking for integrated or diversified energy plays outside of the five supermajors, Galp Energia is a good alternative to consider.

This article first appeared on GuruFocus.