GAMCO Investors Exits Viacom, Spark Therapeutics

Mario Gabelli (Trades, Portfolio)'s firm GAMCO Investors sold shares of the following stocks during the fourth quarter of 2019.

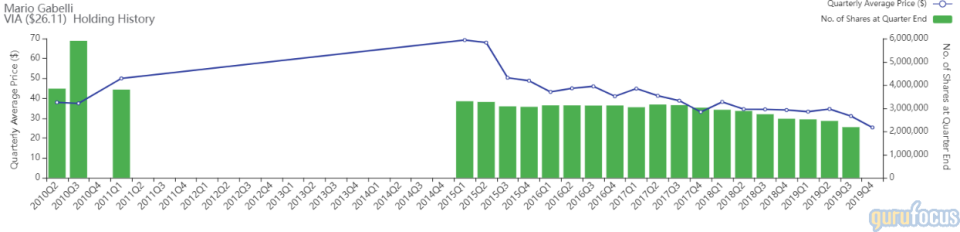

Viacom

The firm's positions in Viacom Inc. (VIA) (VIAB) were closed due to the company's merger with CBS to form ViacomCBS (VIAC). The portfolio was impacted by -0.48% and -0.24%.

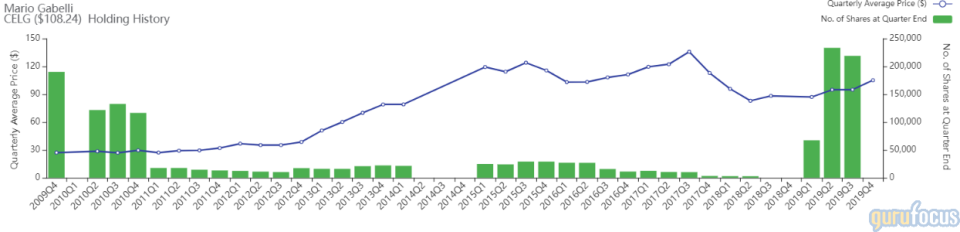

Celgene

The investor's firm closed the Celgene Corp. (CELG) holding. The portfolio was impacted by -0.18%.

The company has a market cap of $77.04 billion and an enterprise value of $85.93 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 71.15% and return on assets of 15.65% are outperforming 91% of companies in the drug manufacturers industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.55 is below the industry median of 0.95.

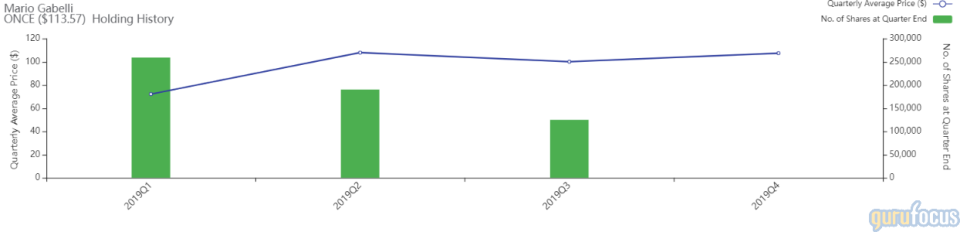

Spark Therapeutics

Gabelli's firm closed the Spark Therapeutics Inc. (ONCE) position. The portfolio was impacted by -0.10%.

During the 4th quarter, three gurus reduced their positions in the company.

The biotechnology company focuses on gene therapy has a market cap of $4.38 billion and an enterprise value of $4.12 billion.

The return on equity of -46.56% and return on assets of -29.63% are outperforming 52% of companies in the biotechnology industry. The cash-debt ratio of 2.9 is below the industry median of 8.74.

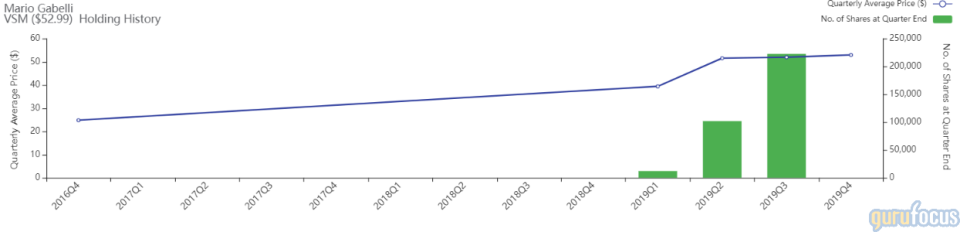

Versum Materials

The guru's firm exited the stake in Versum Materials Inc. (VSM). The trade had an impact of -0.10% on the portfolio.

During the 4th quarter, seven gurus reduced their positions in the company.

The provider of electronic materials has a market cap of $5.79 billion and an enterprise value of $6.53 billion.

The return on assets of 5.26% and return on equity of 40.34% are outperforming 60% of companies in the chemicals industry. The cash-debt ratio of 0.28 is below the industry median of 0.61.

Arconic

GAMCO Investors closed the Arconic Inc. (ARNC) position. The portfolio was impacted by -0.08%.

During the 4th quarter, six gurus reduced their positions in Arconic while four bought shares of the company.

The manufacturer of specialty metals products has a market cap of $13.15 billion and enterprise value of $17.51 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. While the return on equity of 9.4% is outperforming the sector, the return on assets of 2.61% is underperforming 55% of companies in the industrial products industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.28 that is below the industry median of 0.87.

Other guru shareholders of the company include Paul Singer (Trades, Portfolio) with 9.6% of outstanding shares, First Pacific Advisors (Trades, Portfolio) with 5.25% and Steven Romick (Trades, Portfolio) with 3.72%.

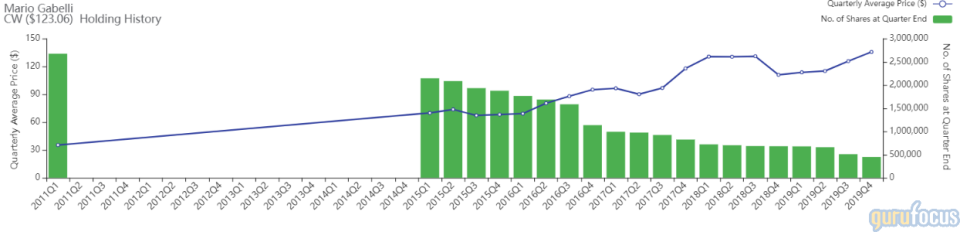

Curtiss-Wright

The Curtiss-Wright Corp. (CW) position was cut by 11.9%. The portfolio was impacted by -0.07%.

During the 4th quarter, seven gurus reduced their positions and four bought shares of Curtiss-Wright.

The company provides products, services and vehicle components to commercial and industrial markets. It has a market cap of $5.25 billion and an enterprise value of $5.83 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 18.6% and return on assets of 8.98% are outperforming 84% of companies in the industrial products industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.34 is below the industry median of 0.87.

Guru shareholders of the company include PRIMECAP Management (Trades, Portfolio) with 3.10% of outstanding shares, GAMCO Investors with 1.05% and Sim Simons' Renaissance Technologies with 0.20%.

Cypress Semiconductor

The guru's firm reduced the Cypress Semiconductor Corp. (CY) position by 22.39%. The portfolio was impacted by -0.07%.

During the 4th quarter, seven gurus reduced their positions and three bought shares of the company.

The provider of semiconductors to consumer and industrial markets has a market cap of $8.61 billion and an enterprise value of $8.97 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 1.92% and return on assets of 1.11% are underperforming 59% of companies in the semiconductors industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.54.

Guru shareholders of the company include Jeremy Grantham (Trades, Portfolio) with 0.91% of outstanding shares, GAMCO Investors with 0.33% and Pioneer Investments (Trades, Portfolio) with 0.28%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Paul Todor Jones' Firm Sells Microsoft, Disney

Jeff Auxier's Firm Exits Viacom, Sells Telefonica

Ronald Muhlenkamp's Firm Exits Celgene, Trims Gilead Position

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.