Gannett Co Inc (GCI) Reports Digital Revenue Growth Amidst Overall Revenue Decline

Total Digital Revenues: Grew approximately 10% in 2023, with Q4 digital revenues at $277.1 million.

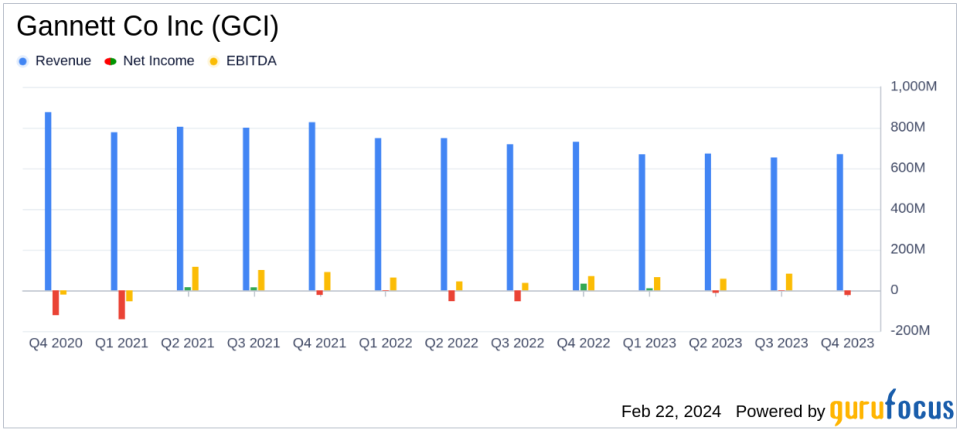

Net Loss: Reported a net loss of $22.9 million in Q4 2023, compared to a net income of $32.8 million in Q4 2022.

Adjusted EBITDA: Decreased by 18.0% year-over-year to $74.1 million in Q4 2023.

Debt Repayment: Repaid $141.6 million of debt in 2023, significantly reducing leverage.

Free Cash Flow: Improved by $14.4 million year-over-year to $12.7 million in Q4 2023.

2024 Outlook: Expects total digital revenues to grow by approximately 10%, with further revenue and free cash flow growth.

Gannett Co Inc (NYSE:GCI) released its 8-K filing on February 22, 2024, detailing its financial results for the fourth quarter ended December 31, 2023. The company, known for its digital newspaper services and marketing solutions, including prominent brands like USA TODAY and over 250 daily newspapers, faced a challenging year with a mix of achievements and setbacks.

Company Overview

Gannett Co Inc operates through two segments: Gannett Media and Digital Marketing Solutions. The majority of its revenue stems from the Gannett media segment, which includes more than 250 daily newspapers and digital marketing services companies like ReachLocal and WordStream. The company also has a significant presence in the U.K. through Newsquest, which provides over 150 local media brands.

Performance and Challenges

The company's digital transformation strategy has started to pay off, with digital revenues exceeding 41% of total revenues in Q4 2023, reaching nearly $1.1 billion for the year. Digital-only subscription revenues surpassed $150 million, and the company achieved full-year growth in both Adjusted EBITDA and free cash flow, marking a positive change in trajectory compared to the previous year's declines.

However, Gannett faced challenges as total revenues declined by 8.4% compared to Q4 2022, and the company reported a net loss of $22.9 million in Q4 2023. This performance highlights the ongoing difficulties in the media industry, particularly in transitioning to digital platforms and monetizing digital content.

Financial Achievements and Importance

Gannett's financial achievements, particularly in digital revenue growth and debt repayment, are crucial for the company's sustainability. By reducing leverage through repaying over $140 million in debt, Gannett has strengthened its balance sheet, which is vital for future investments and navigating the competitive media landscape.

Financial Metrics and Analysis

Key financial metrics from the earnings report include a net loss of $22.9 million and Adjusted EBITDA of $74.1 million, which decreased by 18.0% compared to Q4 2022. The company's cash and cash equivalents stood at $100.2 million as of December 31, 2023. The total principal amount of debt was $1,130.6 million, with a First Lien Net Leverage of 2.0x, a decrease from the previous year.

These metrics are important as they provide insights into the company's profitability, liquidity, and financial health. The reduction in leverage is particularly noteworthy as it indicates Gannett's commitment to improving its capital structure.

"In 2023, we made excellent progress executing on our strategy to drive our digital transformation," said Michael Reed, Gannett Chairman, and Chief Executive Officer. "We are building momentum toward a sustainable digital growth business, with a strong balance sheet."

Looking Forward

For 2024, Gannett expects total digital revenues to grow by approximately 10%, with total revenues projected to be down in the low to mid-single digits. The company anticipates an improvement in net income, excluding an impairment charge related to the exit of its McLean, Virginia office. Adjusted EBITDA and free cash flow are also expected to grow compared to the prior year.

The company's performance in 2023 and its outlook for 2024 reflect its strategic focus on digital transformation and financial stability. While challenges remain, Gannett's efforts to increase digital revenue streams and reduce debt are essential steps toward long-term growth in the diversified media industry.

For detailed financial tables and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Gannett Co Inc for further details.

This article first appeared on GuruFocus.