Gannett: A Non-Obvious Opportunity

Money does not grow on trees but may be hidden in the bushes. You have to work for it. Today I am going to point out an non-obvious "dollar for fifty cents" opportunity. No guarantees obviously, as investing is a game of probabilities and there is risk involved.

This opportunity is with Gannett Co. Inc. (NYSE:GCI) which is a subscription-focused media and marketing solutions company that focuses heavily on digital platforms. Following its acquisition by New Media Investment Group in 2019, it became the largest newspaper company in the U.S. Gannett operates through two segments: Gannett Media and Digital Marketing Solutions. The former owns local media organizations across 46 states, including USA TODAY and over 250 local daily newspapers, while the latter offers digital marketing services such as LOCALiQ. Despite efforts to transform its business model for sustainability, the company is currently experiencing volatility as it undergoes restructuring. The Digital Marketing Solutions segment is growing, but Gannett Media still contributes 88% of the revenue. There is the possibility of spinning off Digital Marketing Solutions as a separate entity, potentially commanding a higher valuation alone than the combined company. I discuss this further. Gannett's move towards an all-digital future mirrors similar successful transitions by other newspapers like the New York Times and Washington Post. These companies have proven that newspapers do not have to involve paper.

The Digital Marketing Solutions segment offers LOCALiQ, a cloud-based platform distinguished by its marketing automation and management tools, artificial intelligence bidding engines, omnichannel advertising optimization, and customizable reporting featuring integrated third-party platform data. Additionally, this segment produces specialized publications catering to local market interests, covering areas such as recreation, sports, healthcare, and real estate. Gannett Co., Inc. extends its solutions across approximately 43 states.

The company's stock has been declining for now nearly a decade. However, note that Gannett was acquired by Private Equity and restructured in 2019 which retained the Gannett name. It's really a new company circa 2019. The stock is quite volatile as the company restructures.

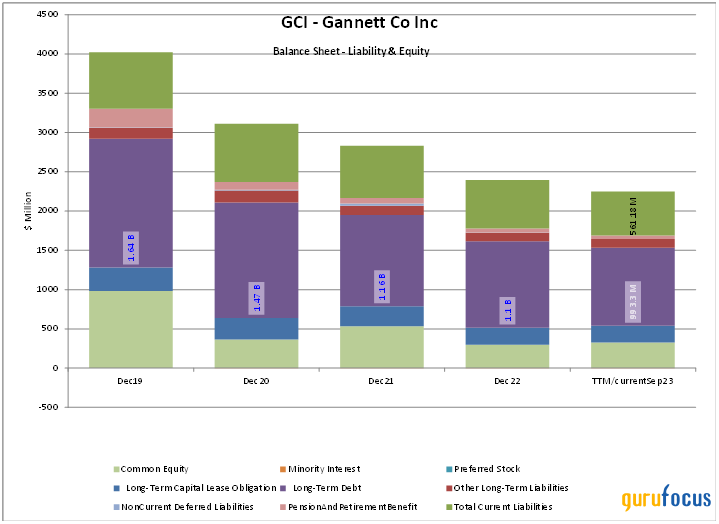

Debt on balance sheet

A large concern stock investors have about Gannett is large amount of debt the company has on its balance sheet. Gannett carries a lot of debt but its paying down debt rapidly. The following chart shows the debt which is going down rapidly. The long term debt is shown as the purple part of the stacked bars below. Gannett has paid down about $700 million in debt over the last ~4 years.

Gannett is able to do that because of the high cash flow its able to generate from its restructuring efforts, which includes freeing up working capital as its transitions from asset heavy printing to asset light digital as well as selling off non-core businesses. As Gannett pays down debt, value should accrue to the equity holders.

The Company's debt currently consisted of the following:

Senior Secured Term Loan | 360.3 |

2026 Senior Notes | 305.6 |

2027 Notes | 485.3 |

2024 Notes | 3.3 |

Total debt | 1,154.5 |

Less: Current portion of long-term debt | (69.3) |

Non-current portion of long-term debt | 1,085.2 |

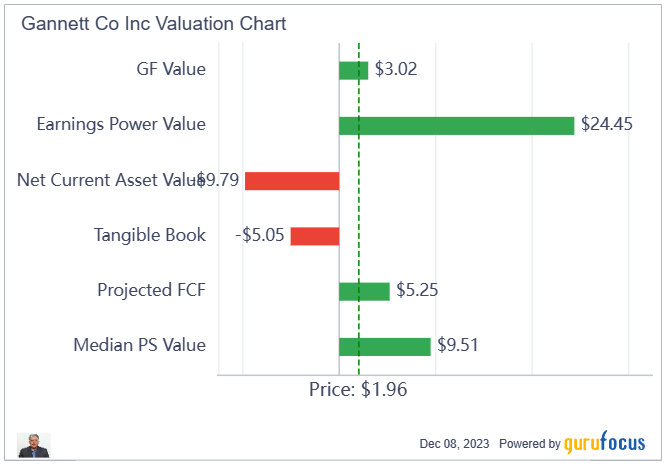

Valuation

GuruFocus Valuation chart shows signs of great value. No guarantees, but Gannett can be multi-bagger from here.

Hidden assets

Gannett has some non-obvious hidden assets which I am highlighting below. If monetized, these could have transformative effect on the company. Think of these as "lottery tickets", which you get for free if you buy the stock.

Currently the value of the Digital Marketing Solutions (DMS) Segment is "buried" within the low valuation being accorded to the whole company. If DMS was to separate itself from Gannett it could command a much higher valuation. A similar standalone company called Yext (YEXT) with sales of about $400 million commands an enterprise value of about $600 million. DMS segment alone has sales of around 475 million. Based on Yexts' enterprise value, I think that if this business is sold Gannett should be able to get about ~500 million from it. Gannett as whole has a market cap of less than ~300 million. By this logic it looks like Gannett is highly depressed mainly due to the large debt it is carrying.

Lawsuit versus Google

Gannett filed a lawsuit against Google in June 2023, alleging violations of antitrust and consumer protection laws that led to significant losses in Gannett's advertising revenue, amounting to billions of dollars. The lawsuit aligns with a case filed by the Department of Justice and 34 states, set for trial in March. Gannett is represented by Kellogg Hansen, a reputable antitrust law firm. Speculation suggests that Google might settle with the DOJ, establishing liability and increasing the likelihood of a substantial settlement with Gannett, potentially reaching up to $1 billion. Even a fraction of this amount could significantly impact Gannett's financial position. Further developments are expected in the next year or so, particularly if Google aims to avoid a trial.

Noteworthy numbers

An interesting number to note from the Gannett summary page is the very low Price to Owner Earning of only 3.5. Owner Earnings is a cash flow concept introduced by Warren Buffett (Trades, Portfolio) in his 1986 Berkshire Hathaway company letter to shareholders. At this time that companies were not required to produce a cash flow statement nor were stock based compensation such a big concern. Buffet's formulations of owners earnings removes non-cash distortions from earnings to focuses the investors attention on how much cash they are getting as partial owners of the company at the end of the period. Buffet explained Owners Earnings as follows: Owner Earnings = (a) Net Income plus (b) depreciation, depletion, amortization, and other non-cash charges minus (c) average annual maintenance capital expenditures. Owners Earnings is similar to free cash flow, but I think a superior metric because it starts from net earnings, so takes stock-based compensation, as well as, maintenance capex into account, which free cash flow does not. Unlike Free Cash Flow, owner's earnings includes stock based compensation and maintenance capital expenditure which can be a significant expense for some companies.

Owner Earnings per Share (TTM) for Gannett | ||||||

0.524 | -2.84 | -0.193 | 0.439 | 0.52 | ||

Another interesting number to note is the very high shareholder Yield of 27.63%. Shareholder Yield is the sum of these three components: Dividend yield, Buyback yield, and Net Debt paydown yield i.e., Shareholder Yield % = Dividend Yield % + Buyback Yield % + Net Debt Paydown Yield %.

First, Dividend yield is how much a company has paid back in dividends divided by the company's market capitalization. It puts money right back in our pocket but is subject to taxation by the government as it is considered income. Second Buyback yield is the value of shares the company has bought back in the last twelve months divided by a company's market capitalization. Stock Buybacks are good for existing stockholders in that they reduce the total number of shares outstanding. Simple logic will tell us that, whatever value you place on a company, the fewer shares out there, the more each share is worth. Finally Debt Paydown Yield is the change in average of four quarters of long term debt over a company's market cap. Debt reduction is also intuitively a good thing. Debt reduction means the company has its act together. It's generating enough cash flow that it can reduce total debt. The less you owe, the lower your interest expenses and more value is left over for equity holders, the owners of the company. Companies that have high debt paydown yields indicate that they are rapidly paying down debt.

As explained above Gannett has been rapidly paying down debt, thus delivering value to owners i.e., the shareholders, resulting in high shareholder yield.

Shareholder Yield for Gannett.

-35.17 | -217.25 | 46.82 | 38.28 | 27.63 |

Conclusion

Gannett can be considered a consolidator in the local news media industry. Through various acquisitions and mergers, over the years Gannett has expanded its presence and became the largest newspaper company in the U.S. However in the process it has accumulated large debt, which it is rapidly paying down through its robust cash flows. If successful this strategy, which is modeled on the private equity playbook can accrue big gains to the equity holders. It also holds a couple of lottery ticket which I have highlighted above.

Another thing to note is that one of the large debt holder Apollo Global (APOL) one of the leading private equity organization is also the second largest shareholder of the company. Apollo is very savvy operator and if Gannett was at high risk of insolvency (as the stock price suggests), I doubt Apollo would have taken an equity position. It obviously expects the company to survive and thrive given its dual position in the company's capital structure.

Insiders are also buying stock, which is a good sign.

The company owns numerous local media organizations across 46 US states, including well-known brands like USA TODAY and over 250 local daily newspapers. This consolidation of media assets allows Gannett to have a broad reach and diverse portfolio, positioning itself as a significant player in the industry. Additionally, the company's move toward digital platforms and the development of its Digital Marketing Solutions segment further reflects its efforts to adapt and consolidate its position the evolving media landscape.

This article first appeared on GuruFocus.