Gap Inc (GPS) Reports Mixed Fiscal 2023 Results and Provides Outlook for 2024

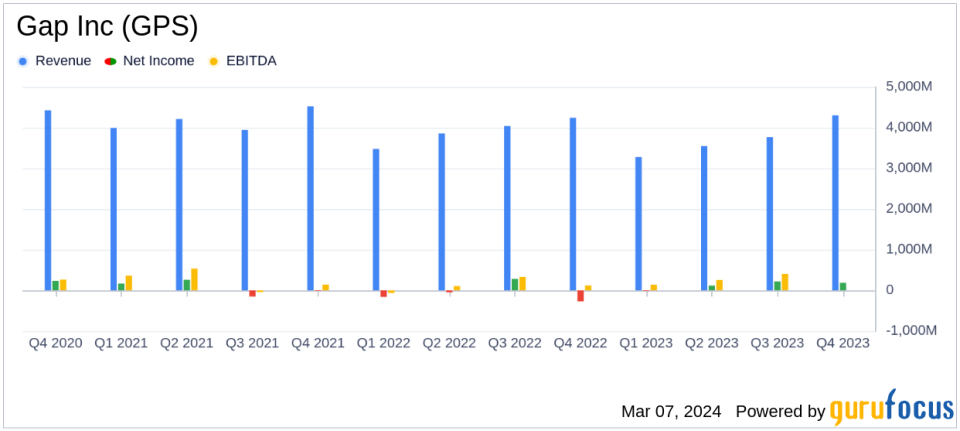

Net Sales: Fourth quarter net sales increased by 1% to $4.3 billion, with a full year decrease of 5% to $14.9 billion.

Operating Margin: Fourth quarter operating margin improved to 5.0%, with full year adjusted operating margin at 4.1%.

Net Income: Fourth quarter net income reached $185 million, with full year reported net income at $502 million.

Earnings Per Share: Diluted earnings per share for the fourth quarter were $0.49, with full year reported at $1.34.

Cash Flow: Operating cash flow for the fiscal year was $1.5 billion, with free cash flow of $1.1 billion.

Inventory and Dividends: Year-end inventory was down 16%, and a quarterly dividend of $0.15 per share was paid.

On March 7, 2024, Gap Inc (NYSE:GPS) released its 8-K filing, detailing the financial results for its fourth quarter and fiscal year ended February 3, 2024. The company, known for its apparel and accessories under brands such as Old Navy, Gap, Banana Republic, and Athleta, reported a slight increase in net sales for the quarter, despite a full year decline. Gap Inc operates a mix of company-operated and franchised stores across the globe, with a significant presence in North America, Europe, and Asia.

Financial Performance and Challenges

Gap Inc's fourth quarter saw net sales rise to $4.3 billion, a 1% increase compared to the previous year, with a notable 530 basis point increase in gross margin to 38.9%. However, the full year results were less positive, with net sales declining by 5% to $14.9 billion, and comparable sales down by 2%. The company attributes part of the decline to strategic decisions, such as the sale of Gap China, and a challenging retail environment.

The company's performance is significant as it reflects the competitive nature of the retail - cyclical industry, where consumer preferences and spending patterns can shift rapidly. Gap Inc's ability to maintain and grow market share, particularly in its Old Navy and Gap brands, is crucial for its long-term success. However, the challenges faced, such as decreased online sales and the need to reinvigorate the Banana Republic and Athleta brands, may pose problems if not effectively addressed.

Financial Achievements and Industry Importance

Despite the mixed results, Gap Inc achieved several financial milestones. The company ended the year with a strong cash balance of $1.9 billion, a 54% increase from the prior year. Operating cash flow was robust at $1.5 billion, and the company managed to reduce its ending inventory by 16%, reflecting disciplined inventory management. These achievements are important as they demonstrate Gap Inc's ability to generate cash and maintain liquidity, which is vital for navigating the cyclical nature of the retail industry and investing in growth opportunities.

Key Financial Metrics

Gap Inc's financial health can be further assessed through key metrics such as operating margin and earnings per share. The fourth quarter operating margin expanded to 5.0%, and the company reported diluted earnings per share of $0.49. For the full year, adjusted operating income was $606 million with an adjusted operating margin of 4.1%, and adjusted diluted earnings per share of $1.43. These metrics are important as they reflect the company's profitability and efficiency in managing its operations.

"The fourth quarter exceeded expectations on several key metrics along with market share gains, reflecting improved trends at Old Navy and Gap and strong continued progress on margins and cash flow," said Gap Inc. President and Chief Executive Officer, Richard Dickson.

Analysis of Company Performance

Gap Inc's performance in fiscal 2023 was a tale of two halves, with the fourth quarter showing signs of recovery while the full year painted a picture of a company in transition. The company's focus on financial and operational rigor has paid dividends, as evidenced by the improved operating margin and cash flow. However, the decline in net sales for the year highlights the ongoing challenges in the retail sector, including the need to adapt to changing consumer behaviors and competitive pressures.

Looking ahead, Gap Inc provided a fiscal 2024 outlook that includes roughly flat net sales on a 52-week basis, gross margin expansion, and low-to-mid teens growth in operating income. This outlook suggests cautious optimism, with the company aiming to build on the positive momentum of the fourth quarter while remaining mindful of the uncertain consumer and macro environment.

For value investors and potential GuruFocus.com members, Gap Inc's latest earnings report offers a nuanced view of a company with enduring brands and a solid financial foundation, yet still facing the need for strategic adjustments in a dynamic retail landscape.

For more detailed analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Gap Inc for further details.

This article first appeared on GuruFocus.