Garrett Motion Inc (GTX) Reports Solid 2023 Results and Provides 2024 Outlook

Net Sales: Increased to $3.886 billion in 2023, up 8% year-over-year.

Net Income: Reached $261 million with a net income margin of 6.7%.

Adjusted EBITDA: Grew to $635 million, reflecting an adjusted EBITDA margin of 16.3%.

Operating Cash Flow: Net cash provided by operating activities totaled $465 million.

Share Repurchase: GTX repurchased $213 million of common stock in 2023 and authorized a new $350 million share repurchase program for 2024.

2024 Outlook: Expects net sales of $3.870 billion, flat year-over-year, with a net income margin of 6.5%.

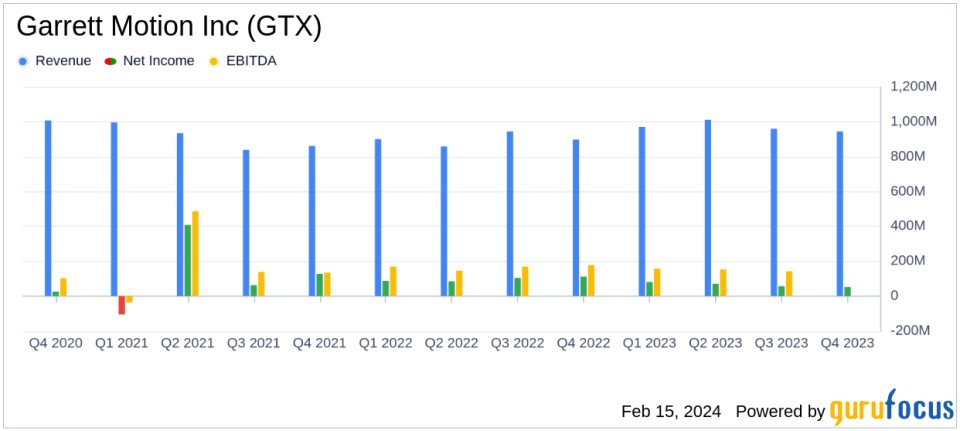

On February 15, 2024, Garrett Motion Inc (NASDAQ:GTX), a global leader in automotive technology, released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, known for its engineered turbocharger and electric-boosting technologies for light and commercial vehicle OEMs, reported a robust financial performance, with net sales totaling $945 million in Q4, marking a 5% increase on a reported basis. The full-year net sales stood at $3.886 billion, an 8% rise from the previous year, demonstrating Garrett Motion's strong market presence and operational efficiency.

Financial Performance and Challenges

Garrett Motion's net income for 2023 was $261 million, translating to a net income margin of 6.7%. The adjusted EBITDA reached $635 million, with an adjusted EBITDA margin of 16.3%, signifying the company's ability to maintain profitability amidst market challenges. The company also generated a significant amount of cash, with net cash provided by operating activities totaling $465 million and adjusted free cash flow of $422 million.

Despite these achievements, Garrett Motion anticipates a flat to down environment for the industry in 2024. The company's CEO, Olivier Rabiller, highlighted the company's expansion in turbo offerings and momentum in zero-emission technologies, aiming for $1 billion of revenue from these technologies by 2030. However, the challenges posed by global macroeconomic conditions, such as rising interest rates, could impact demand, particularly for commercial vehicle applications.

Income Statement and Balance Sheet Highlights

The company's income before taxes for Q4 2023 was $68 million, a decrease from $135 million in Q4 2022, primarily due to higher interest expenses and lower non-operating income. The gross profit margin improved to 20.0% in Q4 2023 from 17.9% in the same period the previous year, reflecting the company's operational efficiencies and cost management.

Garrett Motion's balance sheet showed a total principal amount of debt outstanding of $1.696 billion as of December 31, 2023, up from $1.186 billion the previous year, mainly due to the new term loan facility and foreign exchange impacts. The company's liquidity remained strong, with $829 million available, including cash and undrawn credit facilities.

Share Repurchase and Debt Repayment

In 2023, Garrett Motion repurchased $213 million of common stock and made an early debt repayment of $200 million, underscoring its commitment to returning value to shareholders and strengthening its balance sheet. The Board of Directors has authorized a new share repurchase program of $350 million for 2024, further demonstrating confidence in the company's cash flow generation and financial stability.

2024 Outlook

For 2024, Garrett Motion expects net sales to remain flat at $3.870 billion, with a net income margin of 6.5%. The adjusted EBITDA is projected to be $620 million, with an adjusted EBITDA margin of 16.0%. The company plans to continue investing in innovation and zero emissions products, maintaining its leadership in the automotive technology industry.

Garrett Motion's performance in 2023 and its strategic outlook for 2024 reflect a company that is adept at navigating market dynamics while investing in future growth areas. The company's focus on zero-emission technologies and its proactive capital management strategies position it well for sustained success in the evolving automotive landscape.

For more detailed information on Garrett Motion Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Garrett Motion Inc for further details.

This article first appeared on GuruFocus.