Gartner Inc (IT) Reports Mixed Fourth Quarter and Full Year 2023 Results

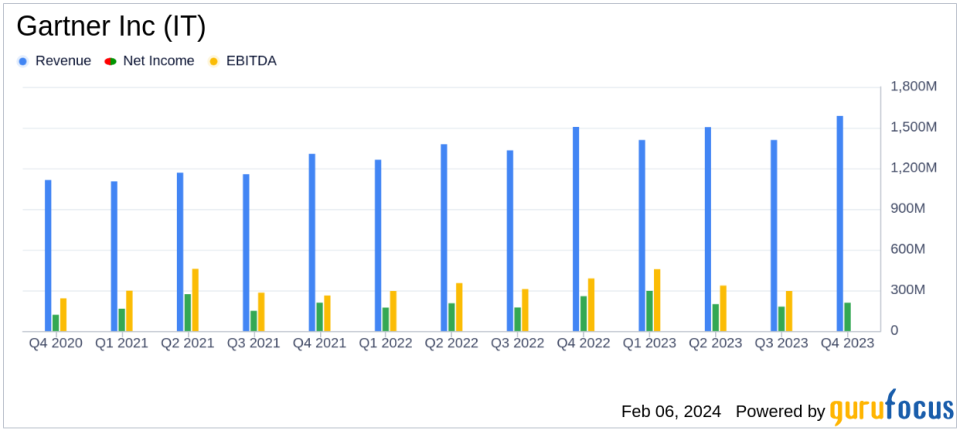

Revenue: Fourth quarter revenue increased by 5% to $1.6 billion, and full year revenue grew by 8% to $5.9 billion.

Net Income: Fourth quarter net income decreased by 19% to $209 million, while full year net income rose by 9% to $882 million.

Earnings Per Share (EPS): Diluted EPS for the fourth quarter was down 18% at $2.64, with full year EPS up 11% at $11.08.

Free Cash Flow: Free cash flow increased by 19% to $196 million in the fourth quarter, and by 6% to $1.1 billion for the full year.

Stock Repurchase: Gartner repurchased 1.8 million common shares for $0.6 billion, reducing outstanding share count by 1% year-over-year.

On February 6, 2024, Gartner Inc (NYSE:IT) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The Stamford, Connecticut-based company, known for its independent research and analysis on information technology, reported a mixed set of financial figures, with contract value growth but declines in net income and EPS for the quarter.

Financial Performance and Challenges

Gartner Inc (NYSE:IT) experienced a solid increase in contract value, reaching $4.8 billion, which represents an 8% year-over-year growth when adjusted for foreign exchange (FX) impacts. This growth was driven by a 6% increase in Global Technology Sales Contract Value (GTS CV) and a notable 13% rise in Global Business Sales Contract Value (GBS CV). However, the company faced a 19% decline in net income for the fourth quarter, which was attributed to various factors including a decrease in adjusted EBITDA and diluted EPS, both down by 18%. Despite these challenges, the company's full year performance remained strong with a 9% increase in net income and an 11% rise in diluted EPS.

Financial Achievements and Industry Significance

The company's financial achievements, particularly the robust free cash flow generation, are significant as they reflect Gartner's ability to convert earnings into cash, a vital aspect for sustaining growth and shareholder returns in the competitive software and IT research industry. The 19% increase in free cash flow for the quarter and 6% for the full year underscores Gartner's operational efficiency and its capacity to fund strategic initiatives, including share repurchases which reduced the outstanding share count by 1% year-over-year.

Key Financial Metrics

Examining the income statement, Gartner Inc (NYSE:IT) reported a 5% increase in revenues for the fourth quarter, amounting to $1.6 billion, and an 8% increase for the full year, totaling $5.9 billion. The balance sheet and cash flow statements further highlight the company's financial health, with operating cash flow rising by 10% to $224 million in the fourth quarter and by 5% to $1.2 billion for the full year. These metrics are crucial as they demonstrate the company's ability to generate revenue and manage cash effectively, which are key indicators of financial stability and potential for future investment.

Executive Commentary

Gene Hall, Gartners Chief Executive Officer, commented, Gartner delivered another strong year, providing exceptional value for our clients, driving high single digit growth in contract value and generating more than $1 billion of free cash flow. Entering 2024, our associate team is the best weve ever had, positioning us for long-term, sustained, double-digit growth. We are introducing guidance which is achievable across a wide range of economic scenarios, with the opportunity for upside.

Analysis of Company Performance

The company's performance in 2023, particularly the growth in contract value and free cash flow, positions Gartner Inc (NYSE:IT) favorably for the upcoming year. However, the decline in net income and EPS in the fourth quarter may raise concerns among investors about the company's short-term profitability. The company's guidance for 2024, which anticipates achievable growth across various economic conditions, suggests a cautious yet optimistic outlook. Gartner's strategic focus on providing value to clients and its strong associate team are likely to be key drivers of its long-term growth trajectory.

For a more detailed analysis and additional information on Gartner Inc (NYSE:IT)'s financial results, interested parties can access the earnings supplement and webcast call on the company's Investor Relations website.

Explore the complete 8-K earnings release (here) from Gartner Inc for further details.

This article first appeared on GuruFocus.