Russia demands sanctions are lifted before it resumes gas supplies

Cut red tape on fracking to secure energy security, Liz Truss urged

London Stock Exchange battles to avoid irrelevance as red tape swamps the City

FTSE 100 falls 0.4pc after Liz Truss named PM

Lucy Burton: Now is not the time for councils to trial four-day weeks at the taxpayers expense

Russia will not restart gas supplies to Europe through a key pipeline until western sanctions are lifted, the Kremlin has warned.

Dmitry Peskov, Kremlin spokesman, blamed the “collective West” for Russia's decision to shut down flows through the Nord Stream pipeline to Germany after three days of maintenance.

He told the Interfax news agency: “The problems pumping gas came about because of the sanctions western countries introduced against our country and several companies.

“There are no other reasons that could have caused this pumping problem.”

It marks Russia’s clearest admission to date that its cuts to energy supplies are a retaliation against western sanctions, rather than a result of technical faults, as it previously claimed.

The move by Moscow reignited fears of continental energy shortages this winter, stoking inflation and pushing the cost of living to fresh highs.

The euro fell below $0.99 for the first time in two decades after Russia's decision to halt flows through Nord Stream.

The single currency dropped by as much as 0.7pc to $0.9878 in early trading as wholesale gas prices surged and stocks slumped.

It is a fresh 20-year low for the euro which is at its lowest level against the greenback since December 2002.

Shares were also hit in early trading. Germany’s benchmark DAX index slumped 2.7pc, while France's CAC 40 stock index fell 2pc. Borrowing costs across the eurozone also rose.

Analyst Michael Hewson said the single currency remained vulnerable to further falls.

“The risk remains for lower levels,” he said, adding the latest drop “opened the prospect of a move towards $0.9620”.

Russia initially blamed the Nord Stream 1 pipeline shutdown on an oil leak at a gas turbine that helps pump the fuel into the pipeline. EU leaders had been bracing for weeks for the Kremlin to cut off supplies, and the move came after the bloc outlined plans for a price cap on Russian oil last Friday.

Germany announced fresh financial help for households and businesses over the weekend, including extra money for pensioners and students as part of a €65bn (£56bn) financial package that will also include caps on energy bills.

Europe’s biggest economy also announced a windfall tax on energy company profits to help mitigate bill rises.

Sweden and Finland also created emergency backstops over the weekend to help energy companies struggling with soaring prices and prevent an “energy industry Lehman Brothers” moment.

Benchmark European prices jumped as much as 35pc after Gazprom’s decision late on Friday not to turn the pipeline back on after three days of maintenance.

04:05 PM

Handing over

That's all from me for today – thanks for following!

04:01 PM

Liz Truss 'considering energy bills freeze'

Newly-elected Prime Minister Liz Truss is said to be considering a freeze on household energy bills in a bid to avert a winter cost-of-living crisis for millions of households.

Public borrowing would be used to fund the gap between current prices and an 80pc rise in the price cap from October under the plan prepared by government officials, Reuters reports.

The cost of the move, which will last until at least January, could eclipse the £70bn bill for the Covid furlough scheme.

According to the report, the cost is likely to be recovered by a levy on bills payable over 10 to 15 years.

Energy suppliers and the Labour Party have called for a freeze on energy bills ahead of a surge in the price cap to £3,549 from next month, with further jumps forecast next year.

03:47 PM

I’d have to charge £100 for a steak to cover my energy bills, says Gaucho chief

A steak would cost more than £100 if the price properly reflected soaring energy bills, a restaurant boss has warned.

Hannah Boland has more:

Martin Williams, the chief executive of Rare Restaurants, which owns Argentinian steakhouse chain Gaucho, said new Prime Minister Liz Truss must act quickly to prevent prices spiralling at eateries like his.

“At Rare Restaurants we fixed our energy prices – had we not, across our 22 restaurants the impact of rising costs would have resulted in a £3.5m hit on our profitability,” Mr Williams said. “To maintain margins this would mean steaks would have to triple in prices to beyond £100.”

At Gaucho, cuts of beef currently range from £19.50 for a small steak to £57 for a large.

Mr Williams said: “Unless energy prices are addressed, restaurants across the sector will be unable to viably open and many SME’s will sadly collapse.”

He called for the new prime minister to urgently reverse April’s increase in VAT and bring business rates for hospitality businesses into line with shops.

03:38 PM

Citi to hire hundreds more staff in Belfast

Citigroup is looking to hire 400 more staff members for its Belfast office as it expands rapidly outside of London.

More than 300 employees have already joined the Wall Street giant in Belfast this year, taking the total to 3,700, according to UK country officer James Bardrick.

Citi wants to fill hundreds more roles, ranging from entry-level positions to directorships.

Mr Bardrick told Bloomberg: “Whether it’s compliance, legal HR, markets support functions or technology, these activities are all wanting more people in Belfast.

“There’s nothing to suggest that the organic rates of growth that we’ve seen recently won’t continue.”

A number of major financial companies have sped up growth in UK cities outside London as they try to cut costs and reshape operations, particularly after the pandemic.

Goldman Sachs last year announced it was taking space with WeWork in Birmingham, while Accenture said in July it’s setting up a regional hub in the Midlands. JPMorgan has more than 4,000 staff in Bournemouth.

03:25 PM

EU's Borrell: I'm less optimistic about Iran nuclear deal

EU foreign policy chief Josep Borrell has said he's less optimistic about reaching a quick agreement on a revival of the Iran nuclear deal than only a short while ago.

He told reporters in Brussels: "I am sorry to say that I am less confident today than 28 hours before... about the prospects of closing the deal right now."

Iran is engaged in talks with world powers to revive its 2015 nuclear deal – which the US unilaterally abandoned in 2018 – with Tehran pushing for the lifting of US economic sanctions.

Tehran today said it hoped to see US sanctions eased or lifted to allow it to sell natural gas to Europe, easing the continent's shortfall as Russian energy exports are restricted.

03:14 PM

Tear up decades-old law to save Britain from hackers, say cyber experts

Cyber security experts have urged the incoming prime minister to tear up a decades-old law that is blocking them from effectively stopping rogue states and criminals from hacking the UK.

Matthew Field and Gareth Corfield report:

Companies representing Britain’s £10bn cyber defence sector have asked Rishi Sunak and Liz Truss to rewrite the 30-year-old Computer Misuse Act, which they said is no longer fit for purpose.

The signatories include the Internet Services Providers’ Association, which represents BT, Virgin Media and Sky, London-listed cyber security company NCC Group and Ciaran Martin, the former head of Britain’s cyber security agency.

The current act prevents unauthorised access to computer material, but the signatories argue this is too broad and prevents them from conducting routine scans of the internet to look for bugs that can be exploited by hackers.

Legitimate internet researchers in the UK are also prevented from accessing hacked files that are shared on the dark web to warn victims their data has been stolen.

Breaking the Computer Misuse Act can lead to a jail sentence of up to 10 years.

02:55 PM

Russian cut-off scuppers Germany's gas storage plans

Germany is unlikely to meet its target for filling natural gas storage sites to 95pc by the start of November following the latest Russian supply cut.

While Europe’s largest economy is ahead of schedule in its efforts to boost winter reserves, Russia’s decision to keep the key Nord Stream pipeline halted jeopardizes further refilling, Bloomberg reports.

Failure to hit the target would be a blow to Germany’s efforts to secure sufficient power for its industries and households and ease worsening inflationary pressures.

Klaus Mueller, president of the Federal Network Agency energy regulator, warned last month that even with storage at the target level, that would cover only two=and-a-half months of demand if Russia stopped flows.

A spokesman for Germany's economy ministry admitted it was still unclear whether the country would reach its November gas storage target, adding: “We will have to see that in the coming weeks.”

02:35 PM

Deliveroo taken to Supreme Court by unofficial trade union

Deliveroo is facing a Supreme Court challenge by an unofficial trade union amid a row over a deal between the food delivery company and the GMB union.

Matthew Field has more:

The court case is the latest step in a six-year legal battle with the Independent Workers of Great Britain (IWGB) union, which wants its Deliveroo riders to have the right to collective bargaining.

In May, Deliveroo signed a deal with the GMB union, giving its freelance riders the right to bargain with the company over pay conditions.

The deal covers its 90,000 riders. But the London-listed food delivery company has spent years fighting the IWGB over whether its riders should have the right to unionise.

The IWGB argues Deliveroo’s voluntary deal with the GMB does not go far enough, ignoring rights such as sick pay, holiday or pensions typically covered by a union agreement.

A Deliveroo spokesman said: “UK courts have repeatedly found Deliveroo riders to be self-employed, which is the only status that offers riders the freedom and control they value.

“This case focuses solely on very narrow issues related to the right to collective bargaining in the UK. Even in this very narrow context, the UK courts have found Deliveroo riders to be self-employed and Deliveroo fully expects this to remain the case going forwards.”

02:13 PM

Germany may have to ration gas, warns Uniper boss

German gas importer Uniper isn't ruling out that Europe's biggest economy will eventually consider gas rationing following the latest cut to Russian supplies.

Uniper, which is Germany's biggest importer of Russian gas, is also considering legal action against Kremlin-controlled Gazprom to compensate its shareholders for a 90pc drop in market value since June.

Klaus-Dieter Maubach, chief executive of Uniper, told Reuters: "We cannot rule out that Germany might look at rationing gas as something that might have to be considered.

"We know that the Government wants to avoid this as much as possible because that would be a disaster for so many reasons."

European gas prices surged on Monday after Russia stopped pumping via Nord Stream and said it wouldn't restart flows until western sanctions were lifted.

01:57 PM

Von der Leyen: EU expects Truss to honour agreements

European Commission President Ursula von der Leyen has issues a somewhat barbed welcome to Liz Truss.

She says she looks forward to a "constructive relationship", adding she expects the new Government to honour all aspects of the Brexit deal.

Congratulations @trussliz.

The EU and the UK are partners.

We face many challenges together, from climate change to Russia’s invasion of Ukraine.

I look forward to a constructive relationship, in full respect of our agreements.— Ursula von der Leyen (@vonderleyen) September 5, 2022

01:48 PM

FTSE maintains losses as Liz Truss wins race

The FTSE 100 maintained its losses in early afternoon trading as Liz Truss was confirmed as the UK's next prime minister.

The blue-chip index was down 0.4pc at 7,255 points, though this was an improvement on the 0.7pc losses racked up earlier in the day.

The pound was trading little changed at its two-and-a-half year lows around $1.15.

Liz Truss' victory will come as little surprise to markets, given she emerged as the frontrunner weeks ago. Focus will now be on any concrete details of her plans for tackling the energy crisis and wider economic gloom.

01:37 PM

Opec agrees to token supply cut to steady oil market

Opec has agreed to make a token oil supply cut for October as it seeks to stabilise global markets after a faltering economic backdrop triggered the longest sell-off in two years.

The producer cartel will reduce production by 100,000 barrels a day next month, taking supplies back to August levels.

It also said it would be willing to call another ministerial meeting at any time if needed to address market developments.

The surprise move from Opec exactly reverses the September increase that was made in response to promises from US President Joe Biden to help bring down oil prices.

It could also spell trouble for consumers at a time when sky-high energy prices are already threatening a winter crunch and possible recession.

Benchmark Brent crude oil was 3.6pc higher at $96.33 a barrel.

01:23 PM

IoD: Support needed for mid-sized firms

Jonathan Geldart, director general of the Institute of Directors, urges the new PM to provide further support to medium-sized businesses.

We warmly welcome the appointment of a new Prime Minister and hope that we can now move on from the recent political uncertainty that has had a real impact on business confidence.

With businesses facing real difficulties and feeling apprehensive about the prospects for the UK macroeconomy, our members have expressed their concern about the lack of a clear direction.

Our data shows that one of the main reasons for low business confidence in the UK economy is political instability, second only to inflation.

We therefore look forward to engaging with the new Prime Minister and her ministerial team at the earliest opportunity to continue to push for the policy priorities that will best encourage and foster a favourable climate for entrepreneurial activity and business growth.

In particular, with business already facing unprecedented energy and other supply-side costs, we urge the new government to help mid-sized firms in their transition to net zero and reverse the recent hike in employers’ national insurance contributions. Action in both areas would support SMEs trying to grow in very difficult circumstances.

01:14 PM

UK faces recession as energy prices hammer factories and hospitality

Here's a reminder of what's facing Liz Truss as she takes the top job in No 10, courtesy of my colleague Tim Wallace:

Britain faces recession as energy prices hammer factories and rising costs push households to cut back on restaurants and hotels.

The UK is joining the eurozone in an economic contraction, led by the manufacturing industry which is heavily exposed to soaring bills, but it is spreading through much of the rest of the economy.

Businesses reported a fall in activity in August for the first time since the 2021 lockdown, in S&P Global’s monthly purchasing managers’ index (PMI) survey.

The index dropped to 49.6, dropping below the 50-mark to indicate that growth is over and the private sector is shrinking.

Manufacturers are leading the decline, with higher energy costs and persistent shortages of key components pushing the PMI down to 47.3.

But the services industry, which dominates the economy, is now stagnating. Its index score fell to 50.9, the lowest since February 2021.

01:03 PM

SMMT: Truss must reduce the cost of doing business

Mike Hawes, chief executive of the SMMT, says reducing the cost of doing business must be a priority for Liz Truss.

SMMT congratulates Liz Truss on her election as Leader of the Conservative Party and looks forward to working with her and her new team to drive the economic growth and investment the country desperately needs.

The new Prime Minister faces immense challenges, not least the urgent need for measures to mitigate the crippling effect of skyrocketing energy prices on businesses and households. Reducing the cost of doing business must be a priority.

Growth, however, will depend on a competitive business framework which stimulates investment, drives innovation and positions the UK at the forefront of global issues, not least the race to net zero.

UK automotive is well positioned to deliver these ambitions and the high value jobs that accompany them.

01:01 PM

Property firms: Strong leadership needed after period of drift

Melanie Leech, chief executive at the British Property Federation, says the UK “urgently needs strong government leadership after a period of drift”.

The new Prime Minister must address the immediate cost pressures facing businesses and families, but in parallel there must a clear focus on the longer-term objectives to tackle inequalities across the UK and transition to a greener, high-productivity economy.

We look forward to working with Ms Truss to harness the power and potential of the property sector to deliver the homes, work and leisure spaces that will revitalise our town and city centres and underpin our future prosperity as a nation.

12:54 PM

Manufacturers urge decisive action

Stephen Phipson, chief executive of manufacturing trade body Make UK, echoes the calls for rapid action.

We congratulate Liz Truss on her appointment and look forward to discussing the critical importance of manufacturing, a sector that delivers millions of well-paid, highly skilled jobs across the whole of the UK.

Britain’s manufacturers are an excellent example of a growing success story, contributing billions of pounds to GDP every year and vital in implementing the Government’s levelling up agenda, creating jobs where they are most needed.

But industry at this time needs decisive action from the new Government to help it through a prolonged period of unprecedented hikes in energy bills, rising cost of raw materials and critical labour shortages in order to keep Britain’s place as a leader of innovation on the world stage.

12:51 PM

Hospitality firms call for 'quick and decisive' action

Kate Nicholls, chief executive of UKHospitality, also calls for Truss to act "quickly and decisively".

Congratulations to Liz Truss on her election as the new leader of the Conservative Party and our Prime Minister.

We very much look forward to working closely with her and the new Cabinet in the coming weeks, as we strive to save the hospitality industry, which is experiencing crushing cost rises.

The new Government must act quickly and decisively to address the soaring energy bills that are facing consumers and businesses.

With the right package of support – including a reduction in the headline rate of VAT for the sector to 12.5pc, a business rates holiday, the deferral of all environmental levies, the reinstatement of a HMRC Time to Pay scheme and the reintroduction of a trade credit insurance scheme for energy – the sector will be well placed to aid growth through generating jobs and local investment.

Pre-pandemic, our industry spent £10bn a year in high-street regeneration and employed 3.2m people but with energy bills for hospitality businesses rising 300% on average – and as high as 750pc in some cases – we desperately need a package of support put in place if we are to be able to play our part in the UK’s economic recovery and growth.

12:47 PM

BCC: Truss must take immediate action to support business

Sarah Howard, Chair of the British Chambers of Commerce, warns of a bleak outlook for businesses unless the new PM acts quickly.

We would like to congratulate Liz Truss on running a successful campaign to become the UK’s new Prime Minister.

She must now take immediate steps to support the economy. The last few months have been difficult for everyone, time is running out and urgent action is needed to deal with the costs’ crisis.

We believe the country has already entered a recession and that inflation will hit at least 14pc in the months ahead.

Like households, firms have been telling us of unsustainable rises in their energy bills and how difficult it is to find new fixed term contracts to buffer against further price hikes.

Unless the new Prime Minister addresses these problems head-on then the economy will drift further into dangerous waters and the outlook for both businesses and consumers will be bleak indeed.

12:46 PM

Liz Truss promises to tackle energy crisis

Liz Truss has reiterated her determination to tackle the energy crisis, both in terms of soaring bills and issues with energy supply.

But once again, there's no actual detail.

She said:

I will govern as a Conservative. We need to show we will deliver over the next two years. I will deliver a bold plan to cut taxes and grow the economy.

12:43 PM

Markets unmoved by PM vote

Markets appear nonplussed by the outcome of the Tory leadership race – at least for now.

The pound is trading around the $1.15 level, while the FTSE 100 is still trading 0.7pc lower.

It's been a lengthy leadership campaign and Truss' election will come as no surprise. Traders will now be focused on the actual policies she'll enact amid soaring energy bills and a cost-of-living crisis.

12:40 PM

Liz Truss chosen as new PM

Liz Truss has won the race with 81,326 votes. Rival Rishi Sunak got 60,399.

Ms Truss begins her acceptance speech saying it was an honour to be elected after what she brands one of the longest job interviews in history.

12:38 PM

Liz Truss confirmed as new prime minister

The results are in and Liz Truss has been confirmed as Britain's new prime minister.

The former foreign secretary, who's long been tipped as the favourite, emerged victorious as the new leader of the Conservative Party after a lengthy contest with Rishi Sunak.

12:21 PM

EU: Russia could send more gas but is choosing not to

Russia could send more gas to Europe through other routes to compensate for the closure of the Nord Stream pipeline, but Moscow is choosing not to do this.

That's according to a European Commission spokesman, who said: "If there was a technical problem which was impeding supplies via Nord Stream 1, there would be a possibility, if there was willingness, to deliver gas to Europe through other pipelines. That's something we're not seeing happening."

The spokesman added that this behaviour was proof of Russia "weaponising" its gas supplies to Europe. Russian gas giant Gazprom has blamed the Nord Stream closure on western sanctions and technical issues.

11:39 AM

ECB poised to announce largest rate rise in history of eurozone

The European Central Bank is poised to deliver the largest interest rate rise since the creation of the euro as it fights to bring surging inflation under control.

Szu Ping Chan has more:

Economists expect the central bank to raise all three of its key interest rates by 0.75 percentage points on Thursday, after data showed that prices rose by a record 9.1pc in the year to August.

This would represent the biggest rate hike since the single currency was created in 1999.

The ECB is also expected to revise up its inflation forecasts and cut growth projections again as Russia’s restriction of gas supplies to the Continent threatens to throw the bloc into a severe recession.

Peter Praet, chief economist of the ECB until 2019, said it was time for the central bank to act forcefully.

He said: “I would do 75 basis points. They need to give a strong signal that they mean business. It’s clear that with inflation at 9.1pc, you cannot keep interest rates at zero.”

The ECB will release quarterly forecasts for growth, jobs and inflation alongside its interest rate decision.

11:25 AM

London Grosvenor Casino workers to stake 72-hour strike

Staff at Grosvenor Casino venues in London have voted to walk out for 72 hours this weekend in a row over pay.

About 150 workers at the group's seven casinos across the capital voted by 91pc to reject retention bonus payments of £600 and £800, branding them "totally inadequate".

The workers are mainly croupiers and dealers but also include food and beverage waiting and kitchen staff.

The Unite union insisted that Grosvenor Casinos, which is part of the Rank Group, could afford to offer more.

Sharon Graham, Unite general secretary, said:

Here we go again: Grosvenor Casinos is another big money company that is raking it in but refusing to pay its workers a wage that they can live on.

It’s just not acceptable and this huge vote for action underscores the sense of anger across this workforce.

11:08 AM

Oil pushes higher ahead of Opec meeting

Oil prices pushed higher this morning ahead of an Opec meeting this afternoon that's expect to confirm another modest rise in production.

At its last meeting, the producer cartel agreed to a small increase of 100,000 barrels per day for September – six times lower than its previous decisions.

It's expected to announce a similar move for October, though it could also opt to cut output to lift prices that have tumbled recently amid recession fears.

Benchmark Brent crude gained 2.6pc to trade at $95.50 a barrel, while West Texas Intermediate rose a similar amount to just over $89.

10:52 AM

Aston Martin shares plunge on cut-price capital raise

Shares in Aston Martin have slumped this morning after the car maker confirmed it's selling shares at a steep discount in an upcoming capital raise.

The right issue, backed by Saudi Arabia's sovereign wealth fund, will raise gross proceeds of about £575.8m. The issue price of 103p per new share represents a 78.5pc discount to the end of last week.

Shares in Aston Martin tumbled as much as 14pc to the bottom of the FTSE 250.

10:37 AM

Kremlin threatens retaliation over G7 oil price cap

The Kremlin has warned the West it will take "retaliatory measures" over a G7 proposal to impose a cap on the price of Russian oil.

G7 finance ministers agreed the cap on Friday in response to Russia's actions in Ukraine, but Moscow has vowed to halt sales to countries imposing it.

10:21 AM

Cut red tape on fracking to secure energy security, Liz Truss urged

Liz Truss will fail to unleash her fracking revolution if she does not overhaul planning laws, the energy industry has warned, as the City braces for soaring gas prices.

Ben Woods reports:

The favourite to become the next prime minister has been told that “comprehensive policy support” is needed to speed up planning and environmental permissions for fracking if the controversial form of energy supply is to become widespread across the nation.

Ms Truss reinforced her support for fracking as a tool for shoring up Britain’s energy security in the face of Russian aggression by telling BBC One’s Sunday with Laura Kuenssberg that extracting shale gas with onshore drilling was among her priorities.

The Foreign Secretary’s support came after reports claimed she would lift the ban on fracking “within days” of becoming prime minister after already stating that she would overturn a suspension on drilling that has been in place since 2019.

However, the fracking industry has warned Ms Truss that she would need to take urgent steps to free energy companies from the planning and regulatory burdens that could hold back their attempts to begin drilling with haste.

09:59 AM

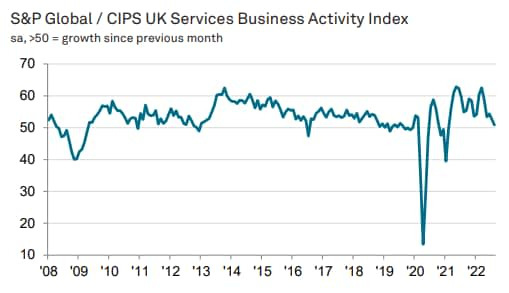

Service sector growth slides as costs surge

The UK service sector continued to expand in August, but growth softened to its slowest rate in the last 18 months.

While sales continued to rise, they were dampened by economic uncertainty, lower consumer confidence and worries over soaring inflation and high energy bills.

The S&P Global Services PMI dropped to 50.9 in August from 52.6 the previous month.

09:44 AM

European shares slide on Putin's gas shutdown

European shares have sunk into the red this morning after Russia halted gas supplies through Nord Stream.

The continent-wide Stoxx 600 index fell 1.7pc in the first hour of trading, while Germany's DAX sank 3.1pc, heading for its biggest one-day percentage fall in two months.

German utilities including Uniper, RWE, E.ON and PNE dropped between 2.9pc and 10pc.

EU leaders will meet later this week to discuss emergency measures amid fears the energy crisis will lead to blackouts and rationing this winter and push the region into recession.

09:33 AM

Aston Martin launches £575m rights issue back by Saudis

Aston Martin has confirmed a £575m rights issue supported by Saudi Arabia's sovereign wealth fund.

The luxury car brand it will launch the rights issue – a share offer to current investors intended to raise new cash –as part of a previously-announced £653m fundraising.

Aston Martin said the new funding will be used to pay down its debts and to improve the firm's liquidity.

The car maker said its rights issue had received "irrevocable commitments" from investors including Saudi Arabia's Public Investment Fund, the Yew Tree Consortium and Mercedes-Benz.

PIF, which is controlled by Crown Prince Mohammed bin Salman, is Saudi Arabia's sovereign wealth fund, one of the biggest in the world.

09:17 AM

Get used to higher energy bills, Philip Hammond warns Brits

Philip Hammond, the Tory former chancellor, has warned that households must get used to higher energy bills.

Jack Maidment has more:

Lord Hammond said the next government must take action to combat the short term "war effect" on energy prices but he stressed that people must be "realistic" that "energy prices are not going to go back to where they were 18 months ago".

He said that "this winter, the next six, nine months is going to be extremely difficult" and the UK must avoid a "wage/price spiral" where wages chase prices, leading to "entrenched inflation that we simply can't get rid of".

Lord Hammond said that if the nation can "hold our nerve" he believes that inflation will start to fall from the spring next year.

09:08 AM

Pound slides to new low ahead of PM announcement

Sterling has slumped to a fresh post-pandemic low as Russia halted gas flows through the Nord Stream pipeline and traders awaited the outcome of the Tory leadership election.

The pound fell as low as $1.1444 – its weakest level against the dollar since March 2020. Against the euro it was largely unchanged at 86.44p.

The pound has been one of the worst performing currencies this year amid surging inflation, a looming economic slowdown and political uncertainty.

The latest slide comes just hours before Liz Truss is expected to be named as Britain's next prime minister.

08:40 AM

FTSE risers and fallers

The FTSE 100 slid in early trading as investors remain on edge ahead of the naming of the new prime minister.

The blue-chip index fell 0.7pc after shedding more than 1pc last week amid fears about surging prices and a looming economic slowdown.

Banking stocks, which are sensitive to interest rate rises, were the biggest drag, with HSBC, Barclays and Lloyds all in the red.

Dechra Pharmaceuticals was the biggest faller, falling about 7pc even as its full-year revenue met expectations.

Energy and mining stocks were the main winner. BP and Shell both posted moderate gains as investors looked ahead to possible output cuts at an Opec meeting later today.

The domestically-focused FTSE 250 slumped 0.9pc. Countryside Partnerships jumped more than 5pc after receiving a £1.25bn takeover offer from Vistry.

08:22 AM

Vistry buys rival housebuilder Countryside for £1.25bn

Housebuilder Vistry Group has snapped up rival Countryside in a £1.25bn deal amid signs the property market is starting to run out of steam.

The cash and share offer totals about 249p a share and marks a 9.1pc premium to Countryside's closing price on Friday. It follows a Telegraph report that Vistry was exploring a bid.

The deal will see the Countryside brand added to Vistry's existing stable including Bovis Homes, Linden Homes and Drew Smith.

Countryside put itself up for sale in June after rejecting two unsolicited takeover bids from US investor Inclusive Capital worth up to £1.5bn. It also faced pressure from activist Browning West to sell the business.

In-Cap said it was withdrawing from the bidding process and supported Vistry's offer.

Greg Fitzgerald, chief executive of Vistry, said the deal "will create a leader in the Partnerships housing sector, with the scale and expertise to accelerate profitable growth across both partnerships and housebuilding, and expand the delivery of much needed affordable housing across England".

Read more on this story: Housebuilder plots takeover amid hopes of construction boom under Truss

08:08 AM

Kwasi Kwarteng: UK can afford to borrow more

A Government under Liz Truss can afford to borrow more to provide support with energy bills but will be responsible with public finances, Kwasi Kwarteng has said.

Mr Kwarteng, who's tipped to be Chancellor under Ms Truss, sought to reassure investors amid reports she's preparing a package of direct support and tax cuts worth up to £100bn.

He wrote in the Financial Times:

Given the severity of the crisis we face, there will need to be some fiscal loosening to help people through the winter. That is absolutely the right thing to do in these exceptionally difficult times.

We know households are worried, and decisive action is needed to get families and businesses through this winter and the next. They need certainty.

08:03 AM

FTSE 100 falls at the open

The FTSE 100 has lost ground at the open as markets digest Putin's latest gas cuts and the mood remains nervous ahead of the announcement of the new prime minister later today.

The blue-chip index fell 0.7pc to 7,232 points.

07:52 AM

Euro sinks to 20-year low against dollar

In a further sign of the economic impact of Putin's gas cuts, the euro has tumbled to a 20-year low against the dollar.

The euro fell 0.7pc to $0.9884 in early trading. That's its first fall below $0.99 in two decades and its lowest since December 2002.

The common currency has continued to weaken since the start of the year as the energy crisis threatens to push the bloc into recession.

But the latest fall comes after Russia said the Nord Stream gas pipeline to Europe will remain shut indefinitely.

07:46 AM

Europe races to stave off energy crisis

Europe is racing to stave off an energy crisis this winter that's threatening to turn into an economic and financial crisis too.

Putin's decision to halt gas supplies through the Nord Stream pipeline has left the bloc rushing to put emergency measures in place.

Countries are now working out how to curb demand dramatically and also prevent wild market swings that could spark wider market disruption.

Sweden and Finland created emergency backstops at the weekend to help utilities struggling with collateral requirements in a bid to prevent a “Lehman” moment.

EU energy ministers are also set to discuss radical proposals to curb power prices when they hold an emergency meeting on Friday – including gas-price caps and a suspension of power derivatives trading.

The bloc has been building its gas stockpiles, with storage sites nearly 82pc full. Germany's storage is now 86pc full.

But Klaus Mueller, president of Germany's Federal Network Agency energy regulator, warned last month that even with gas storage at 95pc, there would only be enough for two-and-a-half months of demand if Russia switched off flows.

07:38 AM

Putin's Nord Stream shutdown drives up gas prices

Good morning.

We start the week with another surge in gas prices after Putin cut off supplies through the crucial Nord Stream pipeline.

The gas link was due to restart on Saturday after three days of planned maintenance. But Gazprom made a last-minute decision on Friday not to restart supplies, blaming an oil leak.

EU leaders had been bracing for such an outcome as Putin continues to use energy supplies as a weapon.

The bloc is now rushing to roll out emergency measures to prevent blackouts and rationing this winter as the energy crisis threatens to push the region into recession.

5 things to start your day

1) Cut red tape on fracking to secure energy security, Liz Truss urged - She is expected to lift the ban on drilling 'within days' of becoming prime minister

2) Truss confirms belief in Bank of England independence - The Foreign Secretary says it would be "completely wrong" for her to dictate the path of interest rates

3) Virgin Money staff to display pronouns on name badges - It follows moves by other banks NatWest, HSBC and Halifax

4) Matalan searches for a buyer as brutal high street conditions take their toll - The founding family has hoisted a "for sale" sign over the discount retail chain, as it grapples with the bruising conditions on the high street.

5) Britain’s pubs confront a bleak winter as energy costs spiral - For many pub landlords, there is little they can do to try to keep their heads above water

What happened overnight

Asian shares slipped this morning while the euro took a fresh spill after Russia shut a major gas pipeline to Europe.

Markets face more uncertainty from US-China tension – the Biden administration is considering moves to curb US investment in Chinese technology firms and will allow Trump-era merchandise import tariffs to continue while the levies are reviewed.

News of more coronavirus lockdowns in China added to the jittery mood, with blue chips down 0.6pc. MSCI's broadest index of Asia-Pacific shares outside Japan eased 0.1pc, and Japan's Nikkei was off 0.3pc.

Coming up

Corporate: Dechra Pharmaceuticals (full-year results)

Economics: Composite PMI (UK, EU), services PMI (UK, EU, China), retail sales (UK, EU)