Gatos Silver Inc (GATO) Announces 2023 Financial Results and 2024 Outlook

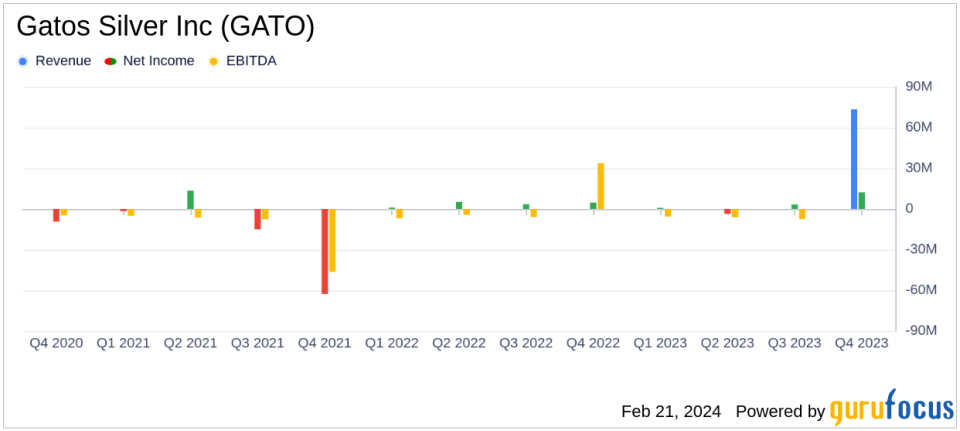

Revenue: Gatos Silver Inc (NYSE:GATO) reported annual revenue of $268.7 million for 2023, a decrease from $311.7 million in 2022.

Net Income: The company's net income for 2023 was $53.4 million, down from $72.2 million in the previous year.

EBITDA: EBITDA for 2023 stood at $135.8 million, compared to $179.5 million in 2022.

Cash Balance: As of December 31, 2023, Gatos Silver's cash balance was $55.5 million, a significant increase from $17.0 million at the end of 2022.

Production Guidance: For 2024, the company expects silver production of 8.4 to 9.2 million ounces with an AISC of $9.50 to $11.50 per payable ounce produced.

Debt Position: The company remains debt-free with $50.0 million available under the Revolving Credit Facility.

On February 20, 2024, Gatos Silver Inc (NYSE:GATO) released its 8-K filing, detailing its financial and operational performance for the fourth quarter and full year of 2023, and providing guidance for 2024. The company, which holds a 70% interest in the Los Gatos Joint Venture (LGJV) and operates the Cerro Los Gatos (CLG) mine in Mexico, reported a decrease in revenue and net income for the year, while significantly increasing its cash balance.

Gatos Silver Inc is a development and exploration company focused on the production of the Cerro Los Gatos Mine and the exploration and development of the Los Gatos District in Chihuahua, Mexico. The district includes 14 mineralized zones with three identified silver-lead-zinc deposits. The company operates through two segments: Mexico and Corporate, with the former encompassing exploration, development, and operation of Mexican mineral interests.

Financial and Operational Highlights

For the year 2023, Gatos Silver reported a decrease in revenue to $268.7 million from $311.7 million in 2022. The net income also saw a decline to $53.4 million from $72.2 million the previous year. The company attributed the higher net income in the fourth quarter of 2023 to a decrease in general and administrative expenses and lower legal settlement expenses. Despite the dividend payment received in the fourth quarter of 2022, the change in operating cash flow was primarily due to the capital distribution received in the fourth quarter of 2023.

The company's cash balance as of December 31, 2023, was $55.5 million, a significant increase from $17.0 million at the end of 2022. This increase was primarily due to the receipt of $59.5 million in capital distributions and a $6.0 million management fee from the LGJV, partly offset by general and administrative costs incurred during the year.

CEO Dale Andres commented on the company's performance, stating:

During the fourth quarter we continued to add cash to the balance sheet, generated from another quarter of strong operational performance at the LGJV. All-in sustaining cost (AISC) per silver ounce was at the lower end of 2023 guidance thanks to improved operating efficiencies, which helped to offset inflationary cost pressures and the impact of the stronger Mexican peso.

Andres also provided insights into the company's 2024 outlook:

For 2024, we expect silver production of 8.4 million ounces to 9.2 million ounces at an AISC, after by-product credits, of $9.50 to $11.50 per payable ounce produced. On a quarterly basis, we expect production will gradually increase throughout the year as we debottleneck the mine and further optimize the mill at CLG. Conversion drilling of the South-East Deeps inferred resource to extend mine life is progressing well and the LGJV has started ramping up exploration efforts on near mine targets in the Los Gatos district.

2024 Guidance and Strategic Focus

Looking ahead to 2024, Gatos Silver expects to produce between 8.4 and 9.2 million ounces of silver with an AISC of $9.50 to $11.50 per payable ounce. The company plans to continue its focus on operational efficiencies and exploration within the Los Gatos district. Sustaining capital expenditures at CLG are expected to be approximately $45 million, with a significant portion allocated to underground development and minor upgrades to the processing plant.

The company will host an investor and analyst call on February 21, 2024, to discuss these results and the outlook for 2024 in greater detail.

Value investors and potential GuruFocus.com members interested in the metals and mining sector may find Gatos Silver Inc's financial achievements and strategic focus for the upcoming year to be of particular interest, as the company continues to strengthen its balance sheet and optimize its operational performance.

Explore the complete 8-K earnings release (here) from Gatos Silver Inc for further details.

This article first appeared on GuruFocus.