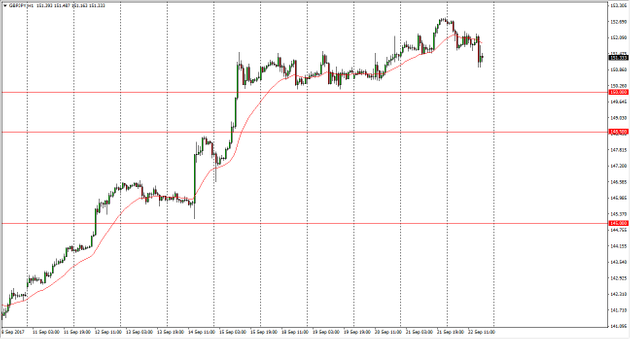

GBP/JPY Forecast September 25, 2017, Technical Analysis

The British pound initially fell during the day on Friday, but as you can see we are starting to find our footing at lower levels. That is a bullish sign, and I believe that the 150 level continues to be support. That is an area that was difficult to break above, but once we did, it’s likely that we will continue to go to the upside. The 150-level course has a certain amount of psychological importance to it, and I believe that the GBP/JPY pair will continue to go higher if we can stay above that level. Remember, this pair tends to react to the risk appetite of markets around the world, and I believe that right now it appears that stock markets look rather healthy. If that’s the case, this pair continues to grind to the upside.

Bank of England

Keep in mind, the Bank of England also is talking about raising interest rates rather soon, and that of course is bullish for the British pound overall. The Japanese yen of course has been saddled with the central bank that continues very loose monetary policy, so I think that the national proclivity of this market will be a “buy the dips” mentality. I think that if we did breakdown below the 150 level, that would be very negative, but I think there is plenty of support below to keep the market afloat over the longer term. A pullback should only and of being a buying opportunity, as the market has exploded in favor of the British pound against most currencies, not just the Japanese yen. I have a target of 155 over the next several weeks, and I believe that this market will continue to favor those who are willing to take risks.

GBP/JPY Video 25.9.17

This article was originally posted on FX Empire

More From FXEMPIRE:

Natural Gas forecast for the week of September 25, 2017, Technical Analysis

Natural Gas Price Forecast September 25, 2017, Technical Analysis

Natural Gas Price Fundamental Daily Forecast – New Resistance Established at $3.055 to $3.086

Natural Gas Price Forecast September 22, 2017, Technical Analysis