GE HealthCare (GEHC), Biofourmis Partner to Boost At-Home Care

GE HealthCare Technologies Inc. GEHC and Biofourmis recently announced their collaboration to boost at-home health care that is easily accessible to assist patients' transitions out of hospitals.

As a result of this collaboration, the companies are likely to enable more patients to return home sooner and provide them with a high-quality, at-home alternative to facility-based care, all while promoting healthy behaviors through remote patient management.

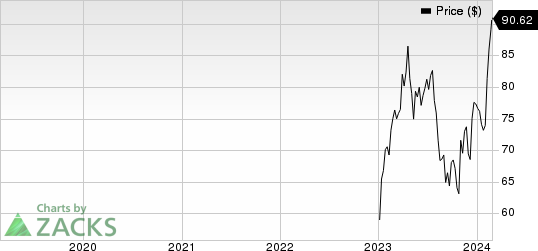

Price Performance

For the past six months, GEHC’s shares have gained 30.7% compared with the industry’s rise of 8.9%. The S&P 500 increased 14.6% in the same time frame.

Image Source: Zacks Investment Research

More on the News

Reduced bed capacity, rising readmission rates, and a shortage of workers all contribute to higher healthcare expenses for hospital systems. In addition to potentially lowering fall risks and hospital-acquired infections, at-home care can promote safety and recuperation. Per this article, patients are likely to be happy three times with the overall care experience when they use remote solutions in their homes.

GE HealthCare is likely to expand its current inpatient monitoring portfolio to assist patients from the hospital to their homes, thanks to Biofourmis' proven performance with care-at-home solutions. Combining the proven expertise of the two companies will transform the approach to the patient care process and assist in solving problems that health systems are now facing, such as shortages of clinical personnel and hospital capacity.

With FDA-approved AI-guided algorithms, clinical-grade wearables, in-home service orchestration technology, and nursing services, Biofourmis provides care-at-home solutions that facilitate and deliver care both in-person and virtually through its digital platform.

Built on a tradition of innovation, GE HealthCare's FlexAcuity monitoring solutions work in tandem with its virtual care offerings, such as Command Center, Digital CMU, and Mural ICU, to adapt to the continually changing demands of hospital patients.

GE HealthCare can expand the continuum of care outside of the hospital and give care teams a longitudinal patient view outside of the hospital setting by providing customers with Biofourmis' virtual care-at-home solutions.

GE HealthCare is likely to begin distributing Biofourmis solutions to customers in the United States starting the first quarter of 2024.

Industry Prospects

Per a report by MarketsandMarkets, the global home healthcare market size was valued at $250 billion in 2023 and is expected to reach $383 billion by 2028 at a growth rate of 8.9%.

The market is expected to increase as a result of the growing desire for affordable options to cut healthcare expenses and the expanding presence of the virtual and remote care sectors. An inexpensive alternative to a costly hospital stay is home healthcare.

Given the market potential of home healthcare, GE Healthcare’s collaboration with Biofourmis is likely to boost its business and increase revenues.

Notable Developments

GE Healthcare recently entered a strategic care alliance with OSF HealthCare and Pointcore to help increase clinical and operational efficiencies, standardize care delivery models and improve patient outcomes across OSF HealthCare. The tie-up is expected to leverage GE HealthCare’s innovative technology and Pointcore’s experience in managing non-clinical matters for hospitals and clinics.

The company announced its collaboration with MedQuest Associates to boost multi-site outpatient imaging networks. As a result of this three-year collaboration, GE Healthcare, with its innovative technologies, along with MedQuest’s outpatient imaging facilities, is set to optimize imaging solutions and provide solutions to support Theranostics.

GE HealthCare Technologies Inc. Price

GE HealthCare Technologies Inc. price | GE HealthCare Technologies Inc. Quote

Zacks Rank & Stocks to Consider

GEHC carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Cencora, Inc. COR, Elevance Health, Inc. ELV and Cardinal Health, Inc. CAH.

Cencora, carrying a Zacks Rank of 2 (Buy), reported first-quarter fiscal 2024 adjusted earnings per share (EPS) of $3.28, beating the Zacks Consensus Estimate by 14.7%. Revenues of $72.25 billion outpaced the consensus mark by 5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cencora has a long-term estimated growth rate of 8.6%. COR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 6.7%.

Elevance Health reported fourth-quarter 2023 adjusted EPS of $5.62, beating the Zacks Consensus Estimate by 1.3%. Revenues of $42.45 billion outpaced the consensus mark by 1.5%. It currently carries a Zacks Rank #2.

Elevance Health has a long-term estimated growth rate of 12%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.1%.

Cardinal Health reported second-quarter fiscal 2024 adjusted EPS of $1.82, beating the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion surpassed the Zacks Consensus Estimate by 1.1%. It currently carries a Zacks Rank #2.

Cardinal Health has a long-term estimated growth rate of 15.9%. CAH’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 15.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

GE HealthCare Technologies Inc. (GEHC) : Free Stock Analysis Report