GE HealthCare (GEHC) to Sell IONIC's FDA-Cleared nCommand Lite

GE HealthCare Technologies Inc. GEHC recently announced the FDA 510(k) clearance of privately-held product lifecycle management company IONIC Health’s nCommand Lite technology.

GE HealthCare is likely to be the exclusive distributor of the vendor-neutral, multimodality nCommand Lite system, which offers remote patient scanning support, remote access for image viewing and the ability to connect to remote experts who can offer real-time guidance to licensed technologists using the scanner.

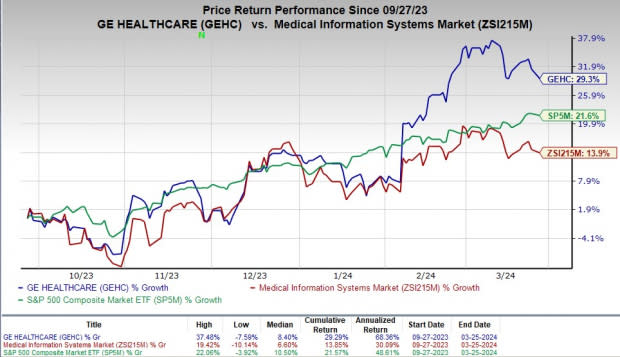

Price Performance

In the past six months, GEHC’s shares have rallied 29.3% compared with the industry’s rise of 13.9%. The S&P 500 has gained 21.6% in the same time frame.

Image Source: Zacks Investment Research

More on the News

The nCommand Lite is a unique remote scanning solution that helps optimize workflow across disparate imaging fleets. It is made to allow off-site experts to remotely provide real-time guidance to the licensed technologist operating the scanner. It also includes vendor-agnostic, multi-modality capabilities. The technology allows for the smooth collaboration of numerous scanner connections from a remote user and it is geared for low bandwidth usage for a better user experience.

The functionalities of the nCommand Lite can be used by off-site professionals to support procedure assessment, training and scanner parameter control. The multi-modality features of IONIC Health's nCommand Lite enable scanning for computed tomography (CT), positron emission tomography/CT (PET/CT) and magnetic resonance.

Per GE Healthcare, it was important for the company to add IONIC Health's nCommand Lite technology to their remote operations portfolio because the company understands that healthcare systems have an imaging fleet with multiple vendors and modalities in addition to leveraging skills of one expert across numerous physical locations for knowledge sharing and training.

Industry Prospects

Per a report by Grand View Research, the global remote patient monitoring system market size is valued at $5.2 billion in 2023 and is expected to grow at a rate of 18.6% from 2024 to 2030.

The need for remote monitoring systems will grow globally in the upcoming years due to their improved management of chronic diseases, which includes progress tracking and early warning indications. Patients are likely to be cautious against physical hospital visits due to the risk of infection, particularly for those with chronic illnesses. As a result, the market for remote patient monitoring is likely to grow further.

Given the market potential of remote patient monitoring, FDA clearance of the nCommand Lite technology is likely to boost GE Healthcare’s business and increase revenues.

Notable Developments

GE Healthcare recently entered a strategic care alliance with OSF HealthCare and Pointcore to help increase clinical and operational efficiencies, standardize care delivery models, and improve patient outcomes across OSF HealthCare. The tie-up is expected to leverage GE HealthCare’s innovative technology and Pointcore’s experience in managing non-clinical matters for hospitals and clinics.

As a result of this three-year collaboration, GE Healthcare, with its innovative technologies, along with MedQuest’s outpatient imaging facilities, is set to optimize imaging solutions and support Theranostics.

GE HealthCare Technologies Inc. Price

GE HealthCare Technologies Inc. price | GE HealthCare Technologies Inc. Quote

Zacks Rank & Stocks to Consider

GEHC carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 58.3% compared with the industry’s 18.9% rise in the past year.

Cardinal Health, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 51.9% compared with the industry’s 3.2% rise in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have surged 51.5% compared with the industry’s 3.6% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

GE HealthCare Technologies Inc. (GEHC) : Free Stock Analysis Report