Gen Digital Inc (GEN) Reports Solid Q3 FY24 Results with Bookings Surpassing $1 Billion

Revenue: Increased by 2% year-over-year to $951 million.

Operating Income: GAAP operating income declined by 9% to $335 million, while non-GAAP operating income rose by 6% to $558 million.

Diluted EPS: GAAP diluted EPS decreased by 12% to $0.22, non-GAAP diluted EPS increased by 10% to $0.49.

Direct Customer Count: Reached a record 38.9 million, demonstrating strong market demand.

Quarterly Cash Dividend: Announced at $0.125 per common share, payable on March 13, 2024.

Future Outlook: Q4 FY24 revenue expected to be between $960 to $970 million, with EPS between $0.52 to $0.54.

On February 1, 2024, Gen Digital Inc (NASDAQ:GEN), a cybersecurity leader, released its 8-K filing, announcing financial results for the third quarter of fiscal year 2024. The company, known for its trusted Cyber Safety brands such as Norton, Avast, LifeLock, and others, continues to empower users with security, identity protection, and privacy solutions.

Despite the broader market challenges, GEN's commitment to innovation and customer-centricity has led to its 18th consecutive quarter of growth. CEO Vincent Pilette expressed confidence in the company's trajectory, citing a record number of direct customers as evidence of the compelling value proposition offered by GEN's suite of products.

Financial Performance and Challenges

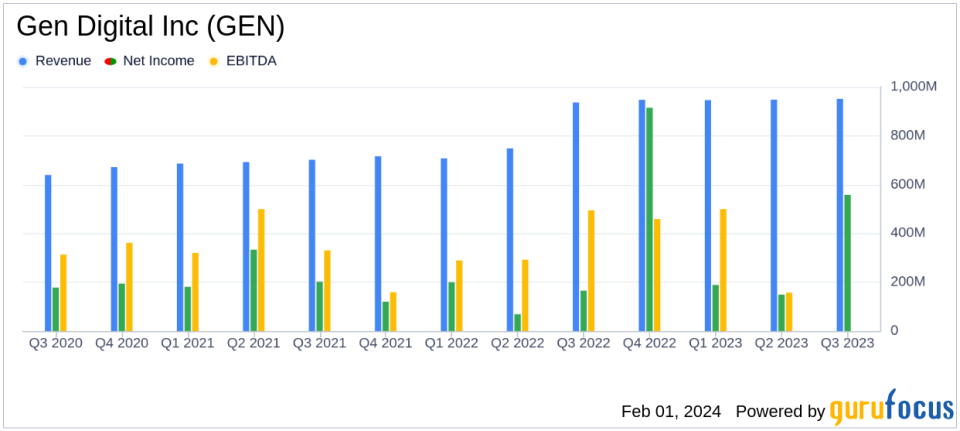

GEN's GAAP revenue for Q3 FY24 increased modestly by 2% to $951 million, while non-GAAP revenue remained consistent with GAAP figures. The company's bookings showed a stronger performance, reaching over $1 billion, marking a 4% increase in USD and a 3% increase in constant currency. This growth in bookings is a critical indicator of future revenue potential and underscores the company's successful customer acquisition and retention strategies.

However, GAAP operating income saw a decrease of 9% to $335 million, with operating margin contracting by 4 percentage points to 35%. The diluted GAAP EPS also declined by 12% to $0.22. These declines reflect the competitive and cost pressures facing the industry, as well as investments in growth initiatives.

In contrast, non-GAAP measures painted a brighter picture, with operating income rising by 6% to $558 million and operating margin expanding by 250 basis points to 58.7%. The non-GAAP diluted EPS increased by 10% to $0.49. These improvements highlight GEN's ability to manage costs and optimize operations amidst growth investments.

Financial Achievements and Importance

GEN's financial achievements, particularly in non-GAAP operating income and margin expansion, are significant in the software industry where profitability and cash flow generation are key. The company's ability to maintain and grow its customer base while effectively managing expenses is crucial for sustaining long-term growth and shareholder value.

CFO Natalie Derse emphasized the company's consistent execution and operational excellence, which have been instrumental in driving the long-term growth plan. The focus on cross-sell and up-sell opportunities, coupled with strategic reinvestments into the business, positions GEN well within the dynamic cybersecurity landscape.

Analysis and Outlook

Looking ahead, GEN provided guidance for Q4 FY24 with revenue expected to be in the range of $960 to $970 million and EPS between $0.52 to $0.54. The company also announced a regular quarterly cash dividend, reinforcing its commitment to shareholder returns.

The company's balance sheet remains robust, with cash and cash equivalents of $490 million as of December 29, 2023, although this represents a decrease from $750 million on March 31, 2023. GEN's total assets increased to $16.282 billion, up from $15.947 billion in the same period.

Overall, GEN's Q3 FY24 results demonstrate the company's resilience and strategic focus in a competitive market. With a strong customer base and a clear vision for the future, GEN is well-positioned to continue its growth trajectory and deliver value to its stakeholders.

For more detailed information on Gen Digital Inc's financials and future expectations, investors and interested parties are encouraged to visit the Financials section of the Investor Relations website.

Explore the complete 8-K earnings release (here) from Gen Digital Inc for further details.

This article first appeared on GuruFocus.