Genco Shipping & Trading Limited's (NYSE:GNK) Popularity With Investors Is Under Threat From Overpricing

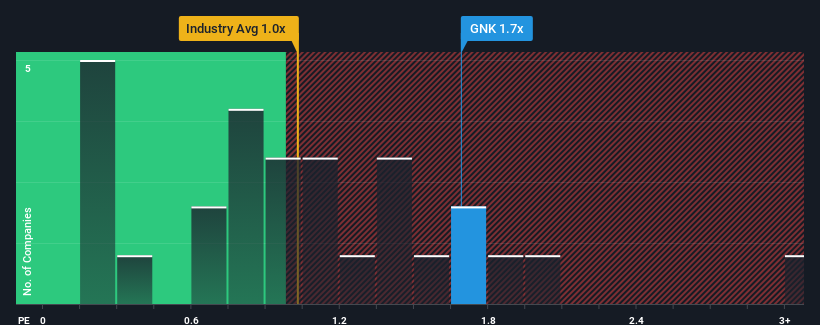

Genco Shipping & Trading Limited's (NYSE:GNK) price-to-sales (or "P/S") ratio of 1.7x may not look like an appealing investment opportunity when you consider close to half the companies in the Shipping industry in the United States have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Genco Shipping & Trading

What Does Genco Shipping & Trading's Recent Performance Look Like?

Recent times haven't been great for Genco Shipping & Trading as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Genco Shipping & Trading will help you uncover what's on the horizon.

How Is Genco Shipping & Trading's Revenue Growth Trending?

Genco Shipping & Trading's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 33%. Regardless, revenue has managed to lift by a handy 7.2% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring plunging returns, with revenue decreasing 7.5% per annum as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to moderate by 1.6% per annum, which indicates the company should perform poorly indeed.

With this in mind, we find it intriguing that Genco Shipping & Trading's P/S exceeds that of its industry peers. When revenue shrink rapidly often the P/S premium shrinks too, which could set up shareholders for future disappointment. There's strong potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Genco Shipping & Trading's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Genco Shipping & Trading currently trades on a much higher than expected P/S since its revenue forecast is even worse than the struggling industry. Revenue outlooks like this don't typically support a company trading at such an elevated P/S, and if it did, it doesn't usually do it for long. In addition, we would be concerned whether the company's revenue prospects could slide further under these tough industry conditions. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Genco Shipping & Trading (of which 1 is concerning!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.