GeneDx Holdings Corp (WGS) Reports Strong Revenue Growth and Margin Expansion in Q4 2023

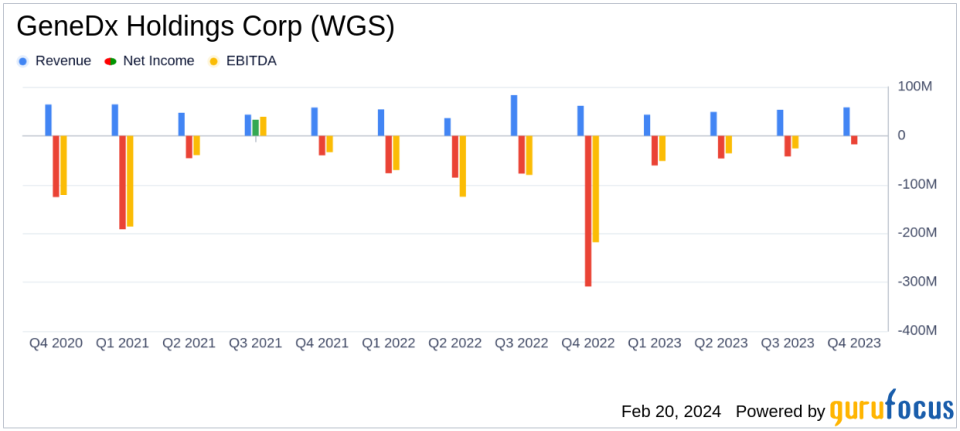

Revenue Growth: Q4 2023 revenue from continuing operations increased by 27% year-over-year to $58.1 million.

Exome and Genome Test Revenue: Significant growth of 68% year-over-year in Q4 2023, reaching $39.2 million.

Adjusted Gross Margin Expansion: Improved to 56% in Q4 2023 from 41% in Q4 2022.

Operating Expenses Reduction: Adjusted total operating expenses decreased by 36% year-over-year in Q4 2023.

Narrowed Net Loss: Adjusted net loss improved by 76% year-over-year in Q4 2023 to $17.8 million.

Cash Burn Reduction: Achieved a 51% year-over-year reduction in Q4 2023 cash burn.

2024 Guidance: Management expects revenue between $220M and $230M and adjusted gross margin profile to at least 50% for the full year 2024.

On February 20, 2024, GeneDx Holdings Corp (NASDAQ:WGS) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, a leader in genomic and clinical insights, reported a significant year-over-year growth in revenue and exome and genome test revenue, alongside an expansion in adjusted gross margins and a reduction in net loss and cash burn.

GeneDx Holdings Corp delivers personalized health insights to inform diagnosis, direct treatment, and improve drug discovery. The company is accelerating the use of genomic and clinical information to enable precision medicine as the standard of care. With its industry-leading exome and genome testing and interpretation, GeneDx is transforming healthcare through one of the world's largest rare disease data sets.

Financial Performance and Challenges

The company's performance in the fourth quarter reflects a strong focus on revenue growth, particularly in exome and genome test revenue, which saw a 68% increase year-over-year. This growth is crucial as it demonstrates the company's ability to expand its market share in the high-value genomic testing sector. The expanded adjusted gross margin, which reached 56%, indicates improved operational efficiency and cost management. However, despite these achievements, GeneDx still faces the challenge of a net loss, although it has significantly narrowed to $17.8 million from the previous year. The company's path to profitability is critical, and while the reduction in cash burn by 51% year-over-year is a positive sign, maintaining financial discipline and continuing to grow revenue will be essential for achieving profitability in 2025 as projected.

Key Financial Metrics

GeneDx's financial achievements are particularly important in the Healthcare Providers & Services industry, where the adoption of precision medicine is rapidly growing. The company's ability to increase revenue while managing costs effectively is a testament to its strategic focus and operational execution. Key metrics from the financial statements include a 27% year-over-year increase in Q4 revenue from continuing operations, a significant growth in exome and genome test volume by 99% year-over-year, and a substantial reduction in adjusted total operating expenses by 36% year-over-year in Q4.

Our strong fourth quarter results were a product of our relentless focus on exome and genome revenue growth, uplift from gross margin expansion, and continued efforts to meaningfully reduce our cash burn," said Katherine Stueland, Chief Executive Officer of GeneDx. "With our focus and disciplined approach to delivering on our goals in 2024, we are confident in our ability to continue to execute and reach profitability in 2025."

These metrics are important as they reflect the company's financial health and its ability to sustain growth and move towards profitability. The increase in revenue and gross margin, coupled with the decrease in operating expenses and net loss, are indicators of a company that is improving its efficiency and positioning itself for future success.

Analysis of Company's Performance

GeneDx's performance in the fourth quarter of 2023 indicates a company that is successfully navigating the complexities of the genomic testing market. The company's strategic focus on exome and genome testing is paying off, with significant revenue growth in this area. The expansion of adjusted gross margins suggests that GeneDx is not only increasing sales but doing so more profitably. The reduction in operating expenses and net loss is a clear sign that the company is on the right track to achieve its goal of profitability by 2025.

Looking ahead, GeneDx's guidance for full year 2024, with expected revenues between $220M and $230M and an adjusted gross margin profile of at least 50%, reflects management's confidence in the company's continued growth trajectory and operational improvements. Investors and stakeholders will be watching closely to see if GeneDx can maintain its momentum and achieve its financial targets in the coming year.

For more detailed insights and analysis, investors and interested parties are encouraged to review the full 8-K filing.

GeneDx is poised to continue its growth and drive towards profitability, making it a company to watch in the precision medicine space.

Explore the complete 8-K earnings release (here) from GeneDx Holdings Corp for further details.

This article first appeared on GuruFocus.