Generac Holdings Inc CEO Aaron Jagdfeld Sells 5,000 Shares

On October 2, 2023, Aaron Jagdfeld, the CEO of Generac Holdings Inc (NYSE:GNRC), sold 5,000 shares of the company. This move is part of a larger trend of insider selling within the company over the past year.

Aaron Jagdfeld has been with Generac Holdings Inc, a leading designer and manufacturer of generators and other engine powered products, for over a decade. Under his leadership, the company has grown significantly, expanding its product offerings and market reach.

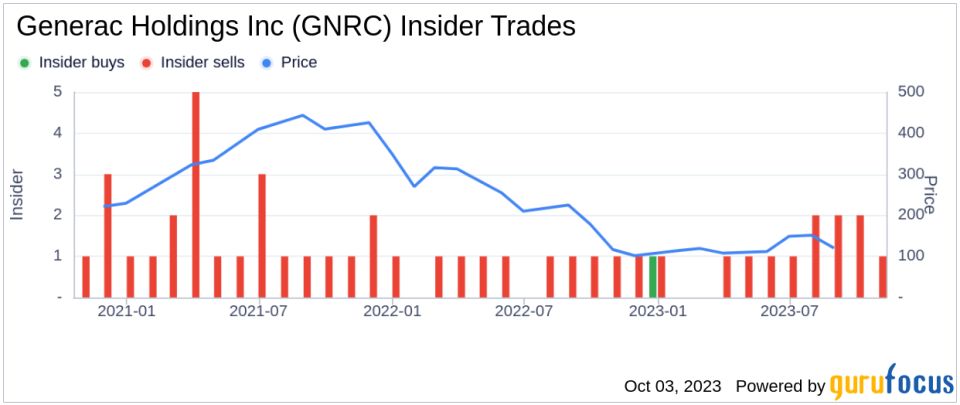

Over the past year, the insider has sold a total of 95,207 shares and has not made any purchases. This trend is mirrored by other insiders within the company, with 15 insider sells and only 1 insider buy over the same timeframe.

The recent sell by the insider occurred when the shares of Generac Holdings Inc were trading at $108.24, giving the company a market cap of $6.6 billion. The price-earnings ratio of the company stands at 44.02, significantly higher than the industry median of 21.95 and the companys historical median price-earnings ratio.

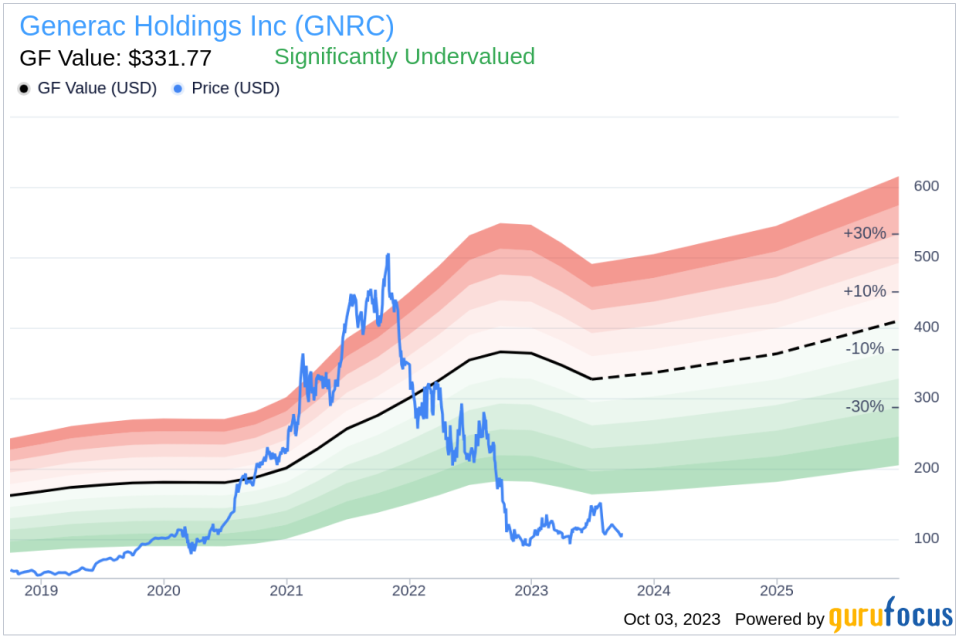

Despite the high price-earnings ratio, the stock appears to be significantly undervalued based on its GF Value. With a price of $108.24 and a GuruFocus Value of $331.77, the price-to-GF-Value ratio stands at 0.33.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The recent sell by the insider, coupled with the overall trend of insider selling within the company, may raise some concerns for investors. However, the stock's significant undervaluation based on its GF Value suggests that there may still be potential for growth. Investors should keep a close eye on the company's performance and any future insider transactions.

As always, insider transactions should not be used in isolation to make investment decisions, but rather should be used as a part of a broader analysis of the company's financial health, performance, and market conditions.

This article first appeared on GuruFocus.