Generac Holdings Inc CEO Aaron Jagdfeld Sells 5,000 Shares

Generac Holdings Inc (NYSE:GNRC), a leader in the design and manufacture of power generation equipment and other engine-powered products, has recently seen a significant insider sell by its CEO, Aaron Jagdfeld. On December 1, 2023, Jagdfeld sold 5,000 shares of the company, a move that has caught the attention of investors and market analysts alike.

Who is Aaron Jagdfeld?

Aaron Jagdfeld has been an integral part of Generac Holdings Inc, serving as the CEO and playing a pivotal role in the company's growth and success. Under his leadership, Generac has expanded its product offerings and market reach, solidifying its position as a key player in the power generation sector. Jagdfeld's tenure has been marked by strategic initiatives that have driven innovation and profitability, making his trading activities particularly noteworthy for investors.

Generac Holdings Inc's Business Description

Generac Holdings Inc is renowned for its comprehensive range of power solutions, including portable, residential, commercial, and industrial generators. With a focus on reliability and innovation, the company has established a strong reputation for providing backup power solutions that are critical during times of emergency. Generac's products are essential for maintaining power continuity in homes, businesses, and industrial settings, making it a go-to source for customers seeking dependable power generation.

Analysis of Insider Buy/Sell and Relationship with Stock Price

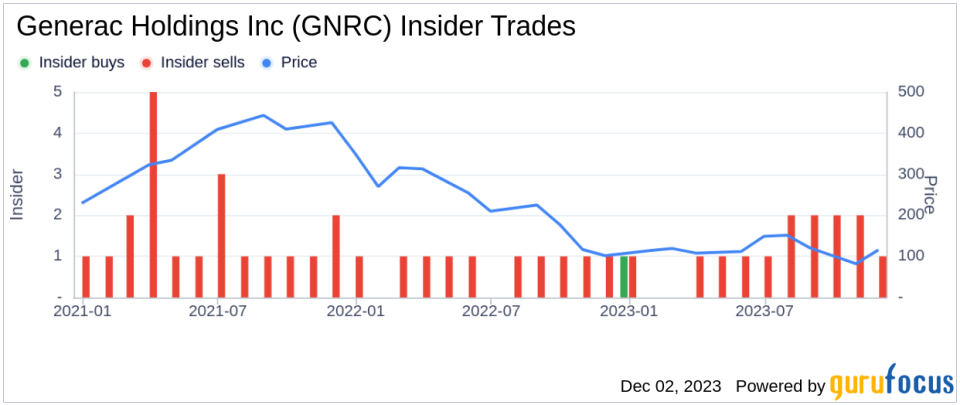

The insider transaction history for Generac Holdings Inc reveals a pattern of more insider sells than buys over the past year. Specifically, there have been 14 insider sells and only 1 insider buy. This trend can often be interpreted in various ways; however, it is essential to consider the context of each transaction. Insider sells do not always indicate a lack of confidence in the company; they can also reflect personal financial planning or diversification strategies by the insiders.Aaron Jagdfeld's recent sell of 5,000 shares follows a year in which he sold a total of 90,207 shares and made no purchases. This consistent selling activity could suggest that the insider is taking profits or reallocating assets, especially given the stock's valuation metrics.

The relationship between insider trading activity and stock price is complex. While significant insider sells can sometimes lead to a decrease in investor confidence and a subsequent drop in stock price, this is not a universal rule. In the case of Generac Holdings Inc, the stock's market cap stands at $7.513 billion, with a price-earnings ratio of 47.96, which is higher than both the industry median and the company's historical median. This suggests that the stock may be overvalued based on traditional valuation metrics, despite the company's strong performance.

Valuation and GF Value Analysis

On the day of Jagdfeld's sell, Generac Holdings Inc's shares were trading at $116.76, which is significantly below the GuruFocus Value (GF Value) of $268.78. The price-to-GF-Value ratio of 0.43 indicates that the stock is significantly undervalued, presenting a potentially attractive entry point for investors.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The discrepancy between the current stock price and the GF Value could be an opportunity for investors who believe in the company's long-term prospects, despite the recent insider selling activity.

Conclusion

The insider sell by CEO Aaron Jagdfeld of Generac Holdings Inc is a significant event that warrants attention. While the insider's selling pattern over the past year may raise questions, it is crucial to analyze the broader context, including the company's valuation and market position. With Generac's stock being significantly undervalued according to the GF Value, investors may find this an opportune time to consider the stock, keeping in mind the insider trends and the company's strong foothold in the power generation industry. As always, investors should conduct their due diligence and consider their investment strategy in light of their financial goals and risk tolerance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.