General Dynamics' (GD) Unit Wins $1.3B Canada Army Contracts

General Dynamics Corporation’s GD business unit, General Dynamics Mission Systems–Canada, recently clinched four contracts from the government of Canada worth $1.3 billion (CAD$1.7 billion). The contract will support the Land Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (C4ISR) system for Canada’s Army.

The four contracts include System of Systems Engineering & Integration; Core Network Sustainment Services; Applications Sustainment Services; and Intelligence, Surveillance, Target Acquisition and Reconnaissance (ISTAR).

What’s Favoring General Dynamics?

Increasing geopolitical tensions across the globe and growing terrorism are likely to increase C4ISR expenditures, which are considered one of the most critical elements of a country’s military budget.

The C4ISR Market size is expected to go from $12.66 billion in 2023 to $14.70 billion by 2028, at a CAGR of 3.03% during 2023-2028, as predicted by Mordor Intelligence’s report.

Such solid growth projections should boost GD’s top-line performance in the coming days, as its Mission Systems unit is among the leading players in this space.

During third-quarter 2023, General Dynamics’ technologies segment generated total revenues of $3.3 billion with a backlog of $12.7 billion. Mission Systems is part of the Technologies segment and continues to receive contracts from its global customer base, which is adding to the backlog.

What About Other Defense Majors?

The growth prospects of the C4ISR market are solid for other defense primes like BAE Systems BAESY, Northrop Grumman NOC and Lockheed Martin LMT.

BAE Systems’ C4ISR team is conquering the complex emerging mission challenges across all domains. The company’s electronic systems segment had 22% of its 2023 sales coming from C4ISR, with a total backlog of $10.3 billion. On Sep 26, 2023, Bae Systems received a five-year contract from Lockheed Martin to sustain the AN/ALR-94 advanced digital electronic warfare system for the F-22 Raptor.

BAE Systems boasts a long-term (three-to five-years) earnings growth rate of 14.2%. The Zacks Consensus Estimate of BAESY’s 2023 sales implies a growth rate of 33.6% from the prior-year reported figure.

Northrop Grumman’s mission systems is a leader in advanced mission solutions and multifunction systems, majorly for the U.S. defense. The maritime/land segment comprised 24% of the total sales in 2022. The land mission systems’ portfolio includes the Ground/Air Task Oriented Radar, a mobile multi-mode active electronically scanned array.

Northrop’s long-term earnings growth rate is pegged at 2.3%. The Zacks Consensus Estimate of NOC’s 2023 sales implies a growth rate of 6.6% from the prior-year reported figure.

Lockheed Martin’s C4ISR technologies enable customers to accomplish a diverse set of missions in the air, on the sea’s surface, beneath the surface, in space and on land. On Dec 13, 2023, LMT successfully tested the Advanced Off-Board Electronic Warfare system’s electronic attack capabilities while installed on a U.S. Navy MH-60R helicopter.

Lockheed Martin’s long-term earnings growth is pegged at 8.6%. The Zacks Consensus Estimate of LMT’s 2023 sales implies a growth rate of 1% from the prior-year reported figure.

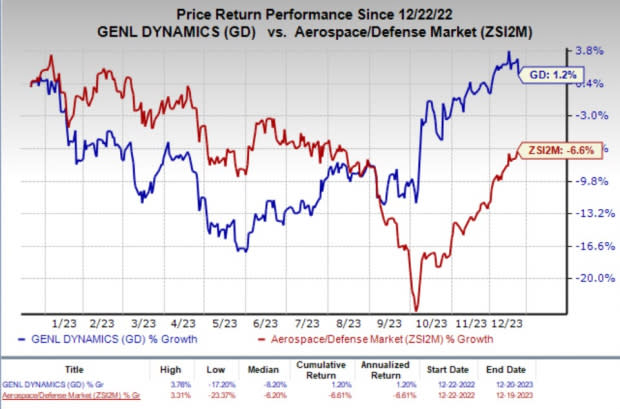

Price Performance

In the past year, shares of GD have gained 1.2% against the industry’s 6.6% decline.

Image Source: Zacks Investment Research

Zacks Rank

General Dynamics currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Bae Systems PLC (BAESY) : Free Stock Analysis Report