General Electric Has Almost Doubled Since Last Year. Is the Stock Back?

General Electric (NYSE: GE) remains a household name after generations as a mega-conglomerate that dabbled in many industries, from home appliances to healthcare. Even so, the financial crisis from 2008 to 2009 was nearly fatal for the company, and it's spent over a decade evolving and trying to get back on its feet.

Today General Electric looks far different from the company your parents or grandparents might recognize. In this case, change is good. General Electric seems to be a much stronger and more focused business than before.

On top of that, shares have nearly doubled over the past year. Is the stock back? Here is what you need to know.

From conglomerate to niche company

General Electric nearly went bankrupt when its financial arm was caught up in the financial crisis. Since then, the stock hasn't been the same. It went through a dark period where shares whipsawed, hitting their lows during the pandemic. To this day, shares have not recovered the highs they reached before 2008-2009:

The company has undergone significant changes over the years. In the mid-2010s, it sold off most of its financial operations and announced a plan in late 2021 to break into three distinct companies.

The healthcare business was spun off as GE Healthcare Technologies last year. Its energy business will become GE Vernova on April 2, 2024. That leaves General Electric's aviation business, which will maintain General Electric's ticker and operate as GE Aerospace.

To be clear, investors considering buying the stock are buying a business focused on commercial and military aviation.

Looking at this "new" General Electric

With so many moving parts, it is best to take a long-term look at the company. Fortunately, management laid out some solid long-term expectations for the company:

The company believes it can generate high-single-digit revenue growth over time. That will come from more robust growth in the commercial engines and services business, where management is forecasting high-teens revenue growth this year. The defense and propulsion business is expected to grow in the low-to-mid-single-digit range.

The company will also receive a nice cash injection between 2024 and 2026. Management expects around $25 billion in total deployable cash from operations and proceeds from the spin-offs. Management will pay investors 30% of net income as dividends and deploy a $15 billion share repurchase program.

General Electric is back. Should investors buy the stock?

A growing, focused company that's repurchasing shares sounds pretty appealing. Indeed, it seems GE Aviation is worth owning in a long-term portfolio. The big question now is whether the stock's worth buying today. After all, shares have nearly doubled in value over the past year.

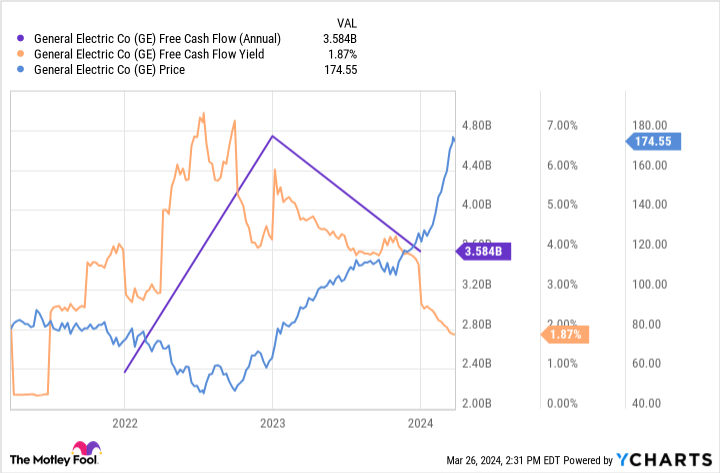

But those gains have been justified by much stronger financials. The company never did $4.8 billion in free cash flow in the past three years, but management is guiding for over $5 billion this year (just GE Aviation), which should continue to grow as operating profit does. Management is targeting $10 billion in operating profit in 2028, up from $6 billion expected this year.

GE Aviation's free cash flow yield is 2.6% today, not factoring in the looming spin-off of GE Vernova. That's not cheap relative to what it's yielded in recent years. Investors bullish on the company's long-term prospects should consider dollar-cost averaging into the stock while all these moving parts settle so the company can put together a few quarters of post-spin-off earnings to show it's on track with guidance.

Should you invest $1,000 in General Electric right now?

Before you buy stock in General Electric, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and General Electric wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

General Electric Has Almost Doubled Since Last Year. Is the Stock Back? was originally published by The Motley Fool