General Electric (GE) Unit to Upgrade Xiangjiaba Plant in China

General Electric Company’s GE unit, GE Vernova’s Hydro Power business secured a contract from Yangtze Power to upgrade the latter’s China based 6.4 giga-watt Xiangjiaba Hydropower Plant.

GE Vernova is the combined operations of GE Digital, Renewable Energy and GE Power. Its Hydro Power business delivers hydropower solutions to provide more renewable energy to the world.

Xiangjiaba Hydropower plant and its eight hydropower units are situated in the downstream of the Jinsha River. Per the deal, General Electric will design, produce, supply, install and commission three sets of main shaft air supply pipe of the Xiangjiaba Hydropower Plant. This will augment the sealing mechanism while preserving hydropower plant’s efficiency as well. The upgrade is likely to be completed in the first half of 2024.

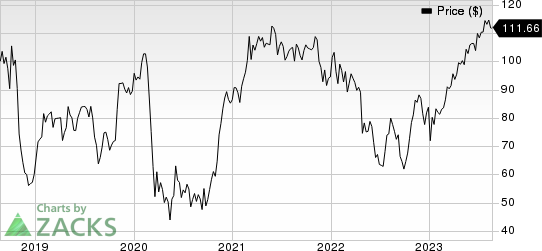

General Electric Company Price

General Electric Company price | General Electric Company Quote

Commissioned in 2014, the Xiangjiaba power plant is one of the largest hydropower plants in the country and is a crucial source of energy from western areas to East China, which provides green energy to approximately five million people every year. Besides its power generation role, the Xiangjiaba project aids in flood prevention, boosts shipping conditions and promotes agricultural irrigation in the region, reducing 12 million tons of CO2 emissions annually.

Zacks Rank & Other Stocks to Consider

GE currently sports a Zacks Rank #1 (Strong Buy). Some other top-ranked companies are discussed below:

Caterpillar Inc. CAT presently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks.

CAT’s earnings surprise in the last four quarters was 18.5%, on average. In the past 60 days, estimates for Caterpillar’s earnings have increased 10.3% for 2023. The stock has gained 39.1% in the past year.

A. O. Smith Corp. AOS presently carries a Zacks Rank #2 (Buy). AOS’ earnings surprise in the last four quarters was 10.5%, on average.

In the past 60 days, estimates for A. O. Smith’s earnings have increased 2.9% for 2023. The stock has gained 13.9% in the past year.

Alamo Group Inc. ALG presently carries a Zacks Rank of 2. ALG’s earnings surprise in the last four quarters was 13%, on average.

In the past 60 days, estimates for Alamo’s 2023 earnings have increased 1.1%. The stock has gained 26.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report