General Merchandise Retail Stocks Q2 In Review: Ollie's (NASDAQ:OLLI) Vs Peers

As Q2 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the general merchandise retail stocks, including Ollie's (NASDAQ:OLLI) and its peers.

General merchandise retailers–also called broadline retailers–know you’re busy and don’t want to drive around wasting time and gas, so they offer a one-stop shop. Convenience is the name of the game, so these stores may sell clothing in one section, toys in another, and home decor in a third. This concept has evolved over time from department stores to more niche concepts targeting bargain hunters or young adults, and e-commerce has forced these retailers to be extra sharp in their value propositions to consumers, whether that’s unique product or competitive prices.

The 7 general merchandise retail stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 2.87%, while on average next quarter revenue guidance was 2.05% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows and general merchandise retail stocks have not been spared, with share prices down 17.8% since the previous earnings results, on average.

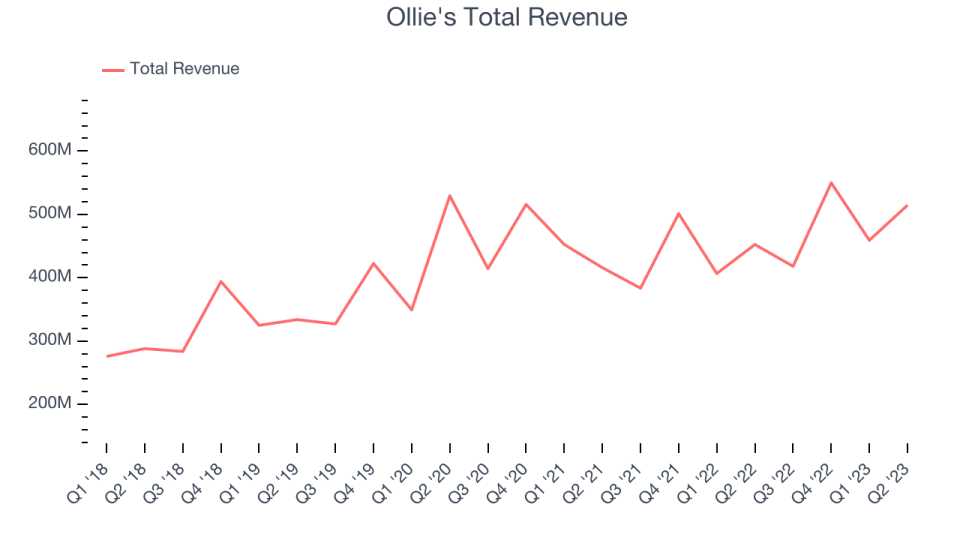

Ollie's (NASDAQ:OLLI)

Often located in suburban or semi-rural shopping centers, Ollie’s Bargain Outlet (NASDAQ:OLLI) is a discount retailer that acquires excess inventory then sells at meaningful discounts.

Ollie's reported revenues of $514.5 million, up 13.7% year on year, beating analyst expectations by 3.1%. It was a decent quarter for the company, with an impressive beat of analysts' revenue estimates. Guidance was also strong as Ollie's raised its full-year outlook for sales, profits, and EPS.

“We feel very good about the current trends and momentum of our business. With over 40 years of closeout buying experience and growing relationships across the industry, we are seeing very strong deal flow, and our customers are clearly responding. In the second quarter, comparable store sales increased 7.9%, with nearly 70% of our product categories contributing to the increase. On top of the strong deal flow, changes to our marketing program and investments in our people and supply chain are driving better execution and an even more exciting shopping experience for our customers. This is raising productivity levels across the organization, which contributed to the more than doubling of our adjusted EBITDA margin in the second quarter to 12.4% of sales,” said John Swygert, President and Chief Executive Officer.

Ollie's achieved the fastest revenue growth and highest full year guidance raise of the whole group. The stock is down 3.77% since the results and currently trades at $72.02.

Is now the time to buy Ollie's? Access our full analysis of the earnings results here, it's free.

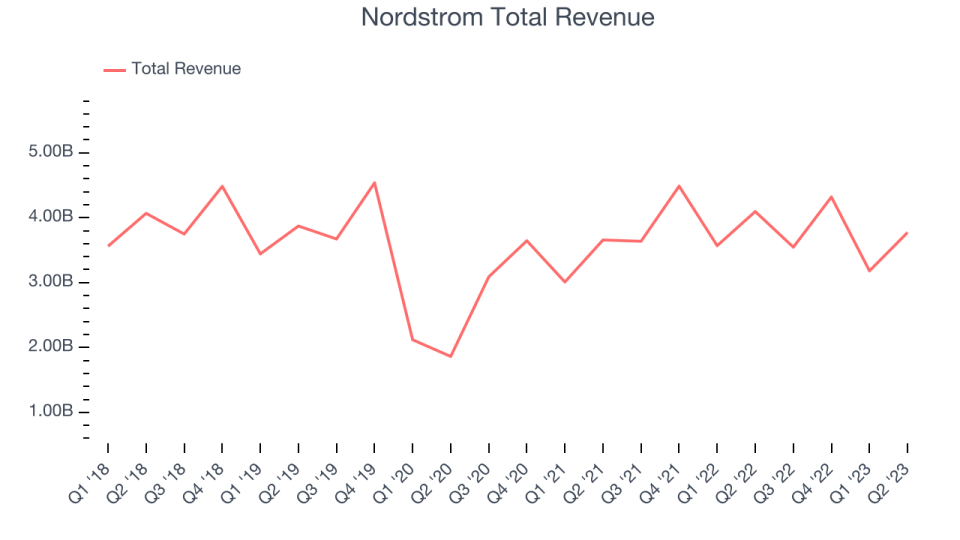

Best Q2: Nordstrom (NYSE:JWN)

Known for its exceptional customer service that features a ‘no questions asked’ return policy, Nordstrom (NYSE:JWN) is a high-end department store chain.

Nordstrom reported revenues of $3.77 billion, down 7.89% year on year, beating analyst expectations by 2.14%. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates. On the other hand, revenue continues to decline year on year and margin performance was roughly flat year on year, meaning no improvement in gross or operating margins.

The stock is down 16% since the results and currently trades at $14.12.

Is now the time to buy Nordstrom? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Five Below (NASDAQ:FIVE)

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ:FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Five Below reported revenues of $759 million, up 13.5% year on year, missing analyst expectations by 0.14%. It was a weak quarter for the company, with underwhelming earnings guidance for the next quarter.

Five Below had the weakest performance against analyst estimates in the group. The stock is down 11.3% since the results and currently trades at $162.1.

Read our full analysis of Five Below's results here.

Dillard's (NYSE:DDS)

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Dillard's reported revenues of $1.6 billion, down 1.27% year on year, beating analyst expectations by 3.19%. It was a solid quarter for the company, with an impressive beat of analysts' earnings estimates. On the other hand, same-store sales missed (although again, revenue beat), and the company called out a "cautious consumer" in the press release.

The stock is down 9.56% since the results and currently trades at $304.03.

Read our full, actionable report on Dillard's here, it's free.

Macy's (NYSE:M)

With a storied history that began with its 1858 founding, Macy’s (NYSE:M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Macy's reported revenues of $5.28 billion, down 9.5% year on year, beating analyst expectations by 3.33%. It was a weaker quarter for the company, with its full-year revenue guidance missing analysts' expectations. Like in the previous quarter, Macy's management team called out the uncertain macro environment, causing investors to worry.

Macy's had the weakest full year guidance update among the peers. The stock is down 24.6% since the results and currently trades at $11.11.

Read our full, actionable report on Macy's here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned