General Mills (NYSE:GIS) Posts Better-Than-Expected Sales In Q3, Reaffirms Guidance

Packaged foods company General Mills (NYSE:GIS) reported results ahead of analysts' expectations in Q3 FY2024, with revenue flat year on year at $5.10 billion. It made a non-GAAP profit of $1.17 per share, improving from its profit of $0.97 per share in the same quarter last year.

Is now the time to buy General Mills? Find out by accessing our full research report, it's free.

General Mills (GIS) Q3 FY2024 Highlights:

Revenue: $5.10 billion vs analyst estimates of $4.97 billion (2.7% beat)

EPS (non-GAAP): $1.17 vs analyst estimates of $1.05 (11.9% beat)

2024 guidance reaffirmed

Gross Margin (GAAP): 33.5%, up from 32.5% in the same quarter last year

Free Cash Flow of $751.4 million, down 22.2% from the previous quarter

Organic Revenue was down 1% year on year (beat vs. expectations of down 2.6% year on year)

Sales Volumes were down 2% year on year (beat vs. expectations of down 4.3% year on year)

Market Capitalization: $38.97 billion

“General Mills’ strategic focus on brand building, innovation, and in-store execution contributed to improved volume and market share trends in the third quarter,” said General Mills Chairman and Chief Executive Officer Jeff Harmening.

Best known for its portfolio of powerhouse breakfast cereal brands, General Mills (NYSE:GIS) is a packaged foods company that has also made a mark in cereals, baking products, and snacks.

Packaged Food

Packaged food stocks are considered resilient investments because people always need to eat. These companies therefore can enjoy consistent demand as long as they stay on top of changing consumer preferences. But consumer preferences can be a double-edged sword, as companies that aren't at the front of trends such as health and wellness and natural ingredients can fall behind. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

General Mills is one of the most widely recognized consumer staples companies in the world. Its influence over consumers gives it extremely high negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don't have).

As you can see below, the company's annualized revenue growth rate of 2.7% over the last three years was weak as consumers bought less of its products. We'll explore what this means in the "Volume Growth" section.

This quarter, General Mills's revenue fell 0.5% year on year to $5.10 billion but beat Wall Street's estimates by 2.7%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

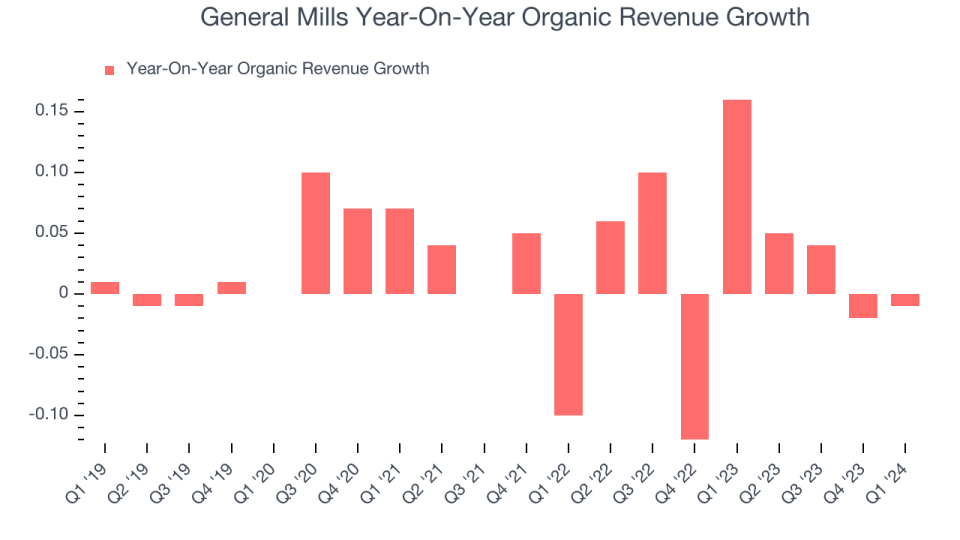

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

The demand for General Mills's products has generally risen over the last two years but lagged behind the broader sector. On average, the company's organic sales have grown by 3.3% year on year.

In the latest quarter, General Mills's year on year organic sales were flat. By the company's standards, this growth was a meaningful deceleration from the 16% year-on-year increase it posted 12 months ago. We'll be watching General Mills closely to see if it can reaccelerate growth.

Key Takeaways from General Mills's Q3 Results

We were impressed by how significantly General Mills blew past analysts' organic revenue growth expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. That the company maintained its full year outlook for organic net sales and EPS means it is staying on track. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 2.9% after reporting and currently trades at $70.64 per share.

General Mills may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.