Generate Instant Income While Waiting for a Rebound in This Beaten-Down Coal Stock

Coal fell on hard times thanks in large part to the development of more cost-effective and plentiful natural gas reserves. But now, with natural gas prices at multi-year highs and double the price low made last year, coal has become more attractive as an energy source to produce electricity for utilities.

Coal miner Peabody Energy Corp. (BTU) has dropped more than 40% in less than eight months, from its November high near $30 per share to under $17.

Earlier this month, support at the previous 52-week low at the $18 level failed, and BTU pushed to new lows below $16.50. The five-year low at $16 is the next significant price support to watch.

If you are comfortable holding on to this inexpensive stock for a potential recovery, then selling put options could allow you to collect income while you wait to get into BTU stock at a 12% discount.

Cash-Secured Put Selling Strategy

While the typical investor might use a limit order to buy a stock or ETF at a designated price or lower, the options trader can do one better by selling a cash-secured put.

This strategy has the same mathematical risk profile as a covered call. With put selling, there is an obligation to buy the stock at the strike price if it is assigned, allowing you to get into the stock at a discount. In fact, the true entry cost basis is even lower with the subtraction of the premium you earned from selling the puts.

And if the stock is not below the strike price at expiration, then the premium received is all profit. In other words, you're getting paid not to own the stock.

There are two rules traders must follow to be successful at selling put options.

Rule One: Only sell puts on stocks you want to own.

The intention of this strategy is to be assigned the stock as a long-term investment (each option contract represents 100 shares). So make sure you have the funds in your account to buy the stock at the options strike price if a sell-off occurs. Paying in full ensures that no additional money is needed to hold the stock for potentially many months or even years until a price recovery.

Rule Two: Sell either of the front two option expiration months to take advantage of time decay.

Collect premium every month on put sales until you are assigned shares at a cost-reduced basis. Every month that you keep the premium is money subtracted from your entry price.

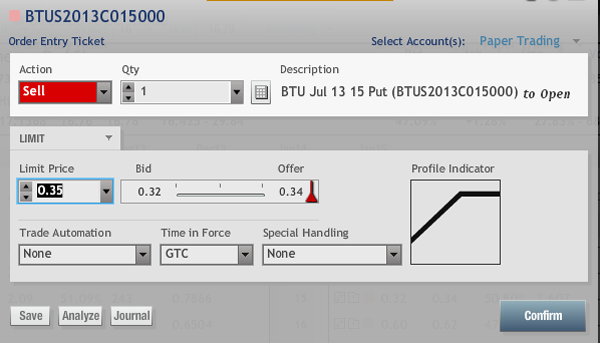

Recommended Trade Setup: Sell to open BTU July 15 Puts at $0.35 or better.

This cash-secured put sale would assign long shares at $14.65 ($15 strike minus $0.35 premium), which is about 12% below BTU's current price, costing you $1,465 per option sold. If the options expire worthless, you keep the $35 premium, earning a potential 2.4% return on risk in one month.

But remember, you should only sell this put if you want to own BTU stock at a discount to the current price. If you are assigned the shares, an August covered call can be sold against the stock to lower your cost basis even further.

If the stock does not fall below the strike price before expiration, then you keep the premium you collected, essentially getting paid not to buy the stock.

Related Articles

After This Week's Sell-off, Here's Who I Turned To...

Chart Pattern Projects This 3D Printing Stock Could Soar 55% by Year-End

Expert's System Says This is the No. 1 Stock to Buy Right Now