Genesco Inc (GCO) Reports Mixed Fiscal 2024 Results Amid Challenging Retail Environment

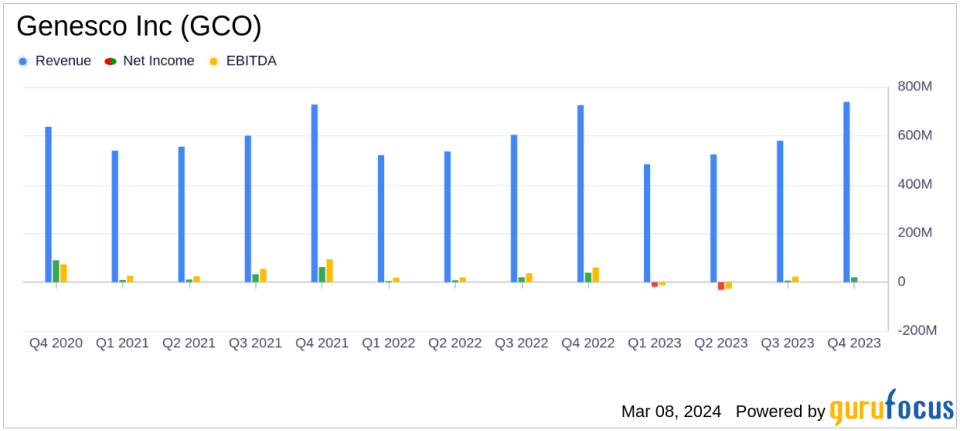

Net Sales: $739 million in Q4, a 2% increase over Q4FY23; $2.3 billion for full year, a 2.5% decrease from FY23.

Comparable Sales: Down 4% in Q4; stores down 7%, direct up 5%.

E-commerce Sales: Represented 27% of retail sales in Q4, up from 25% last year.

GAAP EPS: $1.84 in Q4 from continuing operations, down from $3.23 in Q4FY23; ($2.10) for full year, down from $5.69 in FY23.

Non-GAAP EPS: $2.59 in Q4 from continuing operations, down from $3.06 in Q4FY23; $0.56 for full year, down from $5.59 in FY23.

Store Activity: Closed 94 Journeys stores in FY24, with up to 50 more closures targeted in FY25.

Fiscal 2025 Outlook: Expects total sales to decrease 2-3% compared to FY24, with adjusted diluted EPS from continuing operations in the range of $0.60 to $1.00.

On March 8, 2024, Genesco Inc (NYSE:GCO) released its 8-K filing, detailing its financial performance for the fourth quarter and full fiscal year 2024. The company, known for its footwear, headwear, sports apparel, and accessories across its Journeys Group, Schuh Group, Johnston & Murphy Group, and Licensed Brands, faced a challenging retail landscape, marked by a significant shift in consumer shopping behavior, particularly within its Journeys Group.

Performance and Challenges

Genesco Inc's fiscal year began with a difficult start, as the company grappled with changes in consumer preferences, notably a shift away from boots, which pressured its core product assortment. Despite these challenges, the company achieved record sales for Schuh and Johnston & Murphy, highlighting the strength of these segments. However, the overall 2.5% decrease in net sales for the fiscal year reflects the headwinds faced by the Journeys Group, which saw a 7% decrease in store sales.

Financial Achievements and Importance

Genesco Inc's e-commerce sales growth, representing 27% of retail sales in Q4, underscores the company's successful adaptation to the digital retail space, a critical component in the current retail environment. The company's ability to maintain a strong e-commerce presence is vital for its sustainability and competitiveness within the Retail - Cyclical industry.

Financial Summary

The fourth quarter saw a modest 2% increase in net sales to $739 million, while the full year experienced a 2.5% decrease to $2.3 billion. Comparable sales were down 4% for both the quarter and the year, with a notable 7% decrease in same-store sales for the year. The GAAP EPS from continuing operations took a significant hit, dropping to ($2.10) for the full year from $5.69 in the previous year. Non-GAAP EPS also decreased to $0.56 from $5.59 in FY23.

Commentary from Leadership

"Our Fiscal 2024 results reflect the significant shift weve seen in our Journeys consumers shopping behavior... Although the Holiday season started off positively, consumers subsequently shopped almost exclusively for key footwear items with a notable shift away from boots, putting more pressure on our core product assortment than we anticipated at the beginning of Q4." - Mimi E. Vaughn, Genescos Board Chair, President and Chief Executive Officer.

"Although we faced a difficult operating environment in the fourth quarter, we delivered sales largely in line with our most recent guidance and better-than-expected gross margin. However, the earnings impact from unusually disruptive winter storms, along with higher than anticipated expenses at Journeys drove bottom line results below our most recent expectations." - Thomas A. George, Genescos Chief Financial Officer.

Looking Ahead

For Fiscal 2025, Genesco Inc anticipates a continued challenging environment, with total sales projected to decrease by 2-3%. The company is focusing on improving its core product assortment and is targeting an increased run rate of $45-$50 million in annualized cost reductions by the end of Fiscal 2025. Despite the headwinds, Genesco Inc remains committed to navigating the shifting retail landscape and optimizing its operations for future growth.

For more detailed financial information and analysis, investors and interested parties are encouraged to visit Genesco Inc's website and review the full earnings report and supplemental financial presentation.

Genesco Inc's performance in Fiscal 2024 illustrates the complex challenges facing the retail sector, particularly in adapting to rapidly changing consumer behaviors. As the company continues to refine its strategies and product offerings, investors will be watching closely to see how these efforts translate into financial results in the coming fiscal year.

Explore the complete 8-K earnings release (here) from Genesco Inc for further details.

This article first appeared on GuruFocus.